Although cashless payment methods are growing, many customers still want to use cash to pay and shop. Therefore, balancing your cash drawer is always a necessary business task. Unfortunately, this task can be time-consuming. However, you can learn to speed up cash register procedures by regularly sorting, balancing, and using data from your POS terminal. Not only does cash register balance bring balance to the cash, but it also gives a deeper understanding of how your cash flows in and out. So we’ll give you a step-by-step guide on how to balance cash drawers.

Rules for balancing cash register

Even with modern POS systems, you still need cash register procedures. These internal controls are necessary to protect against loss or theft and to prevent mishandling of funds. Overall, you should ensure the discrepancy doesn’t exceed $10 per day according to UCSC‘s recommendation. Thus, when delegating access to a cash drawer to employees, you should follow these 5 rules to reconcile cash drawers.

#1. Assign a cashier to a cash drawer

When building a cash wrap counter, you should assign each cashier to a specific cash drawer and ask the cashier to do counting drawers to verify the opening balance. If your store is small and has one counter, you can leave cash in your cash drawer overnight. However, keep the process the same.

#2. Add sales report to POS system

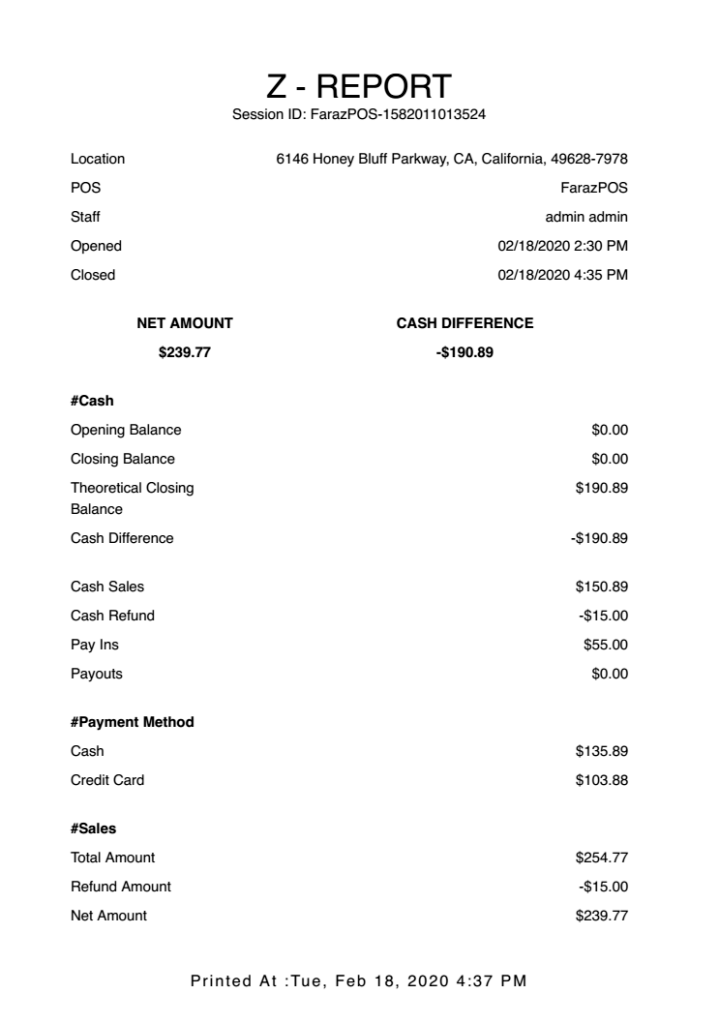

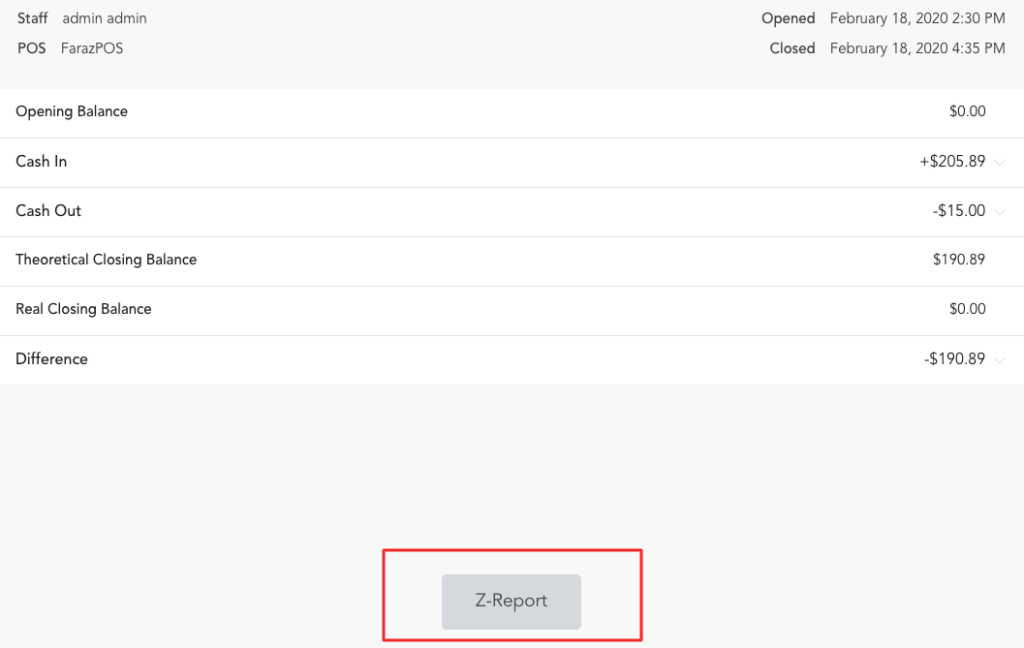

As retailers, you should add cash drawer balance to daily sales numbers so you can know precisely how much cash you need in the cash register at a given time. In addition, your cashiers or store managers can get sales reports from the POS software after the shift. Thus, if you plan to buy a POS solution, choose the right one for your needs and have a clear idea of your cash register procedures. It doesn’t take you more than 5s to print this end-of-day report from a modern POS solution like Magestore POS. And you can quickly see the difference in money, for example $190.89, to reconcile cash drawers.

#3. Ensure safe practice

Some sales staff are often in a hurry and start closing before the store closes. It’s not a safe practice. To balance a cash register, you’ll need to do it at the end of the day or the cashier’s shift. Make sure your employees turn off the lights on the sales floor and lock the doors. Then they can bring the cash drawer and its contents to the office to prepare the report.

#4. Separate employee’s tasks

You might consider using 2 people to balance the cash drawer for greater accountability. For example, one is counting cash registers to generate daily cash statements while the other prepares bank deposits. Both of these employees must sign the report stating that they’re responsible for the presented figures. This audit helps prevent collusion between employees.

#5. Keep the frequency of balance cash drawers

When you reconcile cash drawers correctly and regularly, your cash drawers always have enough money for your employees to work during their shifts without disrupting operations or negatively affecting service. Therefore, your employees should balance the cash drawer at the end of each shift to maintain profitability. However, if you don’t have enough resources for balancing cash registers with such tight frequency, make sure you do it at least once at the end of the day.

How to balance cash drawers

Cash register procedures can vary among retail businesses. For example, a smaller business may have only one cash drawer to count, while a larger business may need counting drawers several times a day. However, regardless of your business size, here are 4 steps to balance your cash drawers:

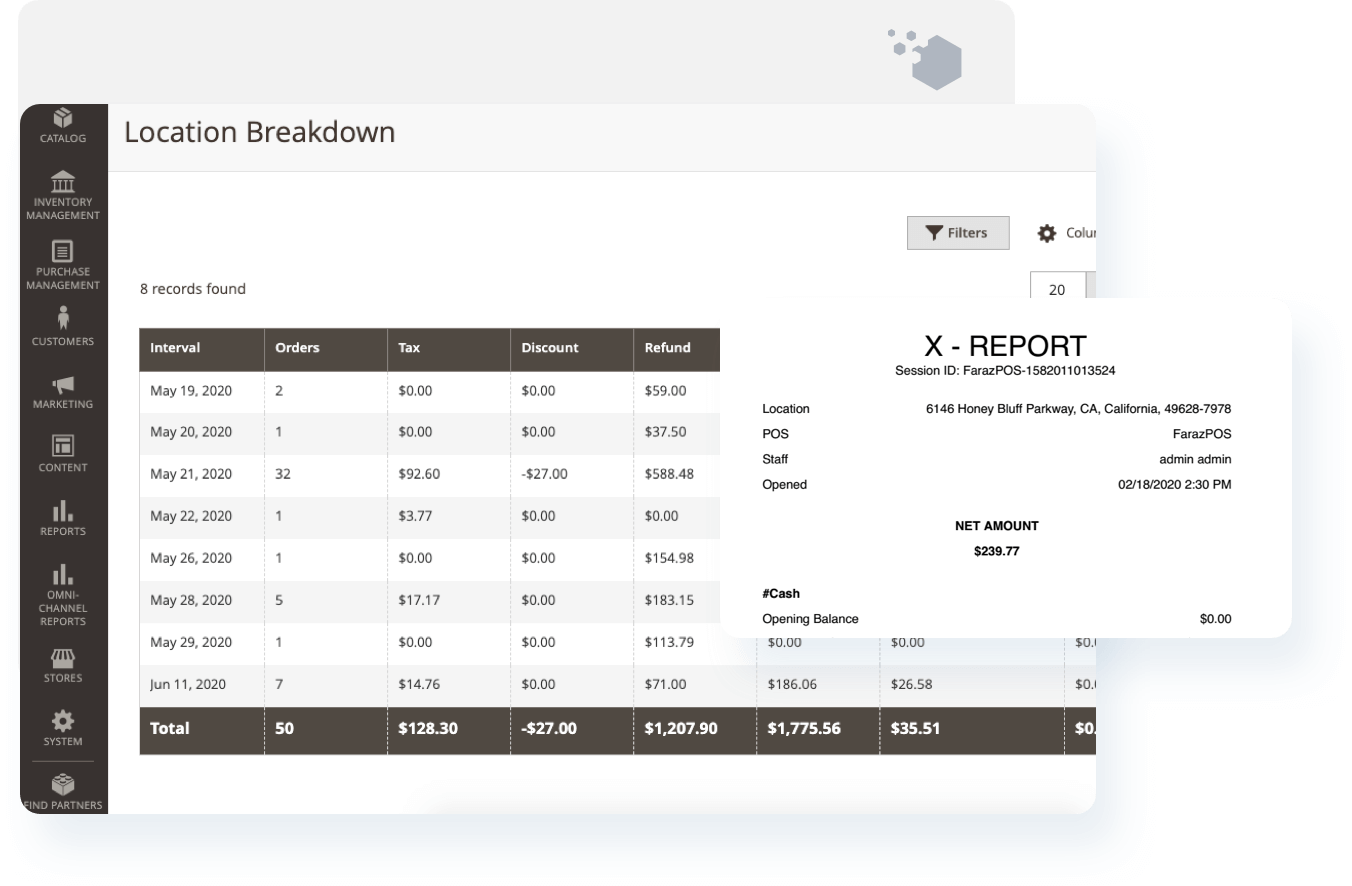

Step 1. Getting sales report

Before you start balancing cash registers and accounting for any incoming cash, you need to write down in detail how much you should have in your cash register. However, if you’re using any POS system, you can easily access your sales data and POS report and print it. Usually, POS reports often break down the total amount by categories such as cash, credit card, and check transactions.

Step 2. Counting drawers

Once you’ve got the sales report from your POS system, it’s time to count your coins. You should count cash items, checks, credit card receipts, and other transactions separately when counting cash registers.

In addition, you may keep a certain amount, like $100, in cash registers at the beginning of each shift or day to ensure your employees have enough cash to hand out change to customers. Thus, make sure you deduct your initial cash balance from your current cash balance, for example, minus $100. Then you write down the remaining amount in cash, check, coupon, credit.

After you’ve summed up your credit card receipts, checks, and cash, compare the totals to the report that came out of your POS system. Are they compatible? If so, it’s good to go! If not, you need to dig deeper.

Step 3. Checking the difference

If you have a cash drawer difference, don’t worry. It happens with most retailers when they reconcile cash drawers. In general, shortfalls can come from lost, stolen cash, or your employees counting incorrectly. When trying to resolve these discrepancies, take the following steps:

- Recalculate cash, checks, credit card receipts, and coupons

- Check around your cash registers for the missing information from printed receipts, such as misplacing a credit card receipt or giving incorrect change to customers

- Review POS transaction details such as credit card transactions

In addition, you should pin all POS reports, credit slips, and other receipts to your daily cash drawer report and file by date. Then make sure you include cash differences as part of your profit and loss statement. You can add a line to your profit and loss statement where the budget shows the loss due to miscalculation. It’s another way you can check and manage losses.

Step 4. Recording transactions in cash drawers

After you’ve checked for any discrepancies and done counting cash registers, record your transactions in your ledger. When recording the total in your cash register, be sure to calculate your opening balance as $100. Then, record any cash, credit, store credit, checks, coupons, and other sales transactions on your books.

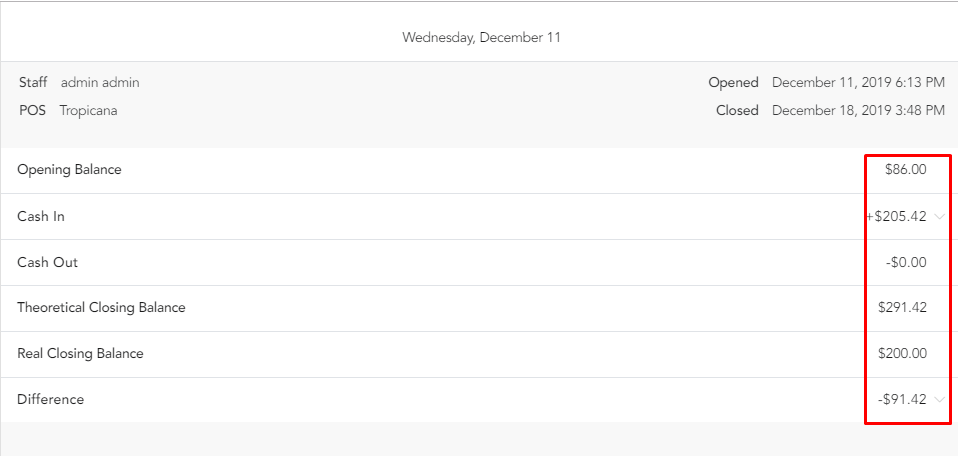

If there are any discrepancies that you can’t resolve, calculate the shortfall in a separate column. See an example of a balanced cash register below:

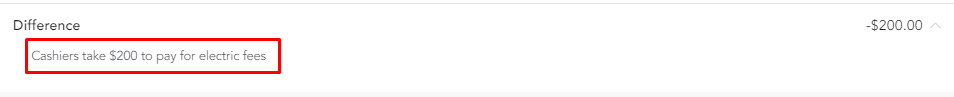

The drawer above misses $91.42 in cash that isn’t credited to sales. When sales are lower than the total collected cashes, it may be because your employee transacted with an incorrect payment method. In other situations, your cashiers may have paid the store’s electric fee during their shift and can take note of the reason into POS systems.

Final thoughts

The key to success is providing accurate cash flow data. So, balancing cash registers is a profitable operation for the retailer. Hopefully, with this article, you no longer have to wonder how to balance cash drawers anymore. Instead, you can perform it quickly with a sales report from your POS system.

It’s human nature to accept mistakes in small amounts. However, frequent discrepancies may be a sign of employee theft, or you need to give more training to a particular cashier. Thus, make sure that you reconcile cash drawers and investigate any shortages for sustainable and healthy revenue growth.