When it comes to launching a business, location is an important aspect, especially in retail. The location of your business may have a significant influence on your visibility and foot traffic, so researching and obtaining the optimal one is time-consuming. Therefore, if you’re already looking for a good location, negotiating for a commercial lease is the most crucial step that you need to go through.

So how to negotiate a commercial lease for retail stores? You may find out some effective negotiation tips in this article.

What is a commercial retail lease?

A commercial retail lease is a lease agreement between a landlord and a business for renting a property where the permitted use is for selling goods. Commercial retail leases, unlike residential leases, are expected to go through numerous rounds of discussions with landlords demanding adjustments to ensure that the lease agreement meets their needs. In reality, real estate makes up two-third of global net worth with US$280.6 trillion value and 6.2% annual growth at the end of 2017 in which commercial real estate accounts for almost 12% with $33.3 trillion, just behind residential real estate. These data prove that commercial real estate has great room for growth and is a competitive market.

Three different types of retail lease

Aside from the agreed-upon rental cost, maintenance obligations, and property specifics, the lease agreement can be constructed in many ways. Clint Gharib, Founder of The Gharib Group-Integrous Investing, describes three primary types of commercial retail leases in a recent Forbes piece as follows:

Gross lease/full – Service lease

According to lexisnexis.com, gross lease accounts for 30% of total retail space leases. The tenant’s rent under a gross lease includes all property running expenditures. These costs may include but are not limited such as property taxes, utilities, upkeep, and so on. The landlord covers these charges by deducting them from the tenant’s rent. Tenants enjoy this sort of lease because they do not have to be engaged in the day-to-day operations of the building and because the rent is constant, even if the expenditures are not.

Net lease

The net lease is a type of commercial retail lease that is quite flexible. A net lease has a lower base rent than a gross lease, but the tenant must pay additional fixed running expenditures such as property taxes, insurance, and common area maintenance (CAM). Net leases are classified into four types:

- Single net lease: Tenants on a single net lease pay a fixed rent as well as a portion of the property tax. The landlord pays for the building’s bills, and the tenant is responsible for paying for utilities and other services directly.

- Double net lease: A double net lease is different from a single net lease in that the tenant pays a portion of the property insurance as well as the property tax. The landlord pays for common area maintenance, but the renter is still liable for his or her utilities and rubbish collection.

- Triple net lease: The triple net lease includes property taxes, insurance, and common area upkeep, with the tenant covering part or all of these costs in addition to their monthly rent. It is one of the most popular forms of leases which account for 42% of total leases following data from lexisnexis.com. This lease structure is unquestionably advantageous to landlords, but it is not always good for tenants. The contract does allow renters to analyze the landlord’s operational expenditures, and any savings are passed on to the tenant.

- Triple net lease in absolute terms: It is a magnified triple net lease. The renter bears all expenditures, allowing them to be solely responsible for the building. It may be preferable to buy a standalone building outright. The advantage of this lease is that renters may essentially own a building without purchasing it; nevertheless, if a disaster damages the property, you are on your own. It is most likely the most unusual commercial real estate lease.

Modified gross lease/modified net lease

The modified gross lease (or modified net lease) is the third primary form of commercial real estate lease and provides a happy medium for both renters and landlords. It occupies 28% of total retail leases. When it comes to operational expenditures, the modified gross provides for a greater range of agreements. The base rent will then be subject to the terms that both parties have agreed upon, such as the gross lease. The leasing rate is set regardless of cost increases or decreases, which is a key differentiator.

20 tips to negotiate a commercial lease for retail spaces

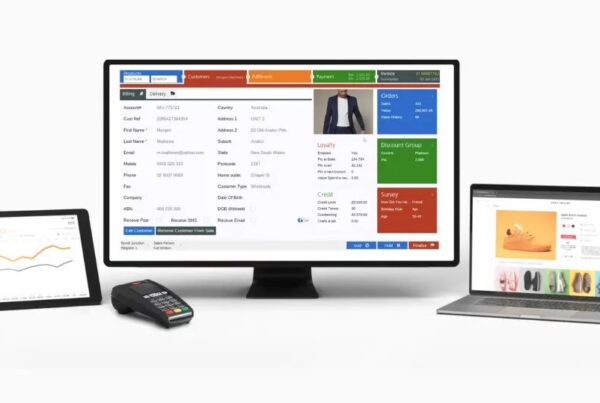

The Covid-19 pandemic has had a devastating impact on the global economy, commercial lease has no exceptions. The United States had a 28.9 million sq ft decline in office occupancy in Q3 2020, the greatest single-quarter drop on record, and vacancy soared to 16 percent. Meanwhile, shopping malls and retail real estate have been completely destroyed. The pandemic has not ended yet, but the world is learning to live together with it and real estate starts to recover. However, it is not the same as before, all businesses have to find ways to adapt, survive and develop in this new normal condition. It is time for businesses to find out their own effective retail management solution to save labor costs and streamline all business activities. Besides, lease negotiation also become much more important than ever which can bring you better prices and favorable conditions. There are some tips on how to negotiate a retail lease that you can apply as follow:

1. Examine your business’s requirements

Before negotiating a commercial lease, do some research. List your company’s existing and anticipated future space requirements, as well as your budget and chosen location. For example, you must determine your specific budget, what items are necessary, and what items are only desirable.

2. Look into comparable market rents

In a business lease arrangement, the amount of rent you will pay is a crucial factor. So, before making a sign for the company’s retail lease, do a search and comparison to get the greatest one that can meet all of your requirements. You have the right to pick among several sites for rent, and no one may tax you for doing so, so take your time to figure out more.

3. Review all the essential information for the most appropriate provision

Negotiating a business lease is likely to take longer than you expect, so begin your search for the ideal office space as soon as possible. Don’t put off signing your initial leasing agreement. Examine it straight away so you don’t end up signing a less-than-ideal lease because you’re out of time.

4. Always get involved with a lawyer and agent

It is vital to have a business lawyer involved in your lease talks. If it is within your means, you may choose to hire an agent to do retail lease negotiation. After all, agents are specialists. They will be able to obtain your deals and terms that you may not have been aware of.

It is preferable to choose a qualified business lawyer who is familiar with leases. Some firms hire a general or family lawyer and then sign a lease with hidden expenses.

5. Do several negotiations

You should negotiate from a position of strength on several fronts at the same time. You will be able to walk away from at least one of the discussions as a result of this, placing you in a stronger position.

6. Make a list of your top priorities

It’s a give-and-take situation in negotiations. It’s unsure that you’ll be able to persuade your landlord to make all of your requests. That’s why prioritizing the adjustments you’re seeking is critical. You’ll be able to tell when to be flexible and when to be firm in this manner.

7. Keep an eye out for hidden costs

Your lease might be a “gross lease,” which includes all expenditures, or a “net lease,” which includes costs in addition to the rent. In many commercial leases, the tenant is liable for charges such as common area maintenance and upkeep. Get the specifics on these expenditures upfront and try to make this area as advantageous as feasible.

Determine whether your company will be responsible for particular system maintenance and if so, learn about the present state of those systems so you can estimate expenses.

Negotiate monetary amounts for these charges or a little higher rent in exchange for the landlord covering all expenses. Determine if each renter has its utility meter or if utilities are shared based on square footage.

8. Check for a competitor clause

You can request a stipulation in the lease requiring the landlord to obtain your permission before renting space in the building to a rival. This might be very relevant for merchants.

9. Enrich your knowledge

Knowing your local commercial real estate market gives you negotiating leverage. This is particularly true in the aftermath of the Pandemic when the commercial real estate market is in flux and see how the retails change after the Covid-19 pandemic to have a better business running.

10. Don’t pay the base rent that has been offered

Landlords typically request a rent that is the greatest amount of rent they believe a tenant will be willing to pay up the advance. However, landlords do not anticipate anybody agreeing to that sum. Bring in a counteroffer that’s 10-15% less than what they’re asking for. After that, you should be able to come up with a figure that works for both.

11. Look for a place to rent for free

Free-rent is a common promotion among landlords, and it can also be a reasonable compromise on a rent reduction.

Although a landlord may be unwilling to reduce base rent because it may reduce the value future renters are prepared to pay, they may be willing to give you a discount through free rent periods.

A single free rent period every year on a three-year lease, for example, will result in a total rent savings of 8.3 percent.

12. Ask for a fair and safe gap period

This is the time for both of you to work out any issues with the lease. Particularly if you have been late on rent payments and have had to incur penalties or legal action because you failed to pay. One of your non-negotiables should be a cure period, especially since the majority of landlords are prepared to work out a deal, so don’t sign the lease until it includes one.

13. Negotiate a lesser penalty cost for early cancellation

Everything, including the early termination costs, is negotiable. All costs you have to pay are worthwhile, though don’t hesitate to fight for lower negotiation to limit your expenses on doing business.

14. Add a sublease clause

A sublease clause is good to have added in either in addition to or instead of lower termination fees. Should you need to move to another space, subleasing will allow you to recoup lost rent.

15. No competitors in the same business building should be written in the lease

It’s a good idea to ask for a condition in your lease that prevents your landlord from renting to the competitors. It might also be a nice-to-have that you’re willing to trade for something greater.

16. Keep an eye on the HVAC responsibilities

HVAC system deems to be a little point but can cost you thousands of dollars. Check with your landlord to see whether you can delegate that task. If that fails, you can have annual out-of-pocket limits established on the system.

17. Negotiate the length of the fixing time

Most likely, you’ll need to rework the room to make it suitable for your store. It might be as easy as hanging a few items, or it could be more involved. In any case, you should not assume responsibility for the job and the space’s rent at the time. If you’re paying rent, some landlords may choose to renovate the area for you. Others, on the other hand, may prefer that you renovate the area themselves, in exchange for free rent throughout the fixing phase. In this case, a planogram is a really necessary drawing to help you and the landlord make clear everything leading to easier and more specific negotiation.

18. Make sure you get all of the incentives you’re eligible for

As previously stated, negotiating with a corporate landlord on issues such as base rent and lease structure can be difficult. However, you may be able to acquire additional items for free from corporate landlords, such as free staff parking or wi-fi. And those bonuses might save you a lot of money in the long term, so don’t settle simply because the landlord says there’s nothing you can do. That’s simply their first move.

19. Negotiate your “force majeure” clause carefully

A lease agreement’s force majeure provision specifies the circumstances in which landlord or tenant duties might be postponed or waived. Acts of God, strikes, war, labor conflicts and other unanticipated events are typically covered under force majeure provisions.

20. Examine the circumstances of renewal

The typical commercial lease terms are from a month to several years. Make sure you know when your lease will be renewed and how it will be done. Also, if renewing the lease at the end of the term is crucial to you, be sure you have that choice. Other possibilities, such as the right of first refusal to lease a nearby unit for expansion, can be possible to negotiate. If the rental market has slumped, for example, the landlord may offer you a better price when you renew your lease.

Frequently asked questions

How long does it take to negotiate a commercial lease?

Commercial lease negotiation can take anywhere from one day to a year or more. Many factors can affect the negotiation process, including the size of the space, the lease’s market worth, each party’s desire to bargain, the number of rounds, and the parties’ expertise, etc. It all comes down to how similar the parties’ expectations are at the start.

How do I write a negotiation lease letter?

It might be difficult to approach your landlord and request a rent decrease. They do have expenses to pay, after all, and your rent may be one of them. Most renters, however, overlook the fact that landlords are human beings as well. A good renter who isn’t troublesome and handles the property like their own is typically worth more to landlords than a few additional dollars per month. So, what’s the best way to work out a rent deal?

In a negotiation lease letter, you have to use facts regarding current market conditions to back up your lease discussions. If applicable, you could indicate dropping property values and vacant apartment units in your region. Also, provide the information you gathered about comparable commercial rents in your neighborhood. Then, present the rent you wish to pay for your retail spaces plainly and directly.

What should I look for before signing a commercial lease?

There are so many things that you have to consider in the commercial lease negotiation process. According to a study in 2018 by RealFoundation, despite 3.2 mils CRE leases globally, there is no standardized lease agreement format. However, there are some terms that you have to look for and check carefully before signing a commercial lease. It includes the parties and the property, the length of lease, the rent, utilities, lease extensions, deposit, tenant’s rights and responsibilities, …

To sum up

In general, if you plan to launch a retail store, the first thing you have to learn is how to negotiate a commercial lease since it can influence your business’s success. However, as long as you take the time to research, consider, and negotiate the right way based on those 20 tips, you will get what you need in that contract. And then, don’t forget to reach the Magestore retail operations solution to limit the complex management process and ease your business retail.

Great Article. Thank you For Sharing…

Thank you for sharing this valuable information. Jeng! It is crucial to verify the lease’s duration and the termination terms in the paperwork.

Jeng, thank you for your valuable advice! Negotiating a business lease may significantly impact your company’s prospects. For example, rent is likely to be one of the biggest expenditures directly affecting a firm’s profit potential. Negotiations can be useful in this situation. However, to negotiate a fair lease, I believe it is vital to perform comprehensive research, remain calm, and seek the guidance of a commercial real estate lawyer.

Thanks for this blog, clearly the best way to negotiate a commercial lease for retail store, this is also applicable in any leasing space available in the market. Great FAQ.

Great article on business law basics! I’d love to see more content on international business law and how it impacts small businesses.