There are some moments in life when you fall in love with a piece of item in a store. You think that the item is a perfect gift for yourself or someone in your family. But how can you buy it if you don’t have enough money in the bank account to pay for that item? Luckily, you might be able to put the item on the layaway program. So what is layaway? This article will help you find out layaway definitions, their pros, and cons when using.

What is layaway? Or what does layaway mean?

Layaway is a payment plan which allows a consumer to put down a deposit on an item to lay it away for future pickup. The retailer will keep those items for a predetermined period and give them to customers when they get the final payment. Understanding layaway meaning can help people make a wise decision when purchasing the things they want without enough cash in hand.

This payment plan is ideal for low-income consumers who are ineligible for credit cards or in-store purchasing, as well as those who have bad credit. According to a survey by NerdWallet in 2018, 25% of customers were still struggling to pay off last year’s credit card debts with accumulated interest. In contrast, layaway involves a zero-interest payment and is not a debt. As a result, failing on a layaway payment has no impact on a customer’s credit score.

The history of layaway

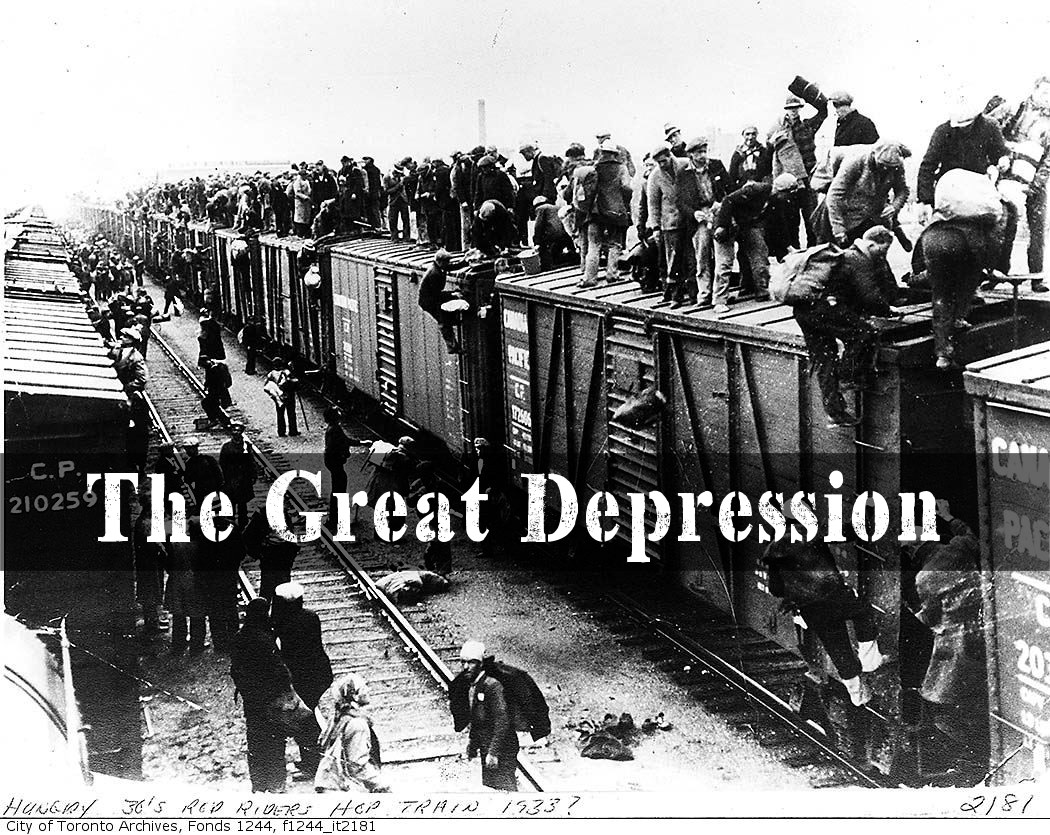

The history of layaway dates back to the 1920s through the Great Depression. It then vanished in the 1980s with the introduction of credit cards and appeared again in the late 2000s with the Great Recession.

The Great Depression from the late 1920s to the early 1930s

The Great Depression was a global economic downturn that lasted from the late 1920s through the early 1930s. The unemployment rate reached its peak at almost 25% in 1933. People didn’t have enough money to buy all their needed stuff as well as be unable to pay debts with high interest. Because of the cash shortage, retailers offered customers to pay in installments and pick up their purchases once they had paid the entire purchase price. Layaway transactions were popular until the 1980s and 1990s. After that, credit cards were more widely used, and layaway began to diminish.

The Great Depression during the late 2000s

The Great Recession during the late 2000s was marked by a sharp reduction in economic activity. It is often considered to be the worst downturn since the Great Depression. During this period, more clients defaulted on their financial obligations which made credit scarce. Banks went bankrupt as well and were unable to collect defaulted loans or extend fresh credit to customers.

Due to customers’ financial difficulties and the necessity to boost diminishing sales, some retailers started to reintroduce layaway services. Until now, there are still many retailers applying layaway plans during holidays. According to paysafe.com, a survey in 2021 showed that 33% of shoppers still planned to use layaway during the Christmas season to spread the cost.

How does layaway work?

Layaway programs go through 5 steps as follow:

Step 1: Select the item

Firstly, the customer selects the items they wish in-store or through an online channel to put on layaway and brings them to the layaway or customer service department. The items must be on the list that can be purchased on the layaway program as demonstrated by the retailer.

Step 2: Make a deposit

Secondly, if the item is authorized, the retailer will require a deposit from the customers. Some stores require a specific percentage of the full price as a down payment, while others allow the consumers to choose a reasonable amount. Customers can deposit cash through an in-store POS terminal or an online payment gateway.

Step 3: Pay remaining amounts

The 3rd step is to decide on the layaway plan’s terms. Depending on the item’s price and the customer’s disposable income, the shop may offer a weekly, bimonthly, or monthly payment plan. According to the agreed-upon layaway plan, customers have to make scheduled payments to pay off the remaining balance of the purchase price.

Step 4: Get the items

Finally, the consumers can pick up the item from the shop once they have completed the planned payments and have a zero balance. Customers may be required to pay layaway costs, which are often a low, flat-rate price for storing things throughout the payment period.

Pros and cons of layaway

Using a layaway plan can bring huge benefits to the customers. However, it also has some drawbacks that you need to consider:

Pros

-

Zero interest

Customers don’t have to pay interest on things purchased through a layaway program. That makes layaway a more cost-effective choice than using a credit card, which charges customers interest rates ranging from 15 to 25%, and sometimes even higher. Layaway services only charge a small flat-rate service fee to help retailers cover storage costs. According to a survey by Splitit in July 2018, 35% of US buyers would be more likely to buy online if they could make interest-free installment payments on digital goods. In addition, almost 50% of participants consider free interest the most important factor when choosing an installment plan following the same survey.

-

Easy acceptance criteria

Layaway plans, unlike other types of finance, do not have strict acceptance criteria. In contrast to credit cards, retailers do not undertake credit checks. Customers with bad credit or no credit history can participate in these programs because they only ask for identification and a deposit for the goods.

-

Available online

Some retailers offer layaway for online purchases. So you don’t need to wait in a long line or go to several locations to search for the products. Consumers can purchase things through online layaway schemes by making scheduled deductions from their checking accounts and later pick up in-store if they feel convenient. By removing associated storage and bookkeeping costs, online layaway makes layaway easier for both businesses and customers. Rather than taking up valuable retail warehouse space, layaway items are kept at the distribution center for the duration of the layaway term.

Cons

-

Fees

Layaway programs offer free interest. However, most retailers still charge some fees besides the deposit including service fees, cancellation fees, or restocking fees. It can be from 5$ to 100$ depending on each store. Therefore, layaway is not a suitable option for a small purchase. In addition, if you cancel the layaway agreement, you may lose all those paid fees

-

Strict payment terms

Customers must make periodic payments within the agreed-upon time frame to participate in layaway services. Customers who break these terms risk losing their stuff and being charged a cancellation fee.

-

Potential losses

If you do not complete your layaway agreement, you will not lose the money you paid, but you will have to pay additional fees. For unpaid or canceled layaway agreements, most businesses charge a cancellation fee. Besides, some stores charge an additional restocking fee to put the items back on the shelf.

-

Not available for every purchase

Many stores just limit the items they have on the layaway programs. Besides, layaway is also not encouraged or applied to items with small value because of all added fees.

Layaway vs. credit cards

When people think about payment methods and plan for purchasing any items without available cash in hand, they will think about layaway and credit cards. These two payment types share some features in common but also have many different points.

Similarities

Layaways and credit cards are both utilized to buy something that a person can’t afford right now. Both have late payment penalties and default penalties. Both enable payments to be made in installments over a set length of time.

Differences

Layaway

With layaway purchases, customers can only bring home the item once they fulfill the payment to the retailer. Besides, layaway requires a deposit that is equal to some percentage of item value. You also do not need good credit to apply for a layaway program. If you fail on a layaway plan, it will not impact your credit score.

Credit cards

With credit card payment, customers can get the item right away. You don’t need to pay a deposit amount. However, you have to pay added interest in the unpaid amount that can increase the original price, and later you may face credit card debt. In addition, you do need good credit to receive a credit card or at least good terms on a credit card.

If you can pay your balance next month, a credit card is a better option. Credit cards allow you to build a positive credit history, have rewards plans where you can earn points or cashback, and receive your item right away. However, if you can’t afford a full payment in a month, layaway can be a better choice to avoid accruing the high-interest debt associated with credit cards.

Top 5 stores that offer a layaway program

Nowadays, there are still many big stores using layaway programs. We can list the top 5 stores as follow:

Buckle

Buckle is a leading retailer of fashion-forward young men and women’s casual clothes, footwear, and accessories in the medium to higher price range. Buckle layaway allows layaway customers to reserve products in-store with a minimum 20% deposit. Layaway merchandise is retained in the guest’s local Buckle store until the balance is paid in full within 60 days. There is no service fee.

Big Lots

Big Lots is a large retail chain where you can find everything from electronic goods to household appliances. Big Lots currently offers layaway purchases only for furniture merchandise at select locations. It does not charge a service fee, but customers have to pay a 5% cancellation fee in some stores. The normal applied deposit rate is 10% of the item value.

Kmart

Kmart is a store chain that sells a wide range of products, including apparel, toys, appliances, and recreational items. Select items can be put on layaway at Kmart in-store, online, or via the app. It provides two layaway options: an eight-week and a 12-week plan. The eight-week plan will generate a $5 service fee and a $10 cancellation fee while a 12-week plan offers a $10 service fee and a $20 cancellation cost.

Baby Depot

Baby Depot is a retailer of baby car seats, clothing, cribs, changing tables, and other items for babies. Baby Depot stores offer a 30-day layaway program, requiring a minimum of $10 or 20% deposit. In addition, they also require a $5 service fee, plus a $10 cancellation fee.

Sears

Layaway at Sears is available both in-store and online. They offer an 8-week plan for purchases below $300 and a 12-week plan for the higher purchase value. The layaway purchase requires a 10% deposit and a $5 service fee with an 8-week plan and a $10 service fee with a 12-week plan. If you use online layaway, you can choose the store location to pick up the item at your convenience once you finish the last payment. It is considered as a click-and-collect purchase that many other stores also offer to improve customer experience. In addition, you also can make an online schedule for delivery.

Additional layaway-related information

What is a layaway plan?

A layaway plan is a payment option for low-income buyers. It allows buyers to pay for an item in weekly and monthly installments after the deposit. A layaway plan ensures that the buyers will get their chosen merchandise once it is fully paid.

Is layaway a loan?

Layaway is not a loan. You don’t need to pay any interest rate for the remaining payments. Besides, you also do not get the products until you pay the full amount. Later you may fail to pay all the remaining amount due to some reasons. You may be asked for some service fees.

Does layaway build credit?

Layaway does not build credit because you do not receive your product until you have paid in full. The store will not lend you anything. As a result, you won’t have to fill out a credit application to be eligible for a layaway plan, and the merchant won’t check your credit score. This is a benefit of a layaway plan because it does not result in a new credit inquiry.

What happens if you stop paying layaway?

Your payments will be returned if you or the shop cancels a layaway agreement. But the store will certainly charge you a cancellation fee or restocking fee. Besides, the service fee will also not be refunded.

Conclusion

In general, layaway used to be the best alternative for clients who couldn’t afford to pay for the things they wanted right away. Through this article, you may get appropriate answers to any of your questions: what is layaway? What are the advantages and disadvantages? What is its history? As a result, you can decide whether or not to apply for this payment plan. Nowadays, despite the availability of many other modern payment methods, many large store chains still use layaway in their payment system. It demonstrates that layaway has its own set of competitive benefits that many buyers still favor.

I love layaway! I’ve used it at several stores. It’s a great way to save money and get your items sooner!