Pay by link, also known as a payment link, is a digital payment method that provides a secure, shareable URL or QR code, which customers can click or scan to complete their payment online via a payment provider’s hosted checkout page.

For omnichannel retailers, pay by link can unlock a smoother customer experience across channels, whether it’s paying online for in-store pickup, completing a purchase via social chat, or handling a phone order with a simple link. But implementing pay by link at scale isn’t always straightforward.

The reality behind the scenes is full of friction: systems that don’t talk to each other, staff spending hours manually reconciling payments, inventory might not update in real time, and customers stalled by a checkout process that’s anything but seamless.

In this guide, you’ll learn what pay by link is, where it fits in an omnichannel strategy, and how to use it to create faster, smoother checkout experiences across all customer touchpoints.

What is pay by link?

Pay by link, also known as a payment link, is a digital payment method where merchants generate a secure, clickable URL (or display it as a QR code) and send it to customers via email, SMS, social media, or messaging apps. When clicked (or scanned), the link directs the customer to a checkout page to finalize the payment.

Payment links primarily come in two key formats:

- URL/Button: This is a clickable link sent to customers via various communication channels, such as chat, email, or SMS. It directs them to a secure payment page where they can finalize their purchase.

- QR Code: Especially powerful for in-store transactions, a dynamic QR code can be generated directly from a payment link for immediate, contactless checkout. Customers simply scan the QR code with their smartphone, review their order, and complete the payment.

How does pay by link work in omnichannel retail?

In omnichannel retail, customers interact with your brand across multiple touchpoints, online stores, mobile apps, physical shops, social media, and messaging platforms. Payment links (or pay by link) help unify these fragmented touchpoints by offering a consistent, secure way to collect payments, no matter how they choose to shop.

Here’s how it operates across an omnichannel retail environment:

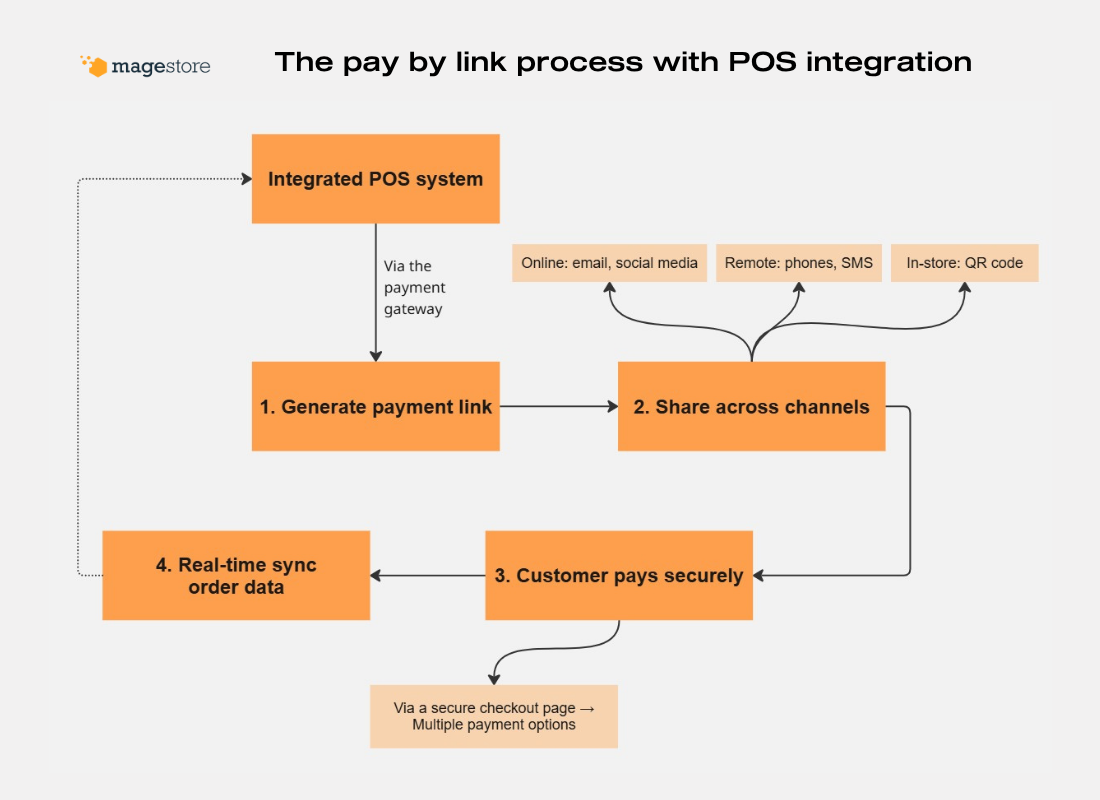

1. Generate the payment link/QR code

Here’s how a payment link is generated:

- Via POS: If your POS is integrated with your payment gateway, when there is an order, the POS sends order metadata (amount, order ID, currency, customer email, etc.) to the payment gateway. A secure link or QR code is then returned instantly.

- Via payment provider dashboard: For one-off transactions, phone orders, or manual invoicing, staff can generate payment links directly in the payment provider’s dashboard or app.

- Via eCommerce backend: For online orders, the eCommerce system or order management tool triggers the creation of the payment link automatically.

The pay by link workflow with POS integration in omnichannel retail

2. Share the payment link with your customer, anywhere

Once generated, you send this link to your customer through their preferred communication channel.

- In-store: A cashier or sales associate can generate a QR code directly on their POS screen, or print a receipt for a customer to scan with their phone, allowing for self-checkout. If the POS doesn’t support QR generation, this option won’t be available.

- Online: For abandoned cart recovery, custom orders, or B2B invoice payments, simply email or text the link to the customer.

- Remote Sales: Securely send links via SMS, chat apps (like WhatsApp or Facebook Messenger), or even over a live chat session for phone orders or social media sales, eliminating the need to collect sensitive card details.

3. The customer completes the payment securely

Customers click or scan the link and are taken to a PCI DSS-compliant, branded checkout page hosted by your payment provider. They can choose their preferred payment method: credit/debit card, Apple Pay, Google Pay, local wallets, or even BNPL, and complete the transaction in seconds.

4. Once the payment is completed, everything syncs in real time

Once the payment is successful, both you and your customer receive immediate confirmation. The funds are processed securely, and the transaction is automatically recorded in your POS system, eCommerce platform, or order management system (depending on what triggered the link), as well as in your ERP or accounting systems, if integrated.

Now that you understand the high-level overview of how payment links function across different channels, let’s explore the specific scenarios where this payment method delivers the most value for omnichannel retailers.

When and why to use pay by link in omnichannel commerce

In this section, we present some real-world scenarios of payment links for omnichannel retailers to benefit from. Keep in mind that this section doesn’t cover all of the use cases, but highlights common examples where pay by link offers significant value.

1. Curbside pickup / BOPIS (Buy online, pick up in store)

If you offer curbside pickup or BOPIS services, payment links can streamline the process:

- Customers place their orders on your website and select “BOPIS.”

- Your POS flags the order so staff can pick and stage the items for pickup.

- The customer receives a secure payment link to prepay before arrival, eliminating in‑store checkout and wait times.

- Once payment is confirmed and inventory is verified, the order is guaranteed to be ready and accurate for a smooth pickup.

For example, a bakery uses Magestore POS to unify its online and in-store inventory. When a customer places an order online and selects BOPIS, the POS verifies inventory availability and instantly generates a secure payment link for the customer to prepay. The link is tied to the exact order amount and fulfillment location. Once payment is completed on the customer’s phone, Magestore POS automatically updates the order status to “Ready for Pickup,” allowing staff to prepare the order in advance and deliver it curbside, no lines, no manual checks, and no risk of inventory mismatch.

2. In‑store out‑of‑stock, fulfilled from online or other store inventory

When an item is sold out at a physical store, payment links can support cross-channel fulfillment by enabling staff to complete the transaction remotely.

For example:

- A customer visits your store looking for a specific item, but it’s out of stock locally.

- Your sales associate uses the POS system to check real-time inventory across your online store and other locations.

- If the item is available elsewhere, they create an order and generate a secure payment link on the spot.

- The customer pays via the link, and the item is shipped directly to their home or preferred address.

For instance, a customer walks into a footwear store looking for red sneakers, but that color is sold out. The staff checks real-time inventory and sees that the item is available either online or at another store. They create the order in the POS, generate a secure pay-by-link, and send it to the customer by SMS. Once paid, the item is shipped directly to the customer from the online warehouse or another branch, saving the sale without any hassle.

Other valuable use cases of payment links for merchants

There are countless other payment-link use cases you can tailor to your business’s unique needs, such as:

- Social & chat‑based commerce: You showcase your latest arrivals on Instagram. When a customer expresses interest in an item, the sales representative chats with the customer via Instagram DM, then generates a payment link for that product in the POS and sends it directly to the customer through DM.

- In‑store QR checkout: After finishing their meal, a customer at a restaurant requests the bill. The server brings the printed receipt, which includes a unique, dynamically generated QR code from your POS. The code encodes a secure payment link tied to that table’s order, allowing the customer to scan it with their phone and pay online.

- Phone & email order payments: Let’s say you run a florist shop that takes same-day phone orders. Staff enter the bouquet and delivery details into their POS, then email a payment link to the customer. The customer clicks, pays via the hosted page, and the POS auto-marks the order paid, ready for dispatch.

- Abandoned cart recovery: A customer adds skincare products to their cart but abandons checkout. The email automated system sends a personalized email 2 hours later: “Hi Sarah, you left some amazing products in your cart! Complete your purchase with 10% off using this link.” The payment link includes the original cart contents with the discount applied.

- Upsell & post‑purchase payments: A customer purchases a bicycle in-store. The following week, the store sends a payment link via email or text to register for a cycling workshop or local race event, making the post-purchase offer seamless and actionable.

Top 5 pay by link providers comparison

Criteria | Stripe | Adyen | Square | PayPal | Worldpay |

Transaction fees | 2.9% + $0.30 per transaction (standard); +1.5% for international cards; 2.7% + $0.05 per transaction (in-person). | A fixed processing fee$0.13 + a fee determined by the payment method (e.g., iDEAL payment € 0.22; Amex transaction 3.95%). | 3.3% + $0.30 per successful link-based payment. | 2.99% + fixed fee based on currency received for pay Links, buttons, and buy buttons (e.g,+ $0.49 for US domestic). | No specific figure, it’s calculated based on annual card turnover and average transaction value. An authorization fee of 4.5p applies to all transactions. |

Set up and ease | Easy for developers & non-devs via dashboard, full API/SDK support. | Easy for developers & non-devs via dashboard, full API/SDK support. | Very easy, built into Square POS/dashboard. API available. | Straightforward setup via PayPal Business. REST APIs are available. | Developer guides for APIs. Requires merchant onboarding and typically some backend setup. |

QR code support | Yes, supports dynamic QR codes for in-store and remote payments. | Yes, strong omnichannel support, including QR. | Yes, can create QR codes for printing or display, directly from the POS or dashboard. | Yes, supports QR code payments for in-person transactions via the PayPal Business app. | Yes, can embed links into a QR code. |

Geographic and currency support | 135+ currencies and local methods. | Supports 150+ currencies, 250+ payment methods. | Mainly US, CA, UK, AU; limited other currencies. | 200+ countries, ~25 currencies. | 146 countries, 135+ currencies. |

Customization | Logo, colors, fonts via Dashboard. | Themes, logo, background, data fields. | Simple branding; limited compared to Stripe/Adyen. | Basic customization, logo, and simple colors. | Basic branding via portal; advanced via API/integration. |

Analytics and reporting | Robust dashboards, real-time reporting, and extensive API access. | Advanced dashboard, fraud tools, real-time insights. | Detailed reporting portal, API/webhook, reconciliation tools. | Track sales generated from each payment link directly within the Square Dashboard, providing performance insights. | Comprehensive reporting and transaction insights. |

Best suited for | Startups, SMBs, subscription businesses. | Large enterprises and global businesses with complex payment processing needs require deep integration and a wide array of local payment methods across multiple regions. | Small to medium businesses already integrated into the Square ecosystem (POS, online store), looking for unified online and in-person payment solutions. | Small businesses, freelancers, and businesses leveraging a globally recognized brand; convenient for those already using PayPal for other business functions. | Large enterprises and medium to large businesses with global reach, seeking robust payment processing, strong fraud prevention, and extensive currency support. |

How to set up pay by link for omnichannel businesses

The pay by link setup process for omnichannel businesses varies based on your chosen payment service provider and typically requires technical integration to ensure seamless data flow across your platforms.

1. Choose a unified payment provider for both channels

For omnichannel retailers, you must use the same payment provider for both online and physical store transactions. Many merchants currently use separate payment solutions, one for online and another for physical stores. This fragmented approach eliminates the omnichannel benefits of payment links since transaction data cannot sync between different payment systems.

What to look for in your payment provider:

- Check if your provider allows you to generate customizable payment links or QR codes.

- Check if pay by link can integrate with your existing systems, such as your POS, CRM, or marketing tools, to automate link creation and payment tracking.

If your current setup uses different payment providers for online and offline channels, you’ll need to switch to a single provider that supports both channels before implementing payment links effectively.

2. Integrating with your core platforms: eCommerce site and POS

Your pay-by-link solution needs to communicate effectively with your existing retail technology stack.

Most leading payment providers offer direct plugins or API/SDK integrations for popular eCommerce platforms (Magento, Shopify, or WooCommerce, etc). This integration ensures that when a customer pays via a link, the transaction data seamlessly syncs with your online store’s order management and inventory systems.

In omnichannel setups where a POS system is involved, POS integration can take this further by automating link generation for in-store and remote orders, updating inventory in real-time, and syncing payment status across channels, whether the link is generated from your POS, eCommerce site, or payment provider dashboard. Here is how the real-time sync works:

- A customer places an order on your website and selects “Prepay & In‑store Pick‑up.”

- The ecommerce platform calls the payment provider’s API to generate a payment link for that order.

- After the customer prepays via the link, the payment gateway notifies your ecommerce platform of the successful payment.

- The POS system receives the order information and alerts in‑store staff.

- Staff check the pick‑up date and time in the POS, prepare the order, and update the BOPIS order status, marking each as “Packed” or “Collected” to ensure smooth operations.

To better illustrate the process of real-time integration and synchronization of payment data between eCommerce platforms and POS systems, let’s look at the real-world example of a dessert shop and coffee house, where Magento, Moneris, and Magestore POS work seamlessly together to ensure every payment made via pay by link is instantly updated across the entire system.

Magestore POS + Moneris + Magento: Successful payment link implementation example

Business background

A mid‑sized Canadian dessert shop and coffee house operates both an online store (Magento) and two physical outlets. They leverage Moneris as their payment processor for in‑store transactions and web orders.

Challenges

- Their former POS (not synced with Magento) required manual, error-prone order reconciliation.

- Fragmented loyalty & gift card systems between online and offline.

- Web orders for in‑store pickup required staff to manually verify and mark orders, slowing service.

- Difficult order management, no real-time updates, and high staff workload.

Unified solution with Magestore POS

- As a native POS for Magento, Magestore POS pulls in prepaid orders placed via payment links, gives store staff real-time access to order details, and lets them update fulfillment status directly from the POS interface, keeping online and in-store operations tightly synced.

- Integration with Moneris supports both online and in-store payments and deploys Moneris payment links for phone, email, BOPIS, or advance orders.

- Real-time synchronization of orders, payment status, inventory, loyalty points, and gift cards throughout the omnichannel ecosystem.

- Orders automatically trigger real-time updates in the Kitchen Display System (KDS) and staff dashboards, with order types assigned to the appropriate bakery or kitchen teams, ensuring smooth handling of scheduled pickups and delivery orders.

- Flexible tax setup supports custom product options and advanced department routing.

Results

- 100% real-time orders and payment sync, reducing staff workload.

- Customers can pay easily from anywhere (in-store, by link, or online), see consistent order status, and receive updates.

- Bakery/Eatery teams always see up-to-date order info and status (KDS auto-refresh, notifications, etc.)

- The owner can track, report, and manage both in-store and online orders in one system.

Book a free consultation to see how Magestore POS for omnichannel retailers can help you streamline your business across platforms.

3. Managing security, link tracking, and automation

If you’re using payment links to collect card details for future charges (recurring payments), enable tokenization. For example, Adyen allows you to tokenize the shopper’s card details during the pay-by-link transaction for one-off or subscription payments. In link settings, you can require a “shopper reference” field (basically a customer ID), which Adyen will use to attach the saved card. This way, after the link checkout, you have a payment token you can charge later.

POS systems can automatically generate payment links or QR codes at checkout, tied to a specific order number. When an order is created, the POS sends the order details, including the unique order ID, amount, and currency, to the payment gateway API, which then generates a secure payment link or QR code linked directly to that order. This ensures accurate tracking and reconciliation of payments with the corresponding sales transaction.

Additionally, you can utilize your payment provider’s dashboard or integrated POS reporting to monitor the performance of your payment links by tracking key metrics such as clicks, conversions, successful payments, and abandoned links.

Final thoughts

Pay by link simplifies payments across every channel—securely handling transactions via a single URL or QR code, with instant confirmation and automatic syncing of orders and inventory. For Magento retailers, Magestore POS integrates pay by link right at the Magento back end, keeping your workflows unified and friction‑free. Ready to eliminate checkout roadblocks?

FAQs

1. Is pay by link safe to use?

Yes, pay by link is highly secure. Payments are processed on PCI DSS-compliant hosted pages, utilizing advanced security features like 3D Secure/SCA (Strong Customer Authentication) and encryption to protect sensitive data and prevent fraud.

2. What are the transaction fees for Pay by Link?

Fees generally align with standard online card rates: 1.5–4% + $0.15–0.30 per transaction, depending on provider and card type. For instance, Stripe charges 2.9% + 30¢, while Square charges 3.3% + 30¢ for its links.

3. Does the payment link expire?

Yes. All payment link providers support expiry settings. You can typically set a link to expire from 24 hours up to several days, depending on each payment provider. Once expired, the link is invalid and cannot be reused.

4. How do I create and send a payment link?

-

-

- Generate the link via your provider’s dashboard (attach order amount, expiry, branding, and customer email).

- Deliver it through your channel of choice: Email, SMS, chat, or show as a QR code in-store.

- Track and sync payment status back to your system using webhooks (automatic notifications sent from your payment provider to update your order status in real time).

- Once paid, the order updates automatically, and inventory is adjusted. This process requires technical setup.

-