People nowadays are living in a digital era with the implementation of technology in every aspect of life. Doing business becomes more complicated and demanding than before.

This article’s purpose is to help you to know about payment gateway as well as realize the importance of payment gateway and eCommerce applications in this new era so you can have a new effective plan for your business.

What is a payment gateway and its application?

Payment gateway is a software that provides the users (sellers and buyers) a secured payment method in which payment can be processed from buyer to seller completely online instead of traditional cash payment or physical cards which are processed by POS terminals. In other words, a payment gateway is a POS terminal for online transactions.

In that sense, payment processors are the final decision-makers to finish a full online payment circle. A payment gateway helps payment processors to authenticate customer information online, just the same as the POS work with the physical card.

With those functions, payment gateway is now widely used in both eCommerce platforms and brick-mortar stores since people nowadays keep less cash in hand and prefer digital payment for all their purchases. But obviously, payment gateway is more essential to online business because of its nature.

So how to choose an eCommerce platform with a built-in or easy-to-integrate payment gateway? Nowadays this is very simple since many different eCommerce platforms are available for your options.

- For creating your own online store/eCommerce:

Shopify and Magento are 2 typical eCommerce platforms that integrate with a variety of payment gateway solutions. However, if we have to make a comparison, Magento is more open to connection. Shopify can charge a 1-2% transaction fee if you collect credit card or e-wallet payments with a third-party payment gateway which Magento doesn’t. Magento is widely suggested recently since it offers a wide range of compatible payment gateway for the users to choose from online stores or online transactions with minor cost.

- For product shows in available online marketplace:

Amazon, Alibaba, Esty,…are some prominent and reliable all-in-one online platforms with their available payment gateways for you to start your online business. The marketplace is different from an eCommerce store since there is a third party involved, that is the marketplace owner.

Why is it important in this new era?

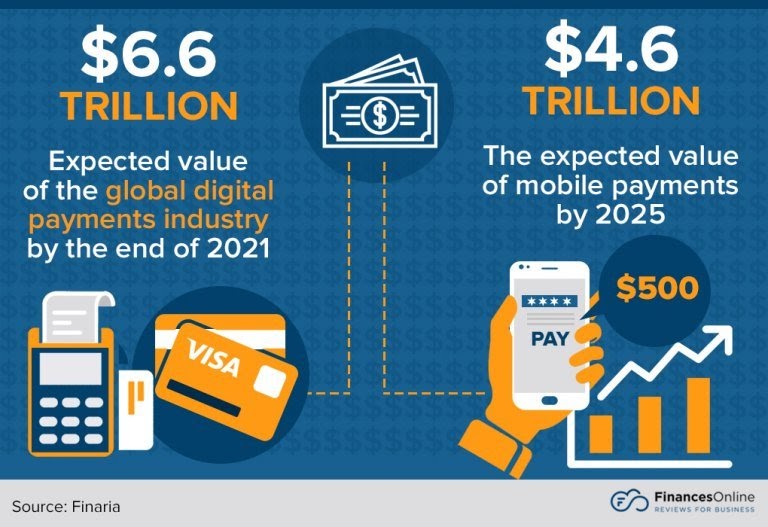

The Covid 19 pandemic has significantly affected all businesses during the past 2 years and even more years shortly. The change in buying behavior from traditional shopping to online shopping or using mostly digital payment instead of cash payment since people spend more time at home and avoiding direct communication with other people, brings a big boom for eCommerce or online selling platforms. The global digital payment industry is expected to hit 6.6$ trillion in 2021 according to the research result from Finaria.it.

The needs for an effective eCommerce, together with secured payment gateways are quite huge. Clearly, the global adoption of eCommerce and digital payment trends will result in significant changes in business models. It is an opportunity and also a challenge to all businesses.

Besides, statistics in recent research by Baymard.com show that the average abandonment rate for the online shopping cart is around 69.8% of which 28% of people said that there is a problem with the payment gateway so they cannot continue the purchase. Therefore, a good payment gateway can reduce this number or bring more sales to your business.

How to use a payment gateway online? How does it work?

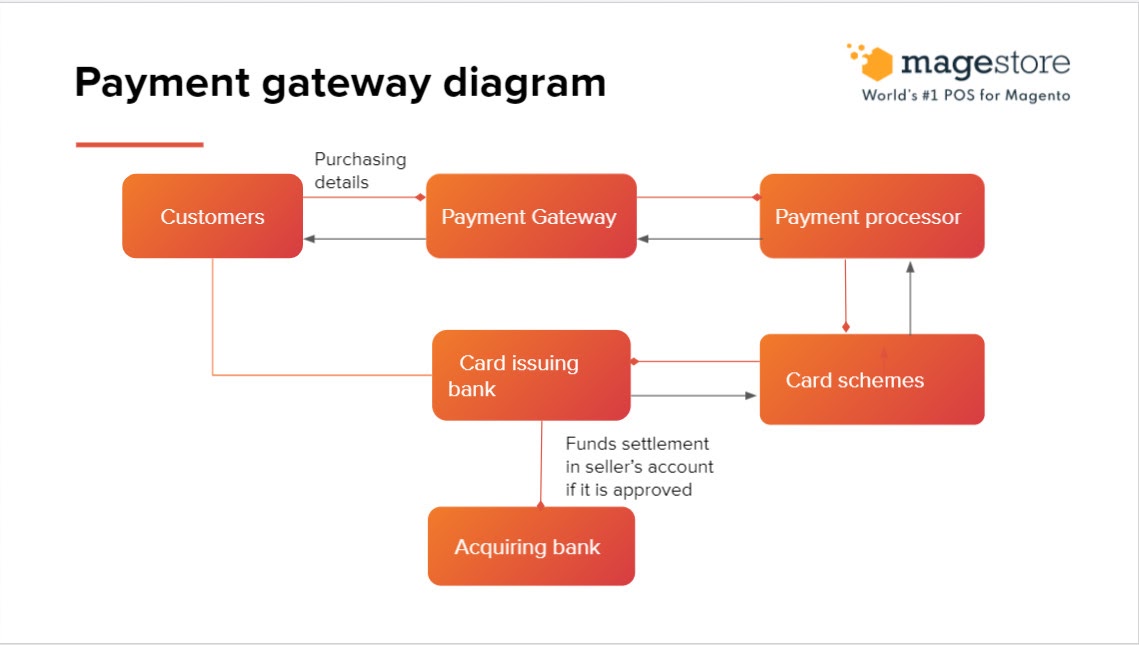

There are 2 important factors involved in online payment including payment gateway and payment processor. So how do these two factors combine to complete the payment?

- Customers go to your online store and want to order/buy an item. They will put their card details on the checkout page to buy the item.

- The payment gateway will receive the transaction details through the checkout page and then has a function to authenticate all the customers’ information and transmit it to the payment processor.

- The payment processor receives the transaction details and sends them to the buyer’s bank, together with checking the legitimation and buyer card’s credit limit.

- The card issuing bank accepts or rejects the transaction and transmits the information to the payment processor.

- The seller’s payment processor transmits the details back to the payment gateway. So if the bank approves the transaction, the seller will receive the approval information through the payment gateway and proceed with the purchase.

- The card issuing bank releases funds to the seller’s bank and the cash will be transmitted to the seller’s account.

Top best existing payment gateways in 2021

1. Paypal

It is simple to integrate PayPal into your online store. It is also the most popular payment gateway so it has the highest credibility and is accepted all over the world. PayPal charges no cost to the buyers, just charges the sellers a 3.4 % transaction fee and adds $0.30 to accept payment by credit cards. However, it gives more protection to customers than the sellers.

Read more: 5 PayPal POS systems with robust features

2. Wepay

Wepay can manage sophisticated payment requests, such as numerous payers and crowdfunding campaigns, and accepts all major credit cards, Chase Pay, and ACH payments. Sellers can create an account with simply an email address and begin receiving payments right away. It is the best for multiple channels. It charges 2.9% + $0.30 per transaction and charges 1% + $0.30 per transaction for ACH payments.

3. Authorize.net

Authorize.net is one of the oldest payment gateway providers since 1966. It is easy to set up and works with any seller’s account and accepts transactions from customers all over the world. Most seller account providers have partnered with Authorize.Net, allowing users to take payments from major credit cards, debit cards, and digital payments, as well as e-checks and foreign payments from most locations. The setup fees are around $49, and the monthly gateway fees are roughly $29 per month.

Read more: 5 Authorize.net POS integrated solution for large retailers

4. Stripe

Stripe is a newcomer but grows fast because it focuses on technology and development. It customizes payment solutions at a competitive rate. No setup cost or monthly fee. It offers a virtual POS that makes it easy for users to unify their online and offline channels. Stripe’s fee is similar to Braintree since it also charges around 2.9%+ $0.30 per transaction.

Read more: 7 Stripe point of sale apps for smooth transactions

5. Braintree

Braintree is a payment gateway with simple pricing but accepts all payment types: credit cards, digital wallets, Venmo, ACH direct debit, Union pay, Paypal. It is a subsidiary of PayPal. It charges a fee to the sellers at 2.9% + $0.30 per transaction.

Read more: #1 Customizable and scalable Braintree POS for medium to large retail enterprises

Conclusion

In general, different payment gateways provide different costs, supports, and payment types. But it is clearly a factor to decide whether you can make a sale or not since sometimes, buyers have to cancel purchasing and look for other options from different stores, just because your store doesn’t offer their preferred payment gateway. Therefore, a payment gateway that supports all payment types is always a preferred choice.

Secondly, it is also important to consider the integration of payment gateway, the payment gateway which is easy to integrate with any eCommerce platform is the next choice.

Thirdly, customers are the ones who decide to buy your products or not so the payment gateway with great credibility and secured elements will be another good option.

It is better if you have clear in mind which is the best and most used payment gateway and which eCommerce platform offers that payment gateway.