More and more retailers have recognized the importance of ensuring a consistent and wow experience for customers throughout their shopping journey. When shopping, customers are not only interested in what they buy, how much items cost, but also how they pay. Thus, implementing the right payment strategy to process payments in stores will open up new opportunities for retailers to win the hearts of customers. With that in mind, we provide this comprehensive guide for you to set up and run a payment acceptance system in your retail stores.

Choose the right methods to accept payments from your customers

Most retailers accept credit cards and cash payments from their customers. However, if you only offer such payment methods, you may inadvertently turn away the opportunity to deepen relationships with your existing customers. Even, you miss out on some new customer segmentations. We’d like to introduce the top 5 accepting payment options that customers will love the most in 2021.

Cash payments

Cash is the primary method of payment. It is a direct form of accepting payment and doesn’t require extra fees or complicated payment processors. Although mobile and credit card payments are on the rise, many customers in the U.S. still remain their choice for cash payments. This proportion is even more in Japan where more than 25% of survey respondents prefer to pay in cash when shopping online.

Debit and credit card payments

Debit and credit cards, or bank-issues are gradually dominating payment methods in the market. According to a Hitachi and BAI Consulting research, 41% of customers tend to use cash less and 97% of consumers gradually switch to debit and credit card payments. Thus, you should accept debit and credit card payment to keep up with your competitors and customers.

That’s not to mention paying with debit and credit cards offers a lot of advantages.

A recent research indicates that customers will pay more with credit cards than with cash. After a girl scout group in the U.S. rolled out a mobile credit card swipe service, their cookie sales increased 4 times year-over-year.

However, credit card processing fees are something to consider. It’ll cost you between 1.5–3% of total sales depending on the card processing providers.

Mobile and smartphone payments

In recent years, smartphone and mobile payments are another rapidly growing payment method. They are also known as contactless payments, or mPOS used on popular smartphones such as Samsung Pay, Google Pay, and Apple Pay.

According to Business Insider’s Mobile Payments Report, the number of Americans using in-store mobile payments reached $150 million in 2020, accounting for 56% of total in-store retail payment volume. Mobile payments really bring a more convenient, easier and faster experience to customers because they often carry their phones with them.

Gift cards, store credit, and discounts

Store credit and gift cards are not only a payment method, but also one of the most powerful tools for retailers to build loyal and lasting relationships with customers.

- Gift cards and store credits help retailers keep money in their ecosystem. They are financial leverages because you get a share of the revenue before the customer actually consumes.

- Store credit helps businesses continue and maintain existing customer relationships, while gift cards promote your store to new customers.

- In addition, they are especially useful in the case of product exchanges and product returns. Instead of a cash refund, you have the flexibility to give customers some store credits or a gift card.

Modernize your payment experience

Once you understand the benefits of offering multiple payment options, you should decide which option is right for your customers and your store.

CustomerThink research indicates that about 50% of shoppers will abandon a purchase if you don’t offer their preferred payment methods at checkout. To avoid losing this large revenue, retailers should accept as many payment methods as possible.

Accepting different payment methods won’t be too difficult if you have a modern point of sale system that integrates flexible terminals. It helps to:

- Create better customer experiences

- Increase repeat purchases

Such a system capable of accounting for transactions like that will help, you flexibly and easily accept multiple payment methods by offering custom payments, including:

- Split payments: 2 customers jointly pay for an item with 2 debit or credit cards, or split a bill among multiple credit cards.

- Split tender: Customers can split the amount and pay by their credit card and in cash for an order.

- Partial payments: Retailers can accept a part upfront and collect the rest by layaway payment or credit packages. Or, you can collect partially by cash and allow customers to pay the rest via online invoicing service. Those payment methods can increase your average order value (AOV).

Accepting a variety of payment methods provides transaction flexibility for both sellers and buyers. Providing the right payment methods for your customers is the key factor you should consider when planning to expand your market or improve your conversion rates.

The choice of certain payment methods depends on your customer location and the nature of your transactions. Here is the table comparison of the 9 most common payment types accepted.

Description | Supports refunds | Supports disputes | Payment confirmation | |

Cash | The easiest and most popular payment methods. Merchants won’t have to pay any fees to accept cash. | Yes | Yes | Immediate |

Checks | Suitable for frequent or large purchases. Merchants won’t have to keep cash in your store or pay any fees to accept checks. | Yes | Yes | Delayed |

Cards | Cards are linked to your credit or debit account at a bank. | Yes | Yes, highest dispute rate | Immediate |

Wallets | Wallets are linked to a bank account or card to store monetary value. It requires authorization such as password, SMS, or biometrics verification to complete payments. | Yes | Yes, lower dispute rate than cards | Immediate |

Bank debits | Bank debits take the value directly from customers’ accounts at the bank. | Yes | Yes, lowest dispute rate | Delayed |

Bank redirects | Bank redirection requires you an additional verifying layer to authorize your debit payment. | Yes | No | Immediate |

Bank credit transfers | Credit transfers allow customers to transfer money from their bank account to the merchant account. | Yes | No | Delayed |

Buy now, pay later | Buy now, pay later provides customers with immediate financial resources and customers will repay recurring installments. | Yes | Yes, most methods will take on fraud risk | Delayed |

Cash-based vouchers | Customers take a scannable voucher with a transaction value that they can bring to the supermarket, convenience store, bank, ATM to complete payments. | No | No | Delayed |

Build your in-store payment experience strategy

In the past few years, the perspectives of store owners on customer payment experience have changed drastically. From just viewing payment processing costs as a business expense, most retailers have admitted that payment methods are the key driver of providing:

- A seamless and integrated shopping experience

- A unique business competitive advantage

To build your payment strategy, you can start by asking yourself the following questions:

- What do my customers expect from the payment experience?

- How can I enhance the in-store accepting payments to meet that expectation?

- How should I design checkout to make the customer’s shopping experience more personalized and seamless?

- How to organize and arrange finances to improve the overall customer payment experience?

- How to balance customer experience and fraud management?

- How do global data protection trends impact my payments strategy?

- Which supplier or partner is suitable for me to process payments?

Choose payment vendors for your business

Next, you should choose suitable payment and supporting technology partners to go with the growth of your business, including:

- Merchant bank to register your business account

- Payment service provider

- Payment processors

- Payment gateway

They keep your retail business agile and modern by staying up to date with new trends. In addition, when you want to add new payment capabilities, they help you adapt and build your payments infrastructure.

Learn more: Pre-authorization explained: How it protects retailers and enhances customer checkout

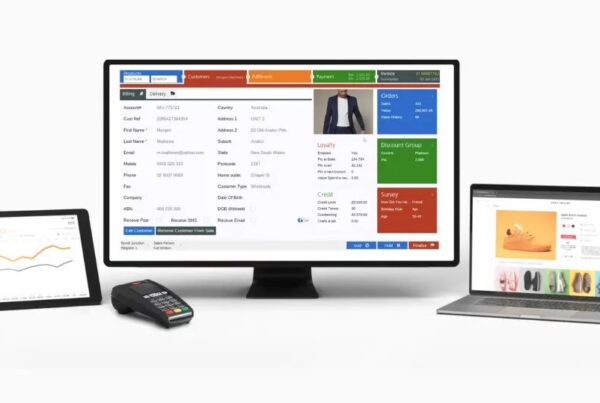

Choose a POS system to process payments

As mentioned in the previous part, having a suitable POS system is helpful for you to keep accurate transaction records and manage your sales, including:

- POS hardware, or POS devices: A card reader, cash register, and receipt printer that you need to set up and connect to your computer or mobile devices

- POS software, or POS system: Store and record all your sales transactions. It can save your time and analyze by reporting data.

Because there are so many POS solution options to consider, we recommend 3 main aspects to your choices:

Cost

The cost of POS systems consists of upfront costs and ongoing fees.

- You can rent (monthly/annual subscription fee included) or purchase POS hardware and software.

- Some POS providers may cover the credit card processing fees if they provide POS terminals, hardware, software, and payment gateway. You should compare the difference between using a separate POS with a third-party payment processing provider and an all-in-one solution.

Features

Depending on the complexity of your retail business, you’ll choose different functionality for your POS system. Also, your requirements may change according to your business growth. Specifically, you should choose POS systems that can fulfill what features you need today and can help you to scale in the future.

We suggest a checklist of a great POS system:

- Accept EMV chip in credit and debit cards

- Accept mobile and contactless payment (swipe and tap rather than insert cards)

- Synchronize loyalty programs both online and offline

- Send digital receipts

- Print physical POS receipts

- Manage employee’s shifts

- Create sales reports

- Track product inventory

- Scan product barcodes

- Store cash in a safe drawer

Read more:

Ease of use and support

The system setup, configuration, and training may take most of your valuable time before launching. Thus, you should choose a user-friendly system that requires minimum effort. In addition, always make sure that you can get the needed support from your POS providers if there are any technical issues happening during sales operation.

Magento merchants can check out our guide to switching POS system.

Deliver payment methods and checkout experiences your customers love

To improve conversion rates and customer loyalty, you should ensure your payment experience implementation meets the following criteria:

- Preferable payment methods: Make sure that you accept payments in accordance with your customers’ expectations

- Alternative payment methods: Always update new trends and popular technologies such as QR code payments, WeChat Pay, Alipay, and PayPal Pay

- Card types: Ensure your processors can handle most popular cards like PayPal and American Express

- Multi-channel interaction: Allow processing payments online and picking up at stores

Conclusion

Processing payments is an important factor in growing a business and increasing overall revenue. An effective payment strategy helps you minimize operation costs and even open new opportunities in the future. Customers will spend more if you give them the payment flexibility they are looking for. It also creates a better customer experience and maintains your loyal customers.

However, it requires careful thought and execution. It’s essential to continuously stay up to date with technology and market trends. That would help you in keeping pace with changing customer needs in terms of payment methods and touchpoints.

To have a big picture, we recommend you include payment processing design into the development strategy of the overall business value chain.

Building the right payment strategy and partnering with the best-suited payment vendors will enhance your payment experience, so you reap more benefits.

If you’re a Magento merchant looking for a POS solution that can be customized to fit your payment strategy, you can book a free consultation with us to get started. Together we can build a solution that fits your business.

Hi –

Not sure if this is important to you, but just an FYI that shopify published an article in Feb 2022 that plagiarizes your post, see example excerpt below:

From your article: Most retailers accept credit cards and cash payments from their customers. However, if you only offer such payment methods, you may inadvertently turn away the opportunity to deepen relationships with your existing customers.

From Shopify: It’s common to accept cash and credit card payments from customers. But if those are the only payment options you accept, you could be turning away new customers and missing out on opportunities to deepen relationships with existing ones.

https://www.shopify.com/retail/retail-payment-options

It’s a really great article, thanks for sharing such informative knowledge with us.