More and more customers expect a fast, convenient, and secure payment experience on their shopping journey. New technology opens up new markets and payment options, and your retail needs to go with a payment provider to grow. Because there are so many options of payment processing, we’ve researched the ease of use, pricing plan, integration, payment types, and provided services to nominate the top 5 retail payment solutions in this article.

What’s a good retail payment solution?

The best retail payment solutions facilitate businesses by providing customers with safe ways to pay with various payment options and the most advanced technologies, both in-store and online.

Customers can make payment transactions directly at a physical POS terminal using the card reader or tapping their smartphones, or online via website portals or applications on their mobile devices.

The payment service market is very competitive with so many brands. We’ll discuss the best payment service providers for both online and offline businesses under 4 criteria:

- Payment services: along with processing transactions services, many retail payment solutions provide additional services like security protection, recurring/subscription collection, virtual terminals, and more, to provide a comprehensive payment experience.

- Payment acceptance: Provide your customers with convenient, fast, and diverse payment methods for their preferred payment gateways and card types.

- Integrations: Consider a payment solution that can integrate with your apps or website platforms.

- Prices: Include transaction fees and service fees. Note: the transaction processing fees on POS are normally lower than online transactions, as there is less fraud risk when the customer is present in person.

It’s time to take a quick look at the best retail payment solutions and find the one that fits your business model.

Top 5 payment service providers for retail

1. PayPal

Established in 1999 and acquired by eBay in 2002, PayPal has become the most recognized and versatile retail payment solution, especially suited for eCommerce solutions.

- Business size: 17 million merchants and 200 million account holders

- Annual transaction volume: 3.74 billion transactions

It’s widely used and trusted by:

- Offering a wide range of payment services for business. PayPal gives customers the freedom to purchase by PayPal or any other form of online payment, thereby increasing payment conversions by 44%.

- Providing an easy and seamless payment experience for customers. Customers can create or log into their account on the website, then press the “Pay with PayPal” button to add PayPal to their payment options.

Payment services

- eCommerce payment gateway

- Virtual terminal to handle over-the-phone payment

- PCI compliance

Payment acceptance

PayPal accepts and processes payment with multi-currency (6 currencies at a time), including:

- Debit and credit cards

- PayPal payments from over 200+ markets in 26 currencies

- PayPal credit payments (available only in the U.S.)

Integrations

PayPal can work well with the most popular eCommerce platforms such as Magento, WooCommerce, BigCommerce, Squarespace, and Shopify.

Prices

PayPal sets competitive rates for payment processing fees:

- Monthly fee: $30

- Transaction fee: 2.9% + $0.30 per transaction

In addition, merchants can sign up for the PayPal Payments Pro plan to use advanced payments and payment features, including:

- Accept payments directly from Mastercard, Visa, American Express, and Discover

- Create digital invoicing (e-Invoicing)

- Offer credit card payments over the phone

Read more: 5 PayPal POS systems with robust features in 2024

2. Authorize.net

Founded in 1996, Authorize.net is the best retail payment solution and one of the oldest international payment gateways in the world.

- Business size: 430,000 merchants

- Annual transaction volume: 1 billion transactions

Authorize.net is famous for:

- Set up and use at ease – the best option for newbie merchants and customers

- Work with all types of merchant accounts: Authorize.net has cooperated with payment account providers and card networks in partnership.

Payment services

- Simple checkout

- Billing and invoicing

- Recurring payments

- Over-the-phone and mobile payment

- Customer information manager

- Fraud prevention to secure customer data and accept payments safely

Payment acceptance

- Accept customer payment transactions in all countries and most forms like major debit and credit cards, e-checks, foreign payments, and digital payments

- Be one of the rare payment gateways that accept PayPal

Integrations

Authorize.net can work well with Magento, 3dcart, BigCommerce, JotForm, Foxy.io, CryptoIVR, Chargify.

Prices

Authorize.net require no setup fees and have 2 pricing plans, which are:

Payment gateway only:

- Monthly fee: $25

- Transaction fee: $0.10 per transaction

- Daily batch fee: $0.10

All-in-one (includes a payment gateway and a merchant account):

- Monthly fee: $25 per month

- Transaction fee: 2.9% + $0.30 per transaction

Read more: Top Authorize.net POS software to supercharge your retail business performance

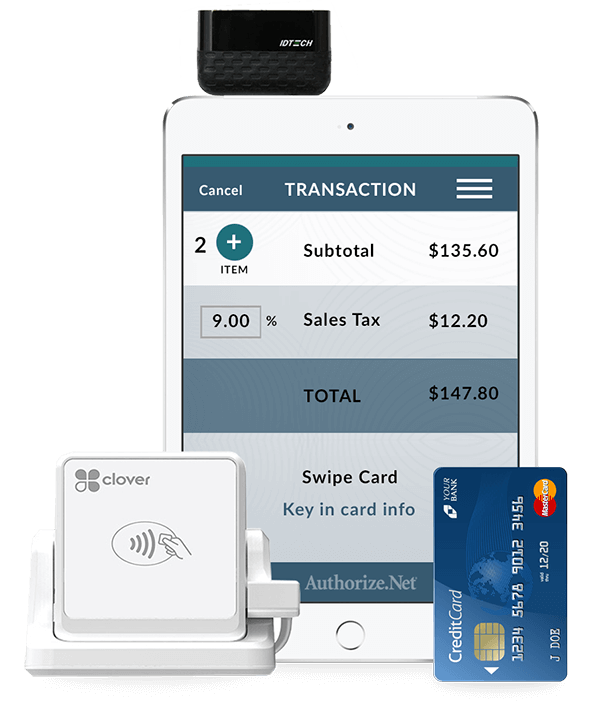

3. Stripe

Created in 2011, Stripe is the most popular global payment solution for online businesses. As an international organization, the company has over 2,500 employees in 14 countries.

- Business size: 2 million merchants

- Annual transaction volume: 600,000 online transactions

- Market size: 90% of online users in the U.S.

Stripe shines for:

- Strength in development and technology

- Unify offline and online business

- Work well on computers, laptops, and mobile devices (available in iOS and Android)

- High ability to customize to scale up to changing requirements and grow with businesses

- Competitive rates

Payment services

- 24/7 support via chat, phone, and email, and self-help via an extensive online support center

- Virtual POS terminal

- Embeddable checkout

- One-click checkout

- Recurring subscriptions and invoicing

- Machine learning fraud prevention

- Mobile payments

- Real-time reporting

- Transaction tracking

- User dashboard

Payment acceptance

- Accept most payment types and local payment methods

- Support more than 135 currencies

Integrations

Merchants can use Stripe with most eCommerce platforms like Magento, Shopify, WooCommerce, BigCommerce, Squarespace, and Wix.

- Work well with 450+ platforms and payment extensions in platform marketplaces

- Integrate with QuickBooks and NetSuite

- Support contactless payments and chip card readers

In addition to integrating with most eCommerce platforms, Stripe can also connect with a wide range of third-party POS solutions. A Stripe POS enables in-store payments with multiple payment methods and synchronizes all the transaction data across channels, making the reconciliation much easier and quicker.

Prices

Stripe doesn’t require a monthly fee for the payment gateway. For transaction fee:

- Automated Clearing House (ACH) direct debit 0.8% ($5 cap) to process transaction in batches

- 2.9% + $0.30 per transaction

For customized solutions other than default functions, merchants should contact Stripe for pricing.

Read more: 7 POS with Stripe with powerful features

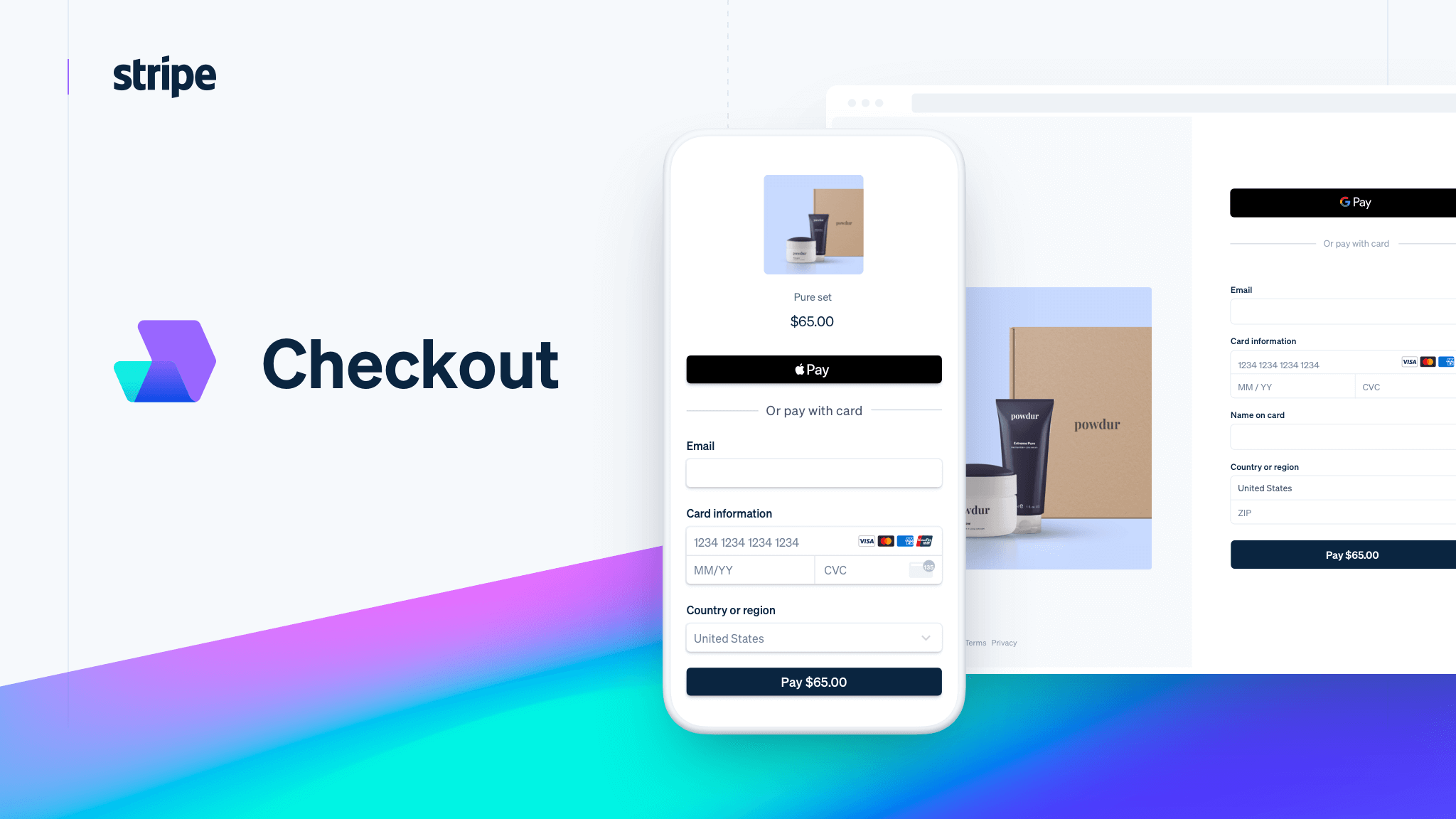

4. Square

Launched in 2009 by Jack Dorsey – Twitter cofounder – Square is the best payment service provider for brick-and-mortar businesses and mobile merchants (craft booths, farmer’s markets, and food carts).

- Business size: 15 million merchants

- Annual transaction volume: 399,000 transactions

It opens the door for retailers to:

- Use Square on any mobile device (tablets or smartphones) as an online payment solution instead of expensive and bulky POS terminals

- Set up at ease – merchants can download the app and install it quickly on any Android and iOS devices

Payment services

- Online and in-person payments

- Over-the-phone payments

- Digital invoicing

Payment acceptance

- Accept most debit and credit cards, and common payment methods such as Google Pay, Apple Pay, and Alipay (but not PayPal – their direct competitor)

- Accept keyed-in transactions via virtual terminal

- Accept NFC and card chips payments

- Do not support e-check payments or ACH

Integrations

- Support 159 popular eCommerce platforms like Magento, WooCommerce, Shopify, and BigCommerce and third-party eCommerce like Ecwid and Wix

- Integrate with other tools such as Squarespace, Slack, Intercom, and Gravity Forms

Prices

Square offers a free mobile card reader, a free magstripe reader, and POS app. Also, it requires no long-term contracts, no startup or setup costs. You can integrate Square with advanced POS if you’re looking for a powerful POS solution for your retail stores.

For transaction processing fees:

- For card-on-file and manual transaction: 3.5% + $0.15 per transaction

- For invoice transaction: 2.9% + $0.30 per transaction

- For eCommerce and in-person transaction: 2.6% + $0.10 per transaction

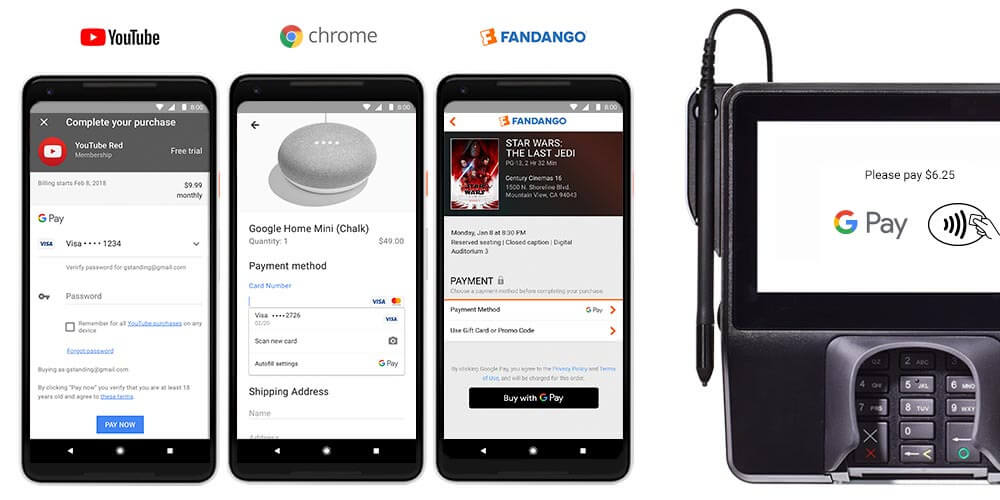

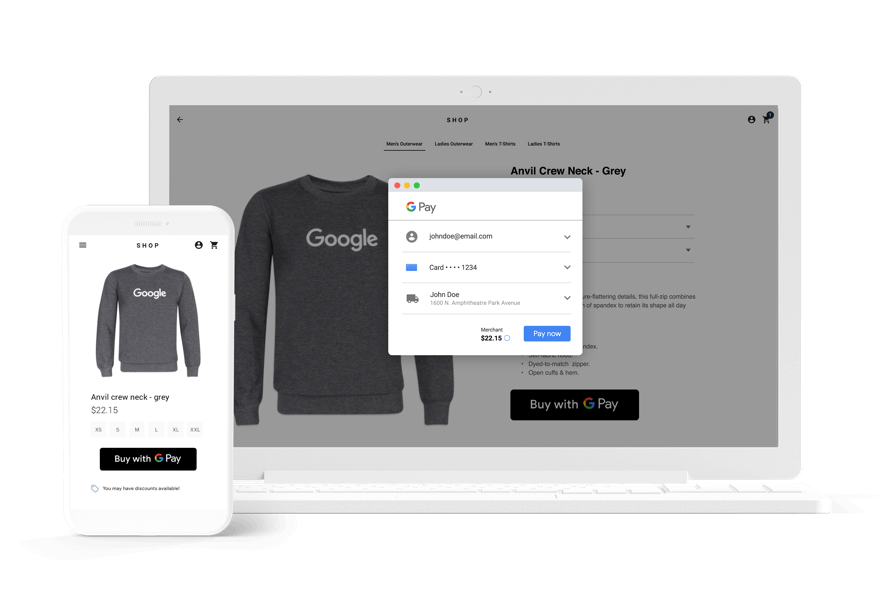

5. Google Wallet

Launched in 2011, Google Wallet is the youngest payment service provider of our nominations and is the most popular solution for mobile payments.

- Business size: 227 million users

- Annual transaction volume: 2.5 billion transactions

By nature, Google wallet merchants is an app:

- Allow customers to complete payment just by logging into their Google accounts – eliminate tedious steps and save valuable times

- Set up at ease for merchants – enable the “Buy with Google” button to add Google Wallet as a payment option on online businesses

Payment services

- Offer to add coupons to wallets and saving gift cards in wallets that the customer can redeem at physical and online stores

Payment acceptance

- Accept payments by the debit and credit cards linked with customer bank accounts

Integrations

Google Wallet can work with POS terminals using near field communication (NFC) and integrate with the 4 most widely used eCommerce platform (Magento, WooCommerce, BigCommerce, and Shopify)

Prices

Google Wallet requires no additional fees because it processes all payments through your current payment processors.

Comparison table of the top 5 retail payment solutions

Transaction cost | API capability | Integration with eCommerce platforms and apps | Payment type acceptance | Support | |

PayPal | 2.9% + $0.30 or less | ✓ | Credit, debit, PayPal | Phone, email, online help center | |

Authorize.net | 2.9% + $0.30 or less | ✓ | Credit, debit, PayPal, Apple Pay | 24x7 online chat, phone, email, eTickets | |

Stripe | 2.9% + $0.30 or less | ✓ | Credit, debit, Apple Pay | Email, IRC channel for developers and engineers | |

Square | 3.5% + $0.15 or less | ✓ | Credit, debit, Google Pay, Apple Pay | Online help center | |

Google Wallet | Free | ✓ | N/A | Credit, debit | Online help center |

Conclusion

Choosing the best retail payment solution is the first step in optimizing your payment process for customers. It takes time but is worth the costs because payment processors play an important role in accepting transactions, both offline and online, with diverse payment methods to meet the growing needs of customers.

Hopefully, with the information provided in this article, you’ll be able to narrow down the list of the best-fit payment service providers for your business. Happy selling!