Whether you run a coffee shop, retail storefront, or pop‑up event, understanding how credit card readers work helps you avoid hidden fees and stay secure from skimming, so you can invest smarter, sell faster, and protect your customers’ data.

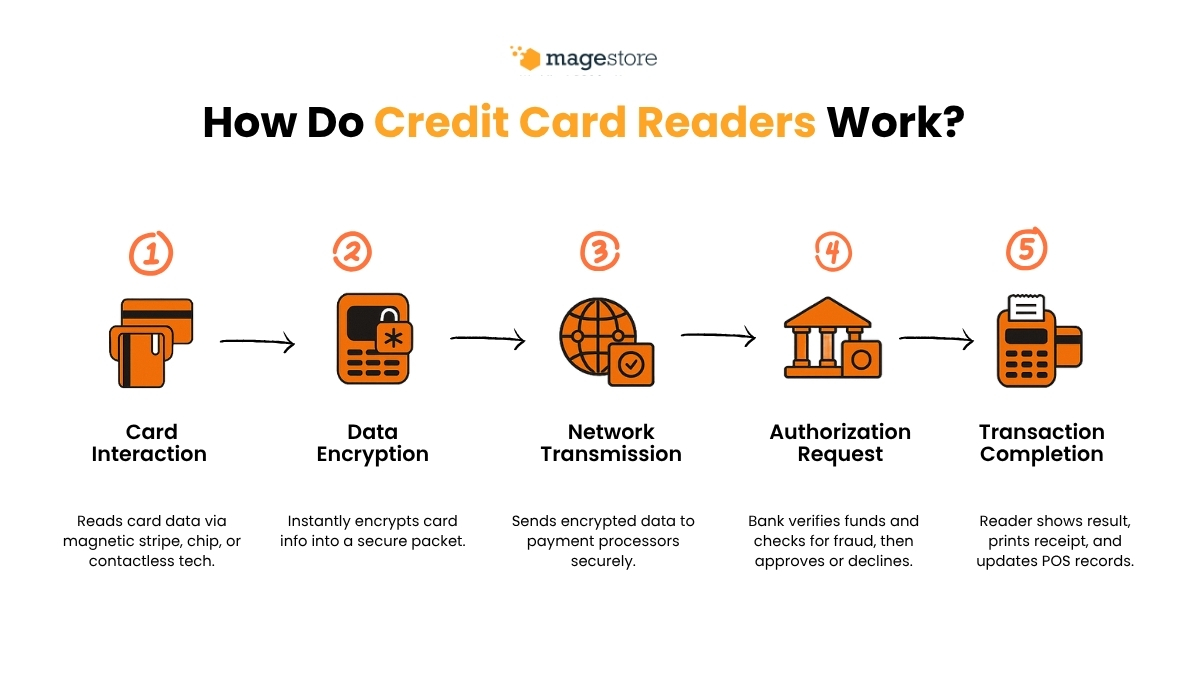

From the classic magnetic stripe swipe to chip insertions and modern contactless taps, every card transaction follows a secure process behind the scenes. While it may seem instant, the process typically follows five key stages:

- Card interaction

- Data encryption

- Transmission through secure networks

- Authorization from the issuing bank

- Transaction confirmation

In this article, we’ll break down how credit card readers handle each step of this process, explore the different types of readers available, and explain how integrating the right reader with your POS system can improve security, speed, and customer experience.

If you’re looking to upgrade your payment system or simply want to understand how it all works, this guide will walk you through everything you need to know.

- How do card readers work? The core process explained

- Types of credit card readers, features and how they work

- Are credit card readers secure?

- Magstripe vs. EMV vs. Contactless: Which reader is right for you?

- How to choose the right card reader for your business

- Do I need a POS system in my retail store or are card readers sufficient?

- Final thoughts: Unlocking efficiency and scalability with the right pos integration

- FAQs about how do credit card readers work

How do card readers work? The core process explained

At its core, a card reader enables you to accept payments by reading your customers’ card information securely and quickly. Now, let’s take a closer look at the process behind credit card transactions:

1. Card interaction

The reader captures payment data using magnetic sensors, chip contacts, or radio frequency communication.

2. Data encryption

In just milliseconds, the reader (or chip) generates encrypted transaction data and wraps it into a secure network packet.

3. Network transmission

Encrypted data travels through your internet connection to payment processors via secure channels.

4. Authorization request

- Card networks route the request to the customer’s bank for fund verification and fraud screening.

- The bank sends approval or decline messages back through the network chain.

5. Transaction completion

Your reader displays the result and prints receipts (optionally) while automatically updating your integrated POS system records. If it isn’t integrated, the cashier must manually enter or reconcile the transaction in the POS system.

Learn more: Credit card processing: An effective payment solution for businesses

Who’s involved in your transaction process?

Every time a customer pays with a credit or debit card, several key players work together in the background to complete the transaction securely and quickly. Here’s who’s behind the scenes when a customer pays:

- Cardholder: The customer using their card or a digital payment method to make a purchase.

- Merchant: A business (like yours) that accepts the payment.

- Payment terminal/card reader: The device capturing the card data at checkout. For example, Verifone, Ingenico, Clover, Square card readers that you may have encountered at retail locations.

- Payment gateway and payment processor: Think of companies like Square or Stripe that handle the data transaction behind the scenes.

- Acquiring bank (merchant’s bank): Your bank that receives the net funds from the customer’s bank via the card network.

- Card network: Visa, Mastercard, or others that route the transaction securely.

- Issuing Bank (customer’s bank): The customer’s bank that approves or declines the payment.

For example, when a customer taps their Visa card on your Bluetooth reader, the card reader captures and encrypts the data, sends it through your payment processor to Visa’s network, which contacts the customer’s bank to approve the purchase. Once approved, the funds are transferred to your merchant account.

Learn more: Payment gateway vs payment processor: Compare key differences

Types of credit card readers, features and how they work

Let’s walk through the three main types of credit card readers you’ll encounter everywhere: magnetic stripe, EMV chip, and contactless payment. We’ll explore what makes each one unique and how they actually work behind the scenes to process your customers’ payments.

The three main card readers: magstripe, chip and contactless

1. Magnetic stripe (magstripe) readers

These are the traditional readers where customers swipe the magnetic stripe on the back of their card. They are simple, affordable, and widely compatible, but offer lower security.

2. EMV chip readers

These readers require customers to insert their chip-enabled card. EMV technology provides enhanced security by generating a unique code for each transaction, reducing fraud.

3. Contactless (NFC) readers

These readers allow customers to tap their card or mobile device to pay wirelessly using Near Field Communication (NFC). They offer fast, convenient, and highly secure transactions.

Today, most card readers support various payment methods including EMV chip, magnetic stripe, and contactless NFC to maximize payment options

How do magstripe card readers work?

Magstripe cards were introduced in the 1960s and became the dominant payment card technology for decades due to their simplicity and low cost.

These cards have a magnetic stripe on the back, made up of tiny iron-based particles magnetized to store static data such as the card number and expiration date.

When a customer swipes their card through a magstripe reader, the reader’s magnetic head detects changes in the magnetic field caused by the stripe’s data. This signal is converted into digital information and sent for processing.

While magstripe readers are simple and inexpensive, the static nature of the data makes them vulnerable to fraud through cloning or skimming. Despite this, they remain in use today, especially where cost is a concern.

How do EMV chip card readers work?

To combat the security weaknesses of magstripe cards, the EMV chip was developed in the 1990s by Europay, MasterCard, and Visa, hence the name EMV. EMV cards contain a small embedded microprocessor chip that securely stores data and creates a unique encrypted code for every transaction.

When a customer inserts their chip card into an EMV reader, the reader powers the chip and initiates a secure exchange. The chip generates a dynamic cryptogram that changes with each use, making it nearly impossible to clone. The customer typically verifies the transaction with a PIN or signature. This encrypted data is then sent to the payment processor and issuing bank for authorization.

EMV chip technology is now the global standard for card payments, offering much stronger protection against fraud than magstripe cards.

How do contactless card readers and mobile payments work?

Building on EMV chip technology, contactless payments use Near Field Communication (NFC) to make transactions even faster and more convenient. Introduced in the 2000s, contactless cards and mobile wallets (like Apple Pay and Google Pay) allow customers to tap their card or device near a reader without physically inserting or swiping.

The reader emits a radio signal that powers the chip and antenna in the card or device, which then transmits encrypted payment information using tokenization. Tokenization replaces the actual card number with a unique, one-time-use token, enhancing security. Mobile wallets add an extra layer of protection with biometric or passcode authentication.

Contactless payments are ideal for quick-service environments and are rapidly growing in popularity due to their speed and security.

Technical specs of card readers to consider

- Size and Portability: Fixed, large countertop POS terminals are ideal for high‑volume checkout lanes; compact, portable units support in‑store mobility; and pocket‑sized Wi‑Fi/Bluetooth readers are perfect for tableside service, pop‑ups, deliveries, or mobile merchants.

- Connectivity: USB, bluetooth, ethernet or wi-fi.

- Battery Life: Important for mobile readers.

- Compatibility: Readers may support Android, iOS, or desktop POS systems. Some are only compatible with proprietary POS platforms, meaning they work solely with specific vendor-supplied systems (for example, Shopify) and may not function with other software or processors.

Are credit card readers secure?

Short answer: Yes, if you’re using modern, certified hardware.

Today’s card readers are built with multiple layers of security such as data encryption and secure hardware design to protect your business and customers from fraud.

Additionally, card payment systems often use tokenization and other advanced security measures behind the scenes to further safeguard sensitive information.

Certified readers never store full card data

Complying with PCI PTS and P2PE (Point-to-Point Encryption) standards, credit card readers do not store full card data. They encrypt the data immediately upon swipe, dip, or tap, ensuring sensitive information never resides unprotected on the device. Only masked data (e.g., the last 4 digits) and secure tokens are retained for receipts or refunds. This means that even if someone gains physical or digital access to your reader, there is nothing useful to steal.

Modern readers encrypt data instantly

Modern payment card readers implement P2PE, encrypting card data instantly at the reader using secure algorithms and device‑specific keys. This ensures that the card information remains scrambled and can only be decrypted within a secure HSM (hardware security module) environment at the payment processor or gateway, not by your POS or merchant systems.

Other secure layers, not handled by the reader:

- Tokenization: Performed by the payment system (gateway/processor/EMVCo), this replaces the real card number (PAN) with a one-time token that is useless outside the system.

- Biometric or passcode authentication: Managed by the customer’s device (e.g. Touch ID, Face ID). This step ensures that even if someone has your phone or card, they can’t complete a transaction without your authentication.

Together, these multi-layered security measures from the card reader’s immediate encryption to advanced system-level safeguards like tokenization and biometric authentication, create a robust and highly secure payment ecosystem for both businesses and customers.

Card readers must be compliant with PCI and EMV security standards

Secure card readers are built to meet PCI PTS requirements (enforced by the PCI Security Standards Council) and EMVCo specifications for chip and contactless payments.

And you can prevent fraud with simple best practices

Even the best tech needs smart usage. Here’s how to make sure your card reader stays secure:

- Use PCI-Certified Hardware: Buy your readers from trusted, certified providers, not secondhand marketplaces.

- Keep Software and Firmware Updated: Manufacturers regularly patch security flaws. Turn on automatic updates if possible.

- Monitor Transactions in Real Time: Many POS systems offer real-time alerts or flag unusual activity.

- Use Physical Safeguards: Train staff to spot suspicious behavior, never leave terminals unattended, and consider tamper-evident stickers for added security.

Magstripe vs. EMV vs. Contactless: Which reader is right for you?

Aspect | Magstripe | EMV chip | Contactless |

Data and security |

|

|

|

Transaction speed and user experience |

|

|

|

Hardware and integration complexity |

|

|

|

Cost and compliance |

|

|

|

Ideal use cases |

|

|

|

Regional popularity |

|

|

|

Nowadays, almost all modern credit card readers support multiple major payment types: magstripe (swipe), EMV chip (insert/dip), and contactless (NFC/tap) payments. Keep reading, we’re gonna share some tips on how to choose a suitable credit card reader for your business in the next section.

How to choose the right card reader for your business

Smart businesses start by selecting a payment processor/gateway. Once that’s in place, choose the right reader from the options your platform supports. Here’s how:

1. Compatibility with your payment solution

Only choose card readers that are officially supported by your payment platform, whether that’s Square, Clover, Stripe, Shopify, or another provider. Just because a reader works on Android or iOS doesn’t mean it’s compatible; it must be recognized and allowed by your payment solution.

Some card readers are considered as “universal terminals” (e.g., Verifone, Ingenico, PAX) and can be reprogrammed to work with multiple payment gateway/processors, but only if the processor supports that model. Always check with your provider before buying.

2. Supported payment methods

Verify whether your payment platform supports local payment schemes (e.g., QR codes), in addition to standard EMV, magstripe, and contactless options. The reader only matters if the platform can actually process those payments.

3. Hardware acquisition options

Check how hardware is offered: outright purchase, rental, or included with subscription plans. Many providers bundle devices with monthly plans, which could be more budget-friendly depending on your setup.

4. Portability and connectivity

Consider how and where you process payments, this determines the connectivity and mobility features you actually need:

- Fixed Counter Setup: Opt for readers with Ethernet or Wi‑Fi for stable, wired or wireless internet. Many countertop terminals support dual connectivity to prevent downtime.

- Mobile or Tableside Use: Choose Bluetooth-enabled or cellular-capable readers that pair with phones/tablets, ideal for pop-ups, events, or restaurant payment.

5. Security compliance

Ensure the reader you choose meets these critical security standards:

- PCI‑PTS certified: Confirms that the hardware is secure for PIN entry and supports point-to-point encryption (P2PE) directly at the terminal.

- EMV‑certified: Meets global chip and contactless transaction requirements.

- End-to-end encryption (P2PE/E2EE): Encrypts card data at swipe/tap and retains encryption until it reaches the processor’s secure HSM, ensuring no readable data is exposed in transit.

6. Ease of use and reliability

An easy-to-use, reliable card reader should pair quickly, stay connected all day, and work flawlessly when customers tap or insert their cards.

Here’s a quick checklist to verify that:

- How long does it take to set up and configure?

- Is the user interface clear and easily understood by staff?

- Will the battery last through your busiest shift?

- Does it reconnect effortlessly when pairing?

- Are there positive long-term user reviews or high ratings?

Ask providers if you can test the reader first. Answering “yes” to these means choosing a reader that’s both easy to use and reliable in real-world operations.

Learn more: Top credit card readers for retailers

Do I need a POS system in my retail store or are card readers sufficient?

Short Answer:

Yes, if you need more than just payment acceptance (like inventory tracking, detailed reporting, or multi‑channel sync), you should use a full POS system. Card readers alone only handle transactions, not the broader retail operations that most stores require.

No, if you only need to accept payments with very low transaction volume and minimal operational complexity.

Let’s show you the full picture so you can clearly understand the differences, benefits, and which option best fits your retail business needs.

What is a POS system?

A POS system ties together the hardware and software you use to process sales transactions and manage business operations such as inventory, customer data, and reporting.

Components:

- Hardware:

- Terminal/Tablet/PC running POS software.

- Card Reader (magstripe, EMV chip, and NFC).

- Receipt printer, cash drawer, barcode scanner, network hardware.

- Software:

-

- POS application that manages sales, inventory, and customer relationships, and generates reports, running locally or in the cloud.

- Optional peripherals: scales, kitchen displays, customer-facing screens, etc.

For example, Square is an all‑in‑one POS solution that combines hardware POS terminals, POS Software and Payment gateway as well.

POS system vs. standalone readers:

- Standalone readers handle only payments and require manual data entry into your POS.

- POS systems include payment hardware and POS software, go far beyond just accepting payments, they automatically record sales, update inventory, customer data, and financial reports in one place.

Learn more: POS vs terminals: Which is the best option?

When a card reader alone is sufficient?

- You only want to accept cards, no inventory, customer data, or sales analytics.

- You’re perfectly fine recording sales manually with pen and paper, or maintaining records in Excel/Google Sheets.

- You’re running a pop-up stall or a tiny shop with few products and no need for inventory or customer data tracking.

- If your payment volume is low, a compact, quick plug-and-play card reader, connecting via Type-C, Lightning or Headphone jack that simply accepts payments and lets you move on is all you really need.

Learn more: How retailers can process payments in-store

When do you need a full POS system?

- Automate stock levels, low-stock alerts, and purchase orders to streamline inventory management.

- As your business grows, a full POS can handle a higher volume of transactions and data without slowing down.

- Track sales trends, customer profiles, gift cards, and promotions, all within one integrated system.

- If you have multiple stores, a full POS can centralize inventory management across all locations, providing a real-time overview of stock levels everywhere.

- Many POS systems include features for tracking employee work hours, managing shifts, and even calculating payroll.

- If your business handles inventory, orders and customer data both online and in-store and you want to unify them in one system, consider using a POS with built-in omnichannel features. It streamlines real-time syncing of stock, sales and customer profiles as an optional benefit rather than a requirement.

Can I use my current card readers with a new POS software without buying a full POS system?

Yes, if your existing card reader is certified and compatible, you may be able to use it with POS software as long as your reader, the payment processor/gateway, and the POS platform all support integration with each other.

What you’ll need to check?

- Does it lock into a specific system?

- For example, Shopify card readers can only pair with their POS software and Payment gateways. Square card readers can pair with other POS software but the payment processor and gateway must be Square Payments.

- Universal terminals like Verifone, Ingenico, and MagTek can integrate with a wide range of POS systems and payment processors, just verify compatibility for your specific model.

- Are there any software or driver requirements?

- Some card readers require specific drivers or apps to integrate properly with POS software. Check if additional installations or configurations are needed.

- Is your card reader certified and secure?

- POS systems require secure, compliant, and certified card readers to ensure reliable integration, compliance with PCI standards, and uninterrupted payment processing.

- Uncertified or unsupported devices pose risks of failed transactions, data breaches, and non-compliance penalties.

Is there POS software flexible in integration?

When choosing POS software, confirm it integrates with the payment gateway you prefer, such as Clover, Adyen, or Square, and ask if there are any integration fees. Flexibility here allows you to select payment processors with the most competitive transaction fees, helping you reduce costs and avoid vendor lock-in over time.

If you run a Magento or Shopify store and need a Magento-native POS or a versatile POS for Shopify with deep payment payment processor integration and seamless omnichannel support, Magestore POS stands apart.

Magestore POS offers flexible integration with top payment gateways like Stripe, Adyen, Square, Clover, Moneris, and WorldPay, plus smooth accounting syncs to QuickBooks, Xero, and Sage. For larger operations, it even connects with ERPs like NetSuite and Microsoft Dynamics 365, ensuring real-time data flow across your tech stack.

Final thoughts: Unlocking efficiency and scalability with the right pos integration

You’ve now seen how credit card readers capture, secure, and transmit payment data; the pros and cons of magstripe, EMV chip, and contactless technologies; and why choosing the right reader goes hand‑in‑hand with strong fraud defenses and cost‑effective processing.

Integrating your reader directly into a modern POS system elevates your checkout from a basic swipe to a unified sales, inventory, and analytics engine, helping you reduce errors, optimize fees, and deliver a seamless experience across every channel.

Ready to streamline your payments and supercharge your store operations?

Get a Free Consultation with our Magestore POS experts and discover how a fully integrated solution can grow your business.

FAQs about how do credit card readers work

Question 1: What is a card reader?

A card reader is an electronic device that can read data from a credit or debit card, typically to process a payment transaction. It can read information from a magnetic stripe, an embedded EMV chip, or via contactless (NFC) technology.

Question 2: How does a credit card reader work?

A credit card reader works by capturing data from a card (magnetic stripe, chip, or NFC), encrypting that data for security, and then transmitting it to a payment processor. The processor forwards the request to the payment network and the cardholder’s bank for authorization. Finally, an approval or decline message is sent back to the reader.

Question 3: Do card readers take a fee?

The card reader itself usually does not “take a fee.” However, the payment processing service (think of Stripe, Shopify Payments, or Adyen) you use with the card reader will charge fees. These typically include per-transaction fees and monthly service fees.

The per-transaction fees you pay already incorporate various underlying costs, such as the interchange fee (a mandatory fee paid to the cardholder’s bank) and scheme/assessment fee (paid to card networks like Visa/Mastercard). These underlying costs, and thus your overall per-transaction fee, can vary based on card type and transaction method.

Question 4: Do you need Wi-Fi to use a card reader?

Most modern card readers and POS terminals require an internet connection (Wi-Fi, cellular data, or Ethernet) to authorize transactions in real time.

However, if your payment solution and the reader’s firmware support an offline mode, the device can securely store transaction data locally and automatically upload it once reconnected. Without any connection, those offline-captured transactions cannot be processed until the reader goes back online.

Question 5: Do chip readers work with all cards?

EMV chip readers are designed to work with all EMV-enabled credit and debit cards. While most cards issued today have chips, older magnetic stripe-only cards will need to be swiped. Many chip readers allow contactless payment which are widely used in many regions.