Cashless commerce is on the rise as the number of transactions for products and services by debit and credit cards is rapidly increasing. As a result, more businesses are outsourcing their payment processing.

Some retailers keep the traditional choice of using services of their account issuing bank. Others choose third-party payment services from global providers to handle their eCommerce transactions. Despite the convenience and availability, merchants’ banks don’t always offer the most cost-effective and suitable option.

Therefore, in this article, we’ll give some useful suggestions and things to keep in mind when choosing a payment service provider (PSP) for your business.

What is a payment service provider?

Payment service provider definition

Payment service providers, or merchant service providers, are third parties that offer merchants the services to accept electronic payments in a variety of payment methods, including:

- Real-time bank transfer via online banking

- Bank-based payments (bank transfer and direct debit)

- Credit card

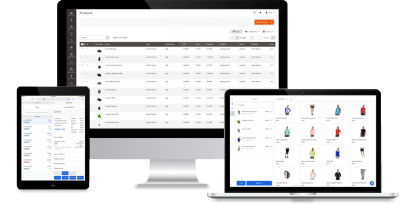

How does payment processing work?

Payment service providers work with payment processors through acquiring banks to manage the entire transaction from the beginning to the end, in which the provider:

- Connects all financial parties (merchants, customers, financial institutions, and card brand networks) to process payments efficiently and quickly

- Provides a seamless payment experience for their customers and merchants

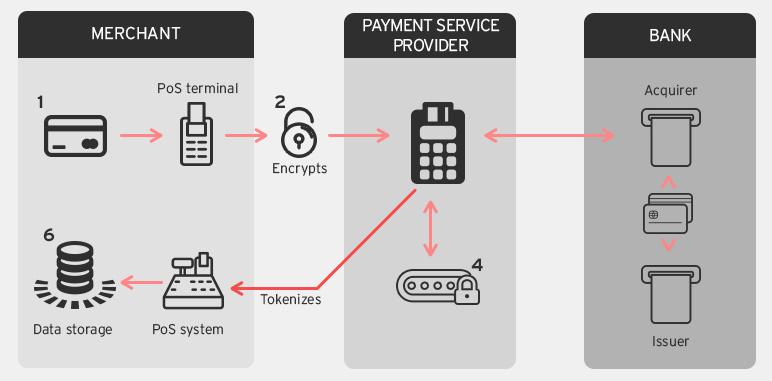

Differences between payment service provider and payment gateway

Payment gateways

- Work as direct customer intercommunication

- Connect different systems, such as card processing platforms and point of sale (POS) systems

- Provide the connectivity for retailers to access their payment processors

- Allow configuring the appropriate gateways in various ways for both in-store and online businesses

Payment services

- Work in the background to facilitate the interaction of payment gateways

- Transfer financial data between merchant accounts and gateways

- Ensure all transactions are processed properly, efficiently, and quickly

Payment service provider vs. merchant acquirer

The key difference between payment service provider and merchant acquirer lies in 2 factors:

How they use the merchant account

- Payment service provider groups and manages all clients in one big merchant account.

- Merchant acquirers provide each client with an individual merchant account.

Pricing

- Payment service providers often set the same rate and fee for all clients.

- Merchant acquirers determine the pricing based on the client’s transaction volume, industry, business size, and various other factors.

What services does a payment service provider offer?

Currency processing

PSPs can process multiple currencies to facilitate cross-border payments. It’s an essential service for businesses that are expanding overseas or doing business in the global market.

Security

PSPs must follow PCI DSS compliance to offer high security standards. Therefore, retailers can rest assured that the financial data of their customers and their own is protected.

Transaction reporting

PSP helps merchants record and reconcile their transactions more effectively. There are normally 2 kinds of reports: real-time and monthly.

How to choose a payment service provider

Based on our experience working with many PSPs, we recommend 5 criteria for choosing a payment service provider.

1. The popularity of payment service providers

You should ensure that your chosen PSP is available to all stakeholders who want to have access to the system. In Europe and especially Germany, direct debit, bank transfer, Mastercard, VISA credit card, and payments via Paypal are available. Debit cards, e-wallets like Skrill, prepaid cards like paysafecard, mobile payments on platforms like mpass are also sometimes available.

1.1. International payments

Global retailers will need to break down and research to select different payment processor PSPs in different countries.

The major number of overseas transactions can’t be completed by eCommerce retailers because the payment methods aren’t available in some countries. Therefore, choosing the right payment service providers will help your website go global.

For example, if you want to open a website in Sweden, you need to adopt Swish, which more than 75% of residents use for their online transactions. Or else, you could lose a large portion of your potential sales.

1.2. Mobile payment offers

With the increasing number of mobile device users, customer behavior tends to change respectively. Consumers expect uncomplicated and efficient online shopping platforms that they can use on the go. Online businesses can increase conversion rates by enhancing the mobile user experience.

- Some PSPs offer checkout features, in which you can tailor the checkout process for each type of mobile device. This provides mobile optimization for the retailer’s website and provides a high level of brand recognition.

- Mobile payment behaviors such as QR code or SMS payments by PSP are also reasonable and useful for an omnichannel strategy for integrated shopping and targeting some customer groups.

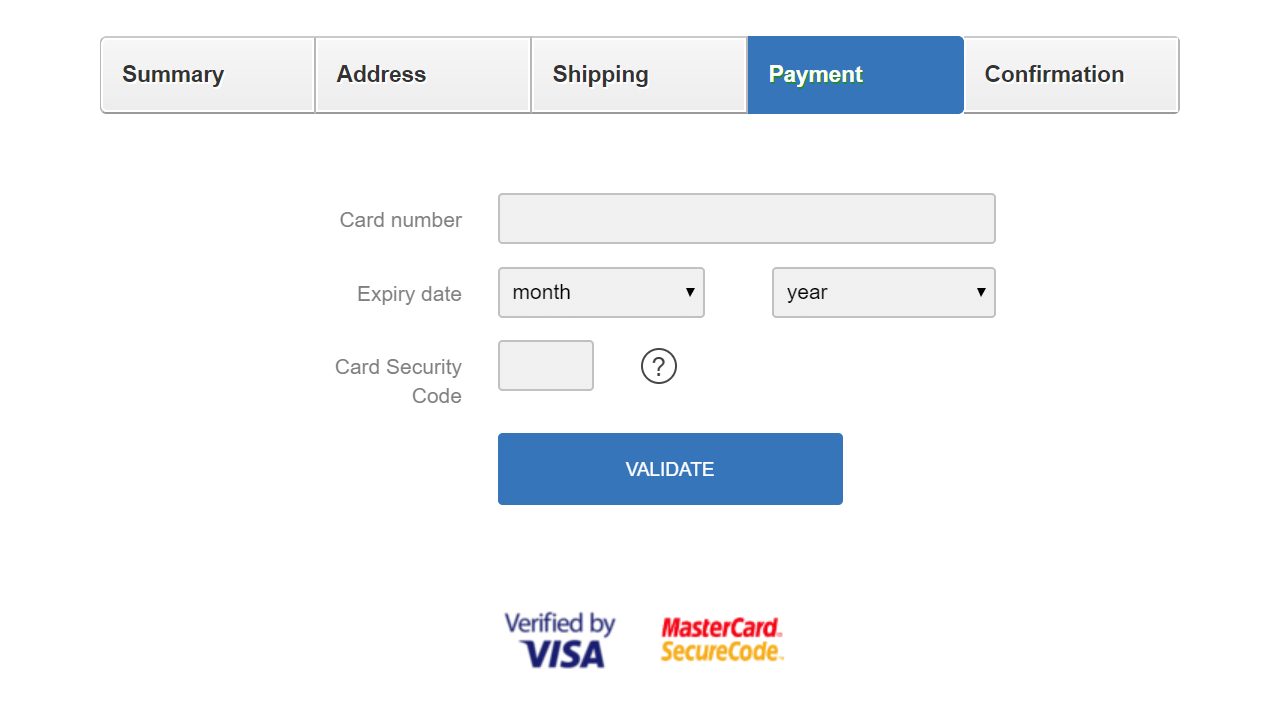

2. Technical requirements of payment service providers

You should choose a third-party service provider that offers modules that can integrate with your existing software and business processes. In some cases, integrating in-house development with the existing store system can be difficult when looking beyond the ERP interface. Thus, your selected PSP should offer modern and popular integration options including:

- API connections for further integration

- Redirects (or forwarding) to forward customers from the retailer’s website to the secure website of the PSP after the checkout process is complete.

- iFrame and iFrame connections to adapt a new layout and page for a secure checkout formula from PSP and transfer payment data at higher security

3. Payment development security

PSPs are independent of the bank so they will need a BaFin certificate. This certificate is issued and certified by major European financial supervisory authorities to:

- Allow PSPs to set up escrow accounts to accept payments at banks across Europe

- Protect PSPs transactions in the countries where they have an established escrow account and in Germany

In addition, PSP must meet worldwide data security standards like Payment Card Industry Data Security Standard (PCI DSS) to offer credit card payments. By having that, PSP can:

- Ensure customer credit card data is protected from theft or fraud

- Save eCommerce retailers a lot of time attempting to obtain this certification yourself (since your chosen PSPs are already certified)

4. Services provided by PSPs

PSPs offer different services among different providers. Therefore, retailers should have a clear outline of what services are necessary and important to the growth of their online stores. For example, new and growing retailers need to address topics such as market and expansion. Below are suggestions for popular services that retailers can refer to:

4.1. Subscriptions and recurring payments

Some PSPs offer recurring payment processing services. This feature is essential for businesses in industries like media and food, in which their customers can:

- Access their payment status in a real-time overview

- Save and retrieve payment data when they want to make repeat purchases

Subscription models should have other available payment methods besides the popular credit cards such as direct debit or PayPal. This ensures a fast and enjoyable reordering experience for customers.

4.2. Support services

The difference in support level can be huge according to cost, language, and scope. Most retailers expect not only guidelines but also a direct support line for in-store incidents. Customer support is extremely important to certain customers and industries. You should consider this aspect in your full service contract with payment service providers.

4.3. Risk protection from missing payments

Online merchants often face a rather higher risk of not receiving or losing payments from customers. High payment rejection rates can lead to reduced profits. You’ll have to pay additional costs by 3–4.5% of direct debit payments for collections and warnings. Most PSPs can provide risk protection services to save you these additional charges.

- You can add additional fraud prevention modules supplied by PSPs to your eCommerce websites. From there, PSP monitors payment issues in the store such as chargebacks or declined payments. Then the PSP can recommend tweaks to their program to better protect the business.

- PSP also offers a customer blacklist check service for stores, even by credits and addresses.

4.4. Further service offers

In addition to the main services mentioned above, some certain payment solution providers may offer many other services based on:

- The transaction volume of the store

- The information that the receivables management department shares with the suppliers

- The payment behavior of the target group

From there, PSP will receive notices to monitor payments, debt collection, and then invoice or refer to a collection agency if necessary. Some service providers also offer factoring and financial services, currency conversion management, and business accounts.

5. Contracts and pricing for payment service providers

Pricing and collaborative contracts between your online store and PSP are an important part of the selection process.

The typical cost model consists of variable and fixed fees. A certain one-time setup fee and a predetermined monthly cost can be as low as €500.

- The variable cost depends on the number of transactions in the online store and the expected sales revenue. PSP typically accounts for 1.5–3% of a store’s sales, which can fluctuate and peak at 9%.

- Other fees are currency conversion rates and transaction cancellation fees.

- For small transaction volumes, some PSPs charge a certain flat fee for each transaction.

Basically, the longer the contract and the larger the sales, the cheaper the cost.

Checklist question to choose a payment service provider

There are many factors to consider when choosing PSPs:

- Overall reputation in the industry, the number of years they’ve been in business, quality, and level of support

- Additional services such as chargeback management and fraud protection depending on the needs of each retailer

- Account opening process (time-consuming and complicated or not)

Therefore, we’d like to help by summarizing the most important questions to consider:

- Does the PSP support your countries?

- Does the PSP support your currency?

- Are the PSP compatible with your existing systems and software?

- What is your expected transaction volume?

- What other features and services does the PSP offer?

- What kind of payment mechanisms does the PSP support?

- What kind of fees does the PSP charge?

- Does the PSP support recurring payments?

- When do PSP payments take place?

If you’re completely satisfied with the answers to all questions, it’s the right payment provider for your organization.

Best payment service providers in 2021

There are more than 900 global payment service providers and more than 300 service providers especially for North America and Europe. Our recommended PSPs offer support for the most payment types, cost, security, and integrations to software that works easily with major eCommerce and POS systems.

Authorize.net

Authorize.net is the best payment service provider overall:

- Trusted by 430 thousand merchants from small to medium-sized businesses

- Straightforward interface and easy-to-use

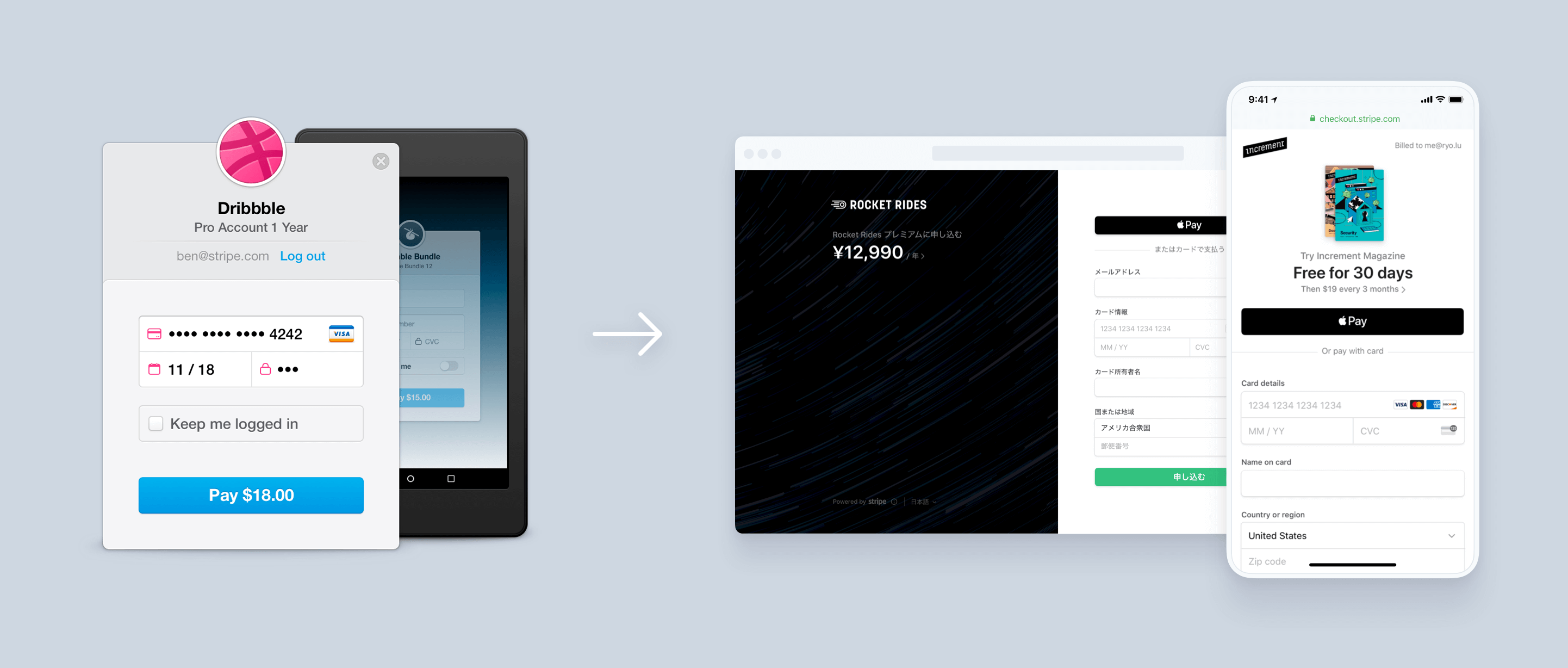

Stripe

Stripe is the runner-up for best payment service provider overall:

- Available in 25 countries

- Highly customizable and scalable

>>> Might you like: Speed up payment processing and reconciliation with a full-featured Stripe POS system

PayPal

Paypal is the best payment solution provider for online businesses including popular eCommerce platforms like Magento, Shopify, and WooCommerce:

- Trusted by more than 17 million merchants

- Most popular solutions among online customers, with 218 million customer accounts

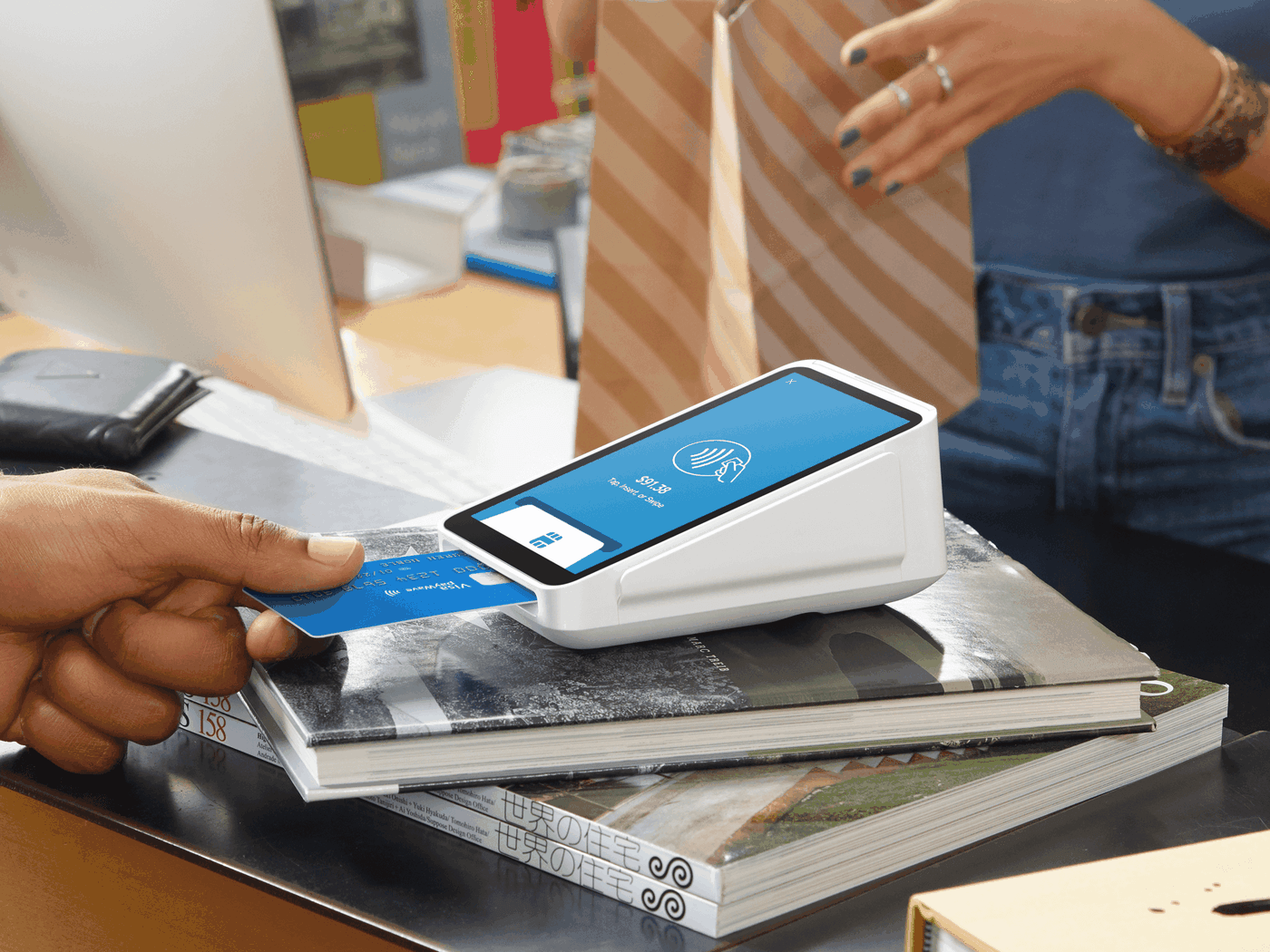

Square

Square is the best merchant service provider for brick-and-mortar businesses and the perfect choice for farmer’s markets, food carts, and other mobile merchants like craft booths:

- Include a free mobile card reader

- Allow merchants to accept both online payments and in-person with no setup

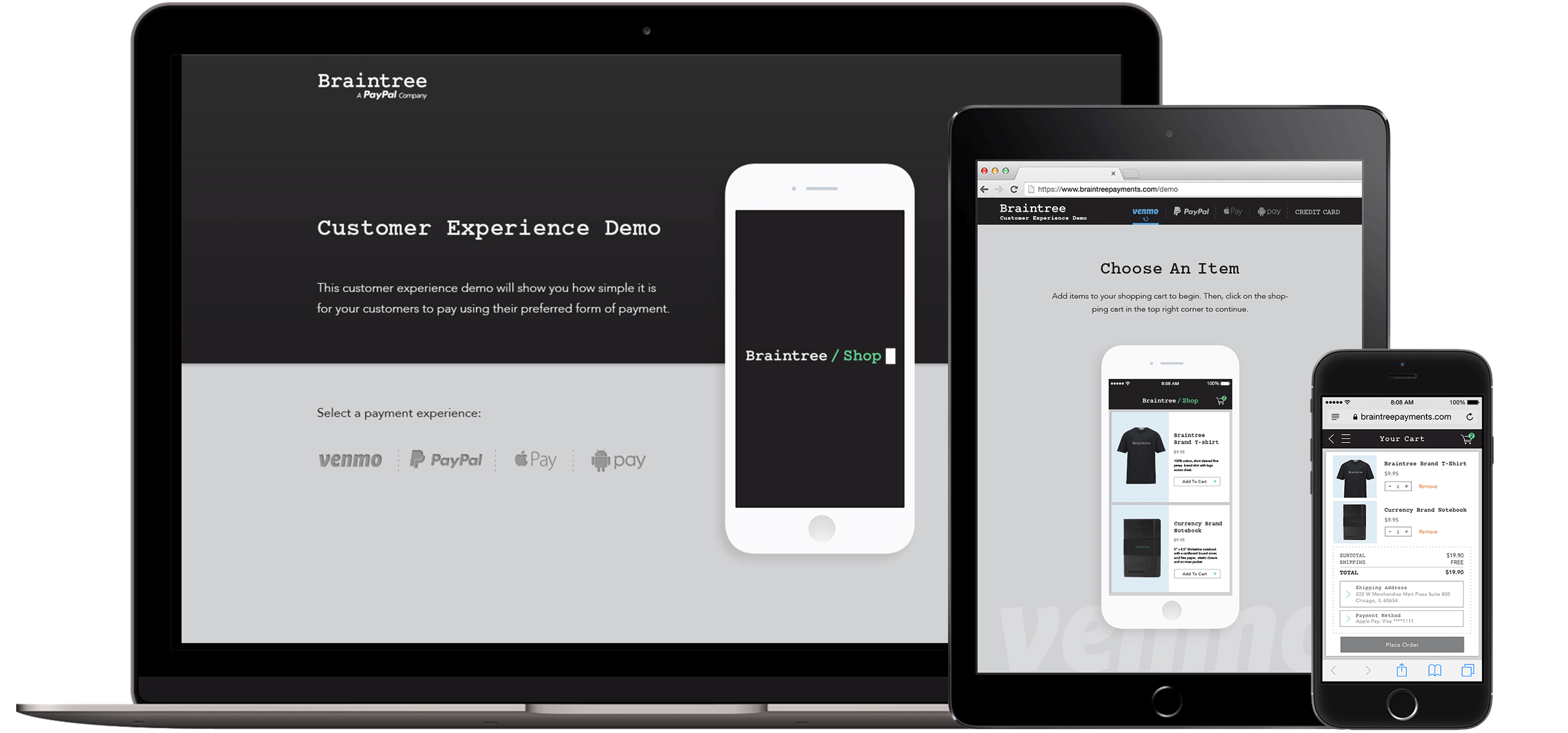

Braintree

Braintree is the best payment service provider for startups, which provides merchants:

- Simple pricing

- Ease of use

- Sleek interface for a seamless checkout experience

>>> Explore more: Customizable and scalable Braintree POS for medium to large retail enterprises

Conclusion

Choosing the right payment service provider can be a difficult and time-consuming decision due to so many factors to consider in the criteria matrix. However, it’s necessary and will be beneficial in the long run. If you make the wrong choice, you’ll face serious problems down the road, including limited forms of payment, poor customer service, high pricing and recurring fees, and many other problems.

We hope that this guide has provided retailers with what you need to know to find a suitable payment service provider for your business. You can take our question checklist to confirm yourself when comparing options.

With our detailed step-by-step analysis, you’re sure to make the right decision for specific needs of your business and customers.