The COVID-19 pandemic is sweeping the world, forcing shopping malls and stores to adjust. When reopening, businesses need to provide employees and customers with protections, not only by glass shields and face masks, but also with safer and more hygienic forms of payment.

It’s important to minimize touching commonly shared surfaces such as card readers, credit cards, and cash. In this article, we recommend 9 contactless payment methods for retailers to accept payments safely during COVID-19.

1. Pay online and get delivered (or pick up in-store)

The outbreak of COVID-19 is accompanied by social distancing measures and avoiding direct contact. Therefore, most popular businesses, retailers, restaurants, pharmacies, and grocery stores have developed Magento eCommerce solutions or implemented shopping apps to deliver necessities and products to their customers.

On the other hand, customers can make online transactions in a highly secure environment and in the shortest time with the help of the most advanced technologies, including:

- Artificial intelligence

- Data encryption

- Tokenization

Customers can pay online for secure delivery, then choose to pick up or deliver. Click and collect software has become a “must-have” for retailers as it offers choice and flexibility for your customers to:

- Remain shopping at home to minimize time in public

- Maintain a sense of normalcy with the products and services available online

Businesses can even offer automatic or recurring purchase options for regular delivery.

2. Gift cards

Gift cards, or digital gift cards are gift codes that retailers deliver to customers via a mobile app or email. Customers can enter this code to check out the order value in brick-and-mortar stores, online websites, or shopping apps.

On the business side, gift cards create a source of prepaid income during times of crisis and store closure due to COVID-19. That’s why many retailers offer online gift card sales to their customers.

On the customer side, they can redeem gift cards on POS or online flexibly anytime, and serves many purposes:

- Complete orders quickly just by applying coupon codes of gift cards – an instant, secure, and safe payment method

- Send gift cards via email to friends and relatives

- Support favorite communities and businesses to overcome the difficult time together

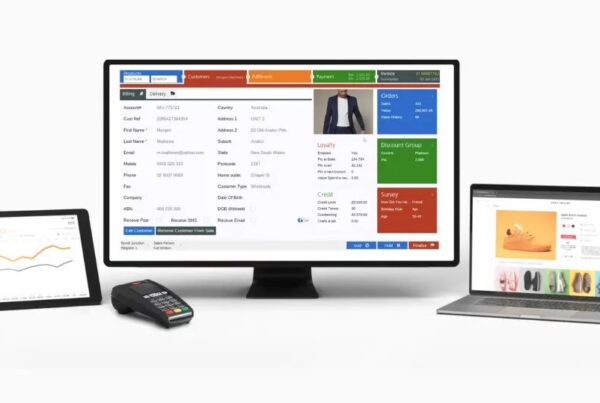

3. Cashless POS system for contactless payment

The outstanding element of a cashless POS system is to limit physical interaction by the combination of:

- Touchless payment technology: Includes radio frequency identification (RFID) and near field communication (NFC), and applications of mobile wallets.

- Contactless cards: In 2015, Europay, MasterCard, and Visa (EMV) started switching to chip cards, opening the door to “tap and go”, or “tap to pay” cards, which use embedded chips to wirelessly transmit payment information.

When merchants adopt touchless payment technology and customers use contactless credit cards, it’s more hygienic by reducing the number of touchpoints in the checkout process. At the counter, customers can securely and conveniently hold their mobile device or card above the reader at the POS terminal to pay for their products and services.

- No need to dip or swipe cards into the card readers

- No requirement for a signature or PIN code to complete the payment

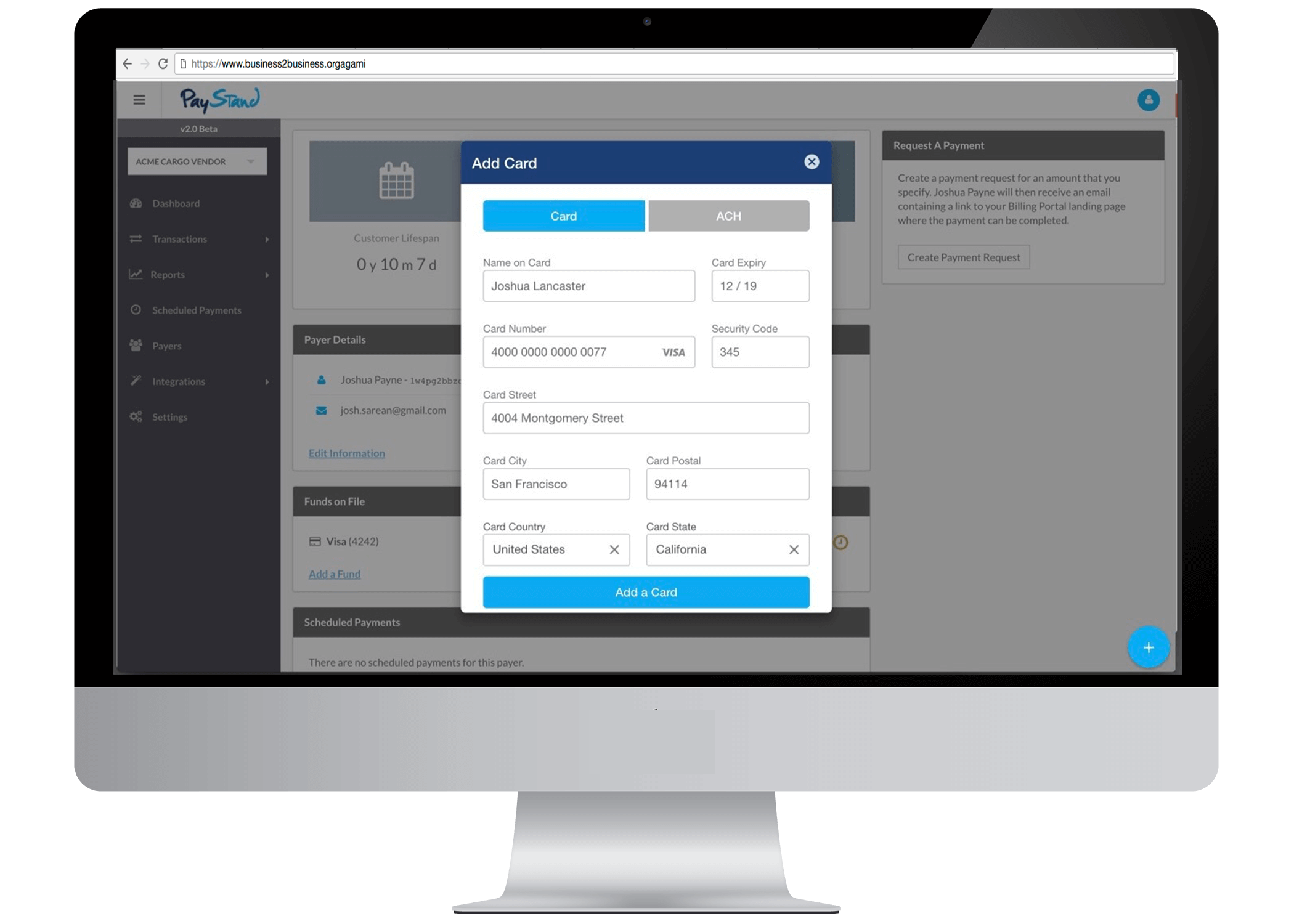

4. Virtual terminals

For businesses with limited counter space or temporarily closed physical stores, you can use a virtual terminal instead of a card reader. A virtual terminal is a web-based application that allows you to input the buyer’s payment information manually over the Internet.

Due to that, customers can pay without their physical presence. Instead of scanning the actual card and entering the PIN into the card reader, you can enter the card details into the virtual terminal, including:

- Customer card number

- Expiration date

- Name as on card

- CSV code

You can use the virtual terminal on all kinds of devices, such as smartphones, tablets and laptops. All you need is an internet connection, then you can:

- Easily manage, process, and authorize card payments in real time

- Retain payment details for future regular transactions and one-time transactions

- Refund from the secure stored payment page in your browser

If you want to safely accept payments while staying compliant with payment card industry security standards (PCI DSS), virtual terminals are a great choice for you. A gateway that uses data encryption or tokenization will process transactions and secure customer payment information.

5. Telephone orders

Taking orders by phone is the most cost-effective, easiest and safest way to accept payment while eliminating or reducing physical interaction with customers during COVID-19 situations. Many POS solutions include built-in phone payment processing features.

Telephone orders and accepting credit card payments over the phone have been quite common for years. However, some merchants are still concerned about potential risks that the person on the other end of the line is not the person authorized to use the card or the cardholder. However, there are many ways to reduce this type of fraud:

- You can ask for CVV code and address verification

- If you want another layer of security, you can try a “payment by link” solution. With pay-as-you-go technology, you can send a text message, including a secure payment link via WhatsApp or iMessage to your customers. That link directs customers to a fast and secure online payment, providing an eCommerce payment experience.

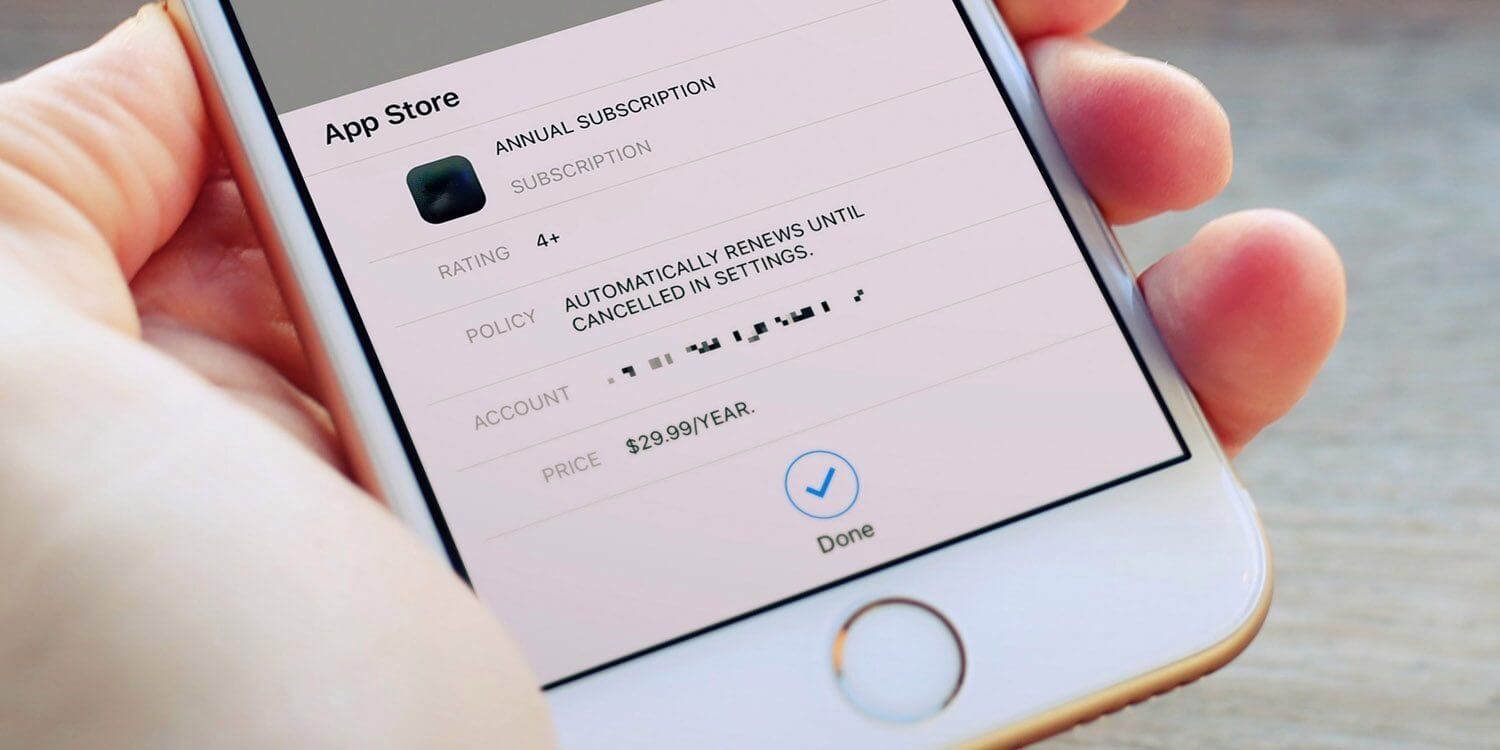

6. Card-on-file payments

Automatic recurring payments ensure a steady stream of income while limiting physical interactions. If you want to send recurring payments to your customers, card-on-file payments, or card-not-present (CNP) are the perfect solution for you. It allows you to store your customer’s credit card details safely in a secure vault and accept repeat online payments.

- Merchants can automatically schedule payments to enhance the customer checkout experience and reduce manual workload. To incentivize customers, you can even offer small incentives like discounts to long-term subscribers.

- Customers don’t have to worry about accruing late fees for pilling bills. Also, card-on-file payments offer flexible opt-in options for customers such as pay directly, by phone, or online.

As a store owner, you should choose a card-on-file payment that can provide the flexibility and security you need to improve your customer experience and protect your business, like strong card encryption and fraud prevention capabilities.

7. Online payments

Online payment has become so convenient to accept payment safely during COVID-19. Especially during the period of social distancing, the number of online transactions from all over the world increased dramatically. So, if your business hasn’t accepted online payments yet, now is the perfect time to begin.

An online payment strategy helps you to distribute your products through reaching and establishing your online presence with your customers. Payment service providers and payment gateways will facilitate online payments to accept online payment and collect money through the internet.

The most popular types of online payment are:

- Debit card

- Credit card

- Bank transfer

- Smart cards

- eWallet

- Bitcoin wallet

The most important thing is choosing a trusted payment partner to accept payments securely and reduce financial risk. Payment service providers need to ensure to equip your online payment solution with strong data security features and the ability to prevent strong fraud.

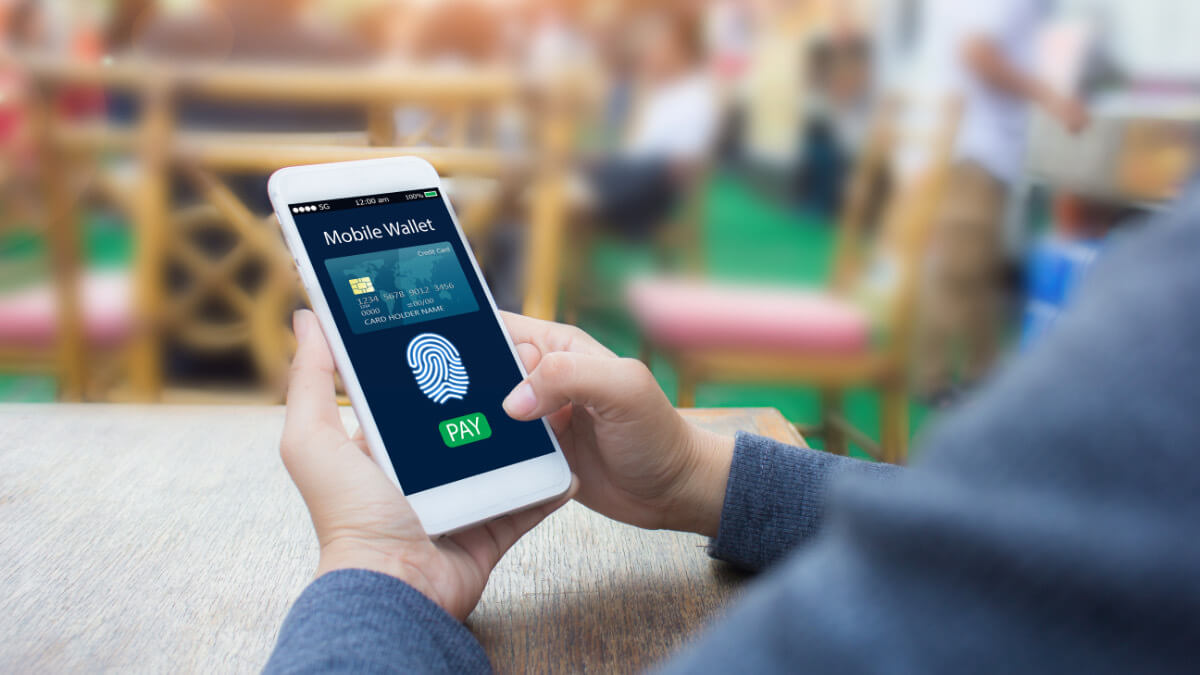

8. In-app and in-browser mobile wallet payments

If you already accept online payments, you can enhance the customer experience with mobile wallet payments. These forms of payment enable customers to pay conveniently and safely for their purchases on websites and shopping apps via mobile devices.

- Customers are increasingly finding it convenient and comfortable to pay with mobile wallets such as Samsung Pay, Google Pay, and Apple Pay. Using mobile wallets, customers can pay seamlessly after their first purchase because their information has been saved.

- From business perspectives, merchants can eliminate abandoned carts and increase conversion rate by not requiring customers to re-enter their contact and payment information.

9. Digital invoicing

If your business collects payments by invoices, digital invoicing is a great option. A digital invoice, or electronic invoice (e-invoice) is a data file transferred among computers in EDI or XML formats. An advanced digital invoicing solution will:

- Pull data from the right sources

- Create the invoice automatically

- Allow the sender to confirm the accuracy of the content before sending

- Send the invoice to the recipient electronically

- Notify the recipient of its arrival

Through these “virtual” invoices, merchants can accept payments electronically and instantly. Thus, digital invoicing has various benefits:

- Remove physical limitations that often happen to traditional invoicing

- Eliminates the actual need for bills and checks

- Streamline the payment process

Conclusion

Both customers and businesses are looking for ways to process payments more safely during the COVID-19 pandemic. No matter which payment method you choose to accept, we recommend you take a close at the most advanced mobile payment trends and contactless technology.

The safety benefits of advanced contactless payment technology are obvious now. In the long run, modernized payment methods will always be valuable assets going forward. It reflects high business management standards, reduces operating costs, and diversifies customer choices to increase experience and conversion rates which are the backbones for the sustainable development of any retailer.