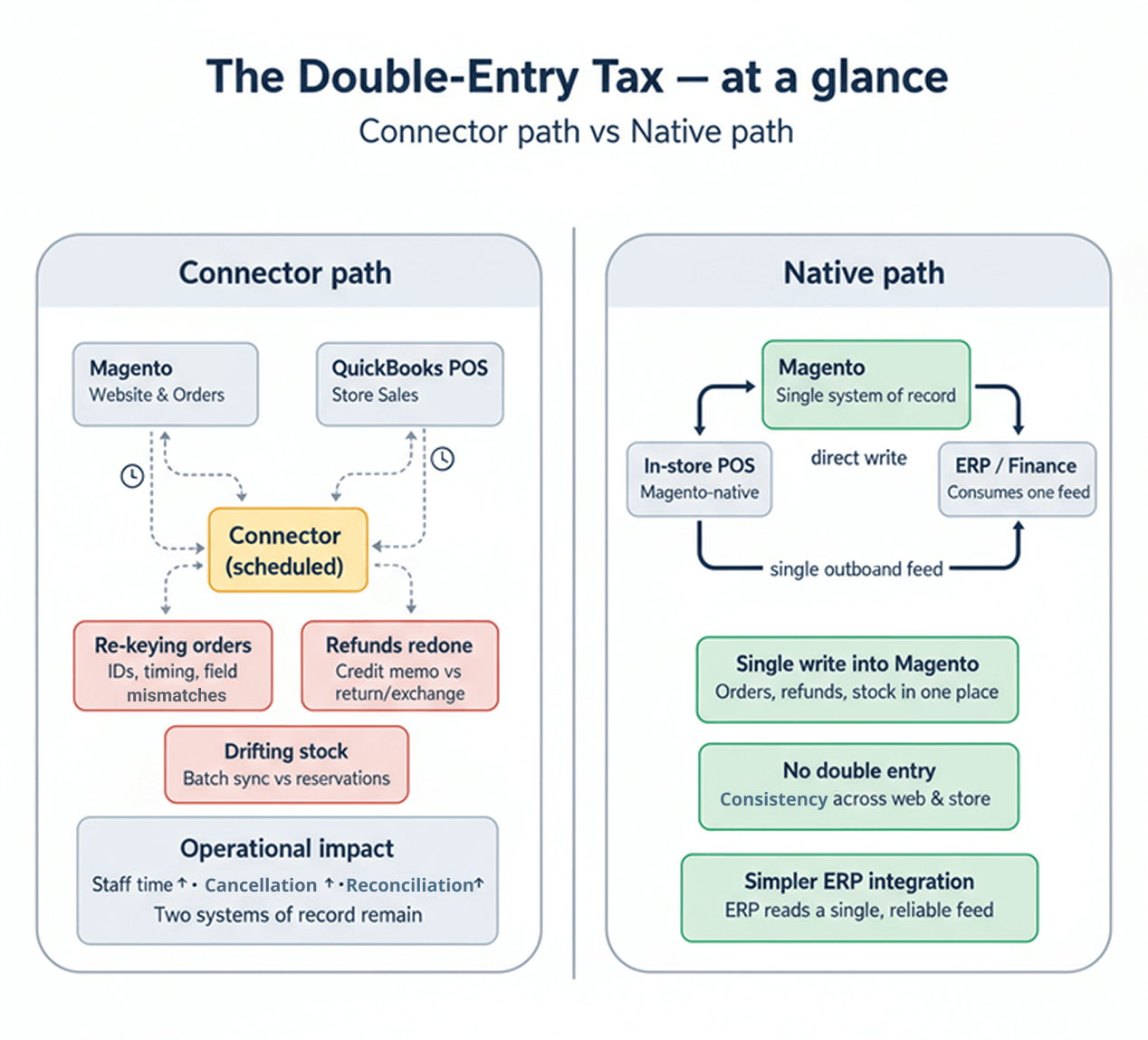

If staff are re-keying web orders into QuickBooks POS, correcting refunds twice, or manually adjusting stock after trading, the organization is incurring a material “double-entry” cost.

These issues are not incidental; they arise from a structural arrangement in which a connector causes QuickBooks POS and Magento to operate as two systems of record.

As volume and complexity increase, batch timing, data-model mismatches, and refund/return mapping gaps compound.

This article identifies the typical failure points in a QuickBooks POS – Magento connection and clarifies when a connector remains appropriate for simple operations.

For the broader decision framework, see our flagship guide on connectors vs native POS and when to use which. We then outline how a Magento-native POS maintains Magento as the single source of truth and eliminates double entry.

Key takeaways

Connector is “good enough” when:

- Scale: ≤ 3 stores, <10k SKUs, and roughly <1,000 orders/day (≈ <30k/month).

- Latency tolerance: Near-real-time under normal load (~1–2 seconds), with occasional peak delays of ~60–90 seconds acceptable.

- Simplicity: No ERP or card-linked loyalty/compliance requirements; catalog is simple (few configurables/bundles).

You’ve outgrown a connector when:

- Scale: >5 stores, >20k SKUs, or >5,000 orders/day (≈ >150k/month).

- Operations: ERP/loyalty/compliance in play; you need stock accuracy in seconds, not minutes (true omnichannel).

- Cost of drift: Reconciliation is consistently >10–15 hours/week or you see repeated upgrade breakages after Magento releases.

Where QuickBooks POS ↔ Magento breaks most:

- Orders: Staff re-keying web orders into QB POS (or vice-versa) introduces timing and mapping drift.

- Refunds: Magento credit memos vs POS returns don’t align field-for-field → manual redo.

- Inventory: Magento MSI reservations vs POS on-hand counts diverge under peak/backlog.

- Offline edge: Store can sell offline, but Magento stays stale until the internet/queue catches up.

Why Magento-native POS fixes it:

- The POS writes orders, refunds, and stock directly in Magento → one source of truth.

- Event-driven updates on Magento’s own entities (orders, invoices, credit memos, MSI) – no translation layer.

- Release alignment: Native POS tracks Magento releases; fewer breakpoints than a connector that must chase API changes.

Next step:

Book a 45-minute consult to see how a Magento-native POS removes double entry and keeps stock/orders accurate in real time.

Why your QuickBooks POS and Magento data don’t match

Every manual re-entry introduces small mismatches that compound into lost sales, inaccurate reporting, and customer frustration.

Order ID remapping and timing conflicts cause rekeying

Most QuickBooks POS connections send updates on a schedule, not instantly. If product codes, customer details, or the way each system handles discounts and refunds don’t line up, the sync can fail, and someone has to re-enter the order to keep both systems accurate.

Under the hood: Why orders get re-keyed with QuickBooks Web Connector (QBWC)

1. Scheduled sync delays: QBWC runs on a schedule, so updates post on the next poll; failed or infrequent runs defer work. (Source: QuickBooks Web Connector: Programmer’s Guide)

Technical appendix: QBWC polling and delays

QBWC runs on a schedule (Polling):

- The QuickBooks Web Connector (QBWC) is an application designed to enable web-based applications (web services) to access QuickBooks or QuickBooks Point of Sale (QBPOS) over the internet

- The fundamental communication model involves QBWC contacting the web service (the “upside-down” model) to ask whether the web service has work to do for QuickBooks/QBPOS

- The frequency of this contact is determined by a scheduler feature inside QBWC. The QuickBooks/QBPOS user decides how often QBWC “polls” the web service using this scheduler feature

- A merchant can specify the update interval in the QBWC UI. A web service can optionally supply a default update interval using the <Scheduler> aggregate in the QWC file, but the user can override these settings in the UI.

- The scheduler can be configured using:

- <RunEveryNMinutes>: Specifies the number of minutes that should elapse between connections

- <RunEveryNSeconds>: Specifies the number of seconds between connections, which results in the update interval being displayed in the UI as “Real Time”

- The Scheduler aggregate defines a minimum time between connections, and scheduled updates only happen when QBWC is running.

Updates post on the next poll (Scheduled transfer):

- QBWC begins the communication sequence when the merchant asks it to or at the regular intervals scheduled by the merchant.

- The web service must locally store the information that should be updated with QuickBooks upon the next connection.

- If the web service has work to do, it responds to the QBWC’s poll (via the authenticate callback) with a session token and an indication that it has requests

- If the web service indicates it has requests, QBWC invokes sendRequestXML. The web service then sends the required data (qbXML/qbposXML requests).

- The update activity continues through repeated calls to sendRequestXML and receiveResponseXML until the web service indicates that the update is 100% complete, at which point QBWC stops calling sendRequestXML.

Failed or infrequent runs defer work:

- Infrequent runs (Deferring based on schedule):

- The web service can intentionally delay future processing by returning an optional element in the authenticate response array containing the number of seconds to wait before the next update. This tells the QBWC client “not to bother you for a specified time,” effectively postponing the update.

- Due to network latency, server bandwidth limitations, or policy enforcement (like preventing “Real Time” updates), a web service may respond to an overly frequent authenticate call with an indication that it has “no requests” (“none”). When “none” is returned, QBWC stops the session.

- Failed runs (Deferring based on error):

- If QBWC encounters a connection error (e.g., QuickBooks company file could not be found), it calls the connectionError callback. The web service can respond to this error by attempting to connect to a different company file or, if the problem is not resolved after a couple of tries, by returning “done,” which tells QBWC that the web service cannot proceed further and is stopping. This implicitly defers the update until the problem is fixed or the update is reinitiated.

- Similarly, if a web service encounters an error (getLastError), QBWC terminates the connection by calling closeConnection, which defers the completion of work.

The concept of reserving inventory quantities until an order ships or cancels illustrates how deferred work is managed in the associated systems (Adobe Commerce), noting that if compensations do not clear reservations, quantities could be held in stasis (not available for sale and never shipping).

2. Customer data mismatch: QuickBooks uses customer IDs; Magento uses customer accounts. Mismatched fields break mapping. (Sources: Adobe Commerce Customer Management Guide, QuickBooks Point of Sale: User’s guide)

Technical appendix: Customer-identity models & mapping

QuickBooks uses customer IDs:

- QBPOS Customer IDs: QBPOS supports Customer ID Numbers and Cards in the Pro version. New customers are automatically assigned a 13-digit Customer ID. This ID format includes a 2-digit System Identifier, a 5-digit Store Number, a 5-digit Customer Number, and a check-digit.

- Purpose of IDs: These Customer IDs can be used to print scannable ID cards, which facilitates identifying the customer when listing them on a receipt. If a user modifies the default format, they risk inadvertently listing an inventory item instead of a customer if scanning the ID into the item field on a receipt.

Magento uses customer accounts:

- Customer Accounts: The Adobe Commerce Customer Management Guide provides information about Customer accounts and aims to help administer the customer account experience on the storefront.

- Account Structuring: Adobe Commerce also uses Customer groups (to determine discounts and tax class) and supports Customer segments (to dynamically display content and promotions). Furthermore, the B2B edition supports maintaining company accounts tied to individual storefront customer accounts.

Mismatched fields break mapping:

- Mapping requirement: Integration between Point of Sale (POS) and QuickBooks Financial Software relies heavily on Account Mappings which are the “linking” instructions for various POS fields, payment types, or transaction information to the correct accounts in the QuickBooks Chart of Accounts. Customizing this linking is a core part of setting up Financial Exchange.

- Field naming mismatches: If integrating custom fields (for customers, vendors, or items) between QBPOS and QBF, information can only be imported and shared if the fields are named exactly the same in both programs.

- Integration failures due to mismatches/typing errors: When setting up a web application integration (via QBWC), misconfigurations regarding how customers, items, or sales tax should be mapped can lead to the user entering incorrect information (like typos), which can cause subsequent data exchanges to fail or, severely, create duplicate accounts, items, etc. that can be difficult or impossible to reverse.

- Breaking financial exchange: Direct data constraint failures, which act as a form of mismatched data constraint, can stop the exchange of documents. For example, if a multi-store customer exceeds their set Account Limit via purchases at two different remote stores between Financial Exchanges, the later receipt will cause an error when trying to send it to QuickBooks, and the posting of that receipt will not be allowed. Such exchange errors often require correcting the record or reversing the original document to proceed.

3. Product mapping gaps: QuickBooks relies on Item Numbers; Magento relies on SKUs and product attributes. Incomplete mappings prevent orders from linking to inventory. (Sources: Order by SKU, Point of Sale barcodes and UPCs defined)

Technical appendix: Product identifiers & attribute mapping

QuickBooks relies on item numbers:

- Item number is essential: Every item (except special order items) has an Item # assigned by Point of Sale when first added to inventory. This Item # is internally referenced as the row number that identifies each item.

- Item numbers for lookups: Item Numbers are a core “item identifier” used, along with UPC and Alternate Lookup (ALU) values, to look up and list items on documents.

- Item numbers for barcodes: When printing tags from within QBPOS using the default tag templates, the Item Number creates the barcode. This allows items to be scanned and listed on documents even if they lack a vendor-provided UPC code.

- Item uniqueness: The Item Number must be unique (duplicates are not allowed).

Magento relies on SKUs and product attributes:

Explicitly relies on SKUs (Stock Keeping Units) and attributes for product identification and inventory management:

- SKU definition and use: The SKU is a Stock Keeping Unit, normally generated by the seller based on the product name and attributes for marketing or internal tracking (e.g., T-COT-MED-BL for a blue, cotton T-shirt, size medium). SKUs are critical for effectively tracking and managing inventory.

- SKUs in reservations: The Inventory Management system, which tracks available product quantities, uses the product SKU when creating an inventory reservation (a temporary hold on quantity upon order submission).

- Attributes: SKUs generally help sellers identify important product characteristics such as size, color, price, and material. QBPOS also uses attributes, along with size, description, and department, to define a unique item.

Incomplete mappings prevent orders from linking to inventory:

Proper configuration and mapping are vital for system integration, and failure to link identifying fields correctly prevents effective inventory management or transactional linkage:

- Inventory tracking based on mappings (Adobe Commerce): When a customer submits an order in Adobe Commerce, the system checks the current inventory’s salable quantity at the stock level based on the product SKU to determine if a reservation can be issued. If the SKU is not properly identified, this linking step (the reservation) cannot take place, which is the mechanism used to deduct inventory quantities and secure the items needed to fulfill the order.

- Integration risk (QuickBooks): When setting up external web service integrations with QuickBooks (which would handle web orders), if the user provides incorrect information (like typos) regarding how items should be mapped, it “can cause their subsequent data exchanges to fail or, worse, to create duplicate accounts, items, etc. that can be difficult or impossible to reverse.”

- Field mismatch failures (QuickBooks POS): QBPOS documents confirm that item identification must be precise:

- Duplicate Alternate Lookups for different items may lead to inaccuracy in Sales and Inventory Tracking

- If a user scans an Item ID into an incorrect field (e.g., scanning a customer ID into the item field on a receipt), it risks inadvertently listing an inventory item instead of the intended customer, demonstrating how field confusion breaks transactional accuracy [322 (referencing Customer ID field context)]

Successful importing of data (like items, customers, and vendors) relies on having complete control over how the import fields are mapped to the internal data fields. Failure to define initial item information (like cost and quantity) when manually adding an item before a sale can result in an inventory value discrepancy and require compensating adjustments in the financial software.

4. Discounts and promotions: QuickBooks POS applies line-item or transaction-level discounts; Adobe Commerce uses rule-based Catalog and Cart Price Rules. Because these models differ, complex promotions may not map one-to-one through a connector without explicit mappings, which can lead to misapplied or missing discounts. (Sources: Catalog price rules, Manual Discount Quickbooks POS)

See more

QuickBooks POS applies line-item or transaction-level discounts:

- Item-level discounts (Line-item): These apply individually to each quantity of a specific item sold. For example, if a $$2$ item-level discount is applied to speakers with a quantity of two, the total discount is $$4$ ( $$2$ per speaker). Manual item discounts can be entered using the Price field or discount fields in the item list, where QBPOS automatically calculates the corresponding value in the other field.

- Subtotal/global discounts (Transaction-level): These affect the total amount of all items on a receipt before additional charges like shipping or sales tax are applied. A global discount is taken from the receipt subtotal and is not spread across the listed items.

- Price manager discounts (Rule-based for POS Pro): QBPOS Pro versions offer a Discount Pricing feature to predefine discounts based on models like “Get Y % off” or “Buy X quantity for $$Y$ price”. These discounts are always given as line-item discounts on the receipt.

- Customer discounts: QBPOS allows associating a fixed percentage discount or a discounted price level with a specific customer, which is then applied as an item discount (reducing the price of each item on the sale).

Adobe Commerce uses rule-based catalog and cart price rules:

Adobe Commerce (Magento) uses highly structured, rule-based systems for promotions:

- Catalog Price Rules: These rules are used to offer discounted prices based on a set of defined conditions. Importantly, Catalog Price Rules are applied before a product is placed into the shopping cart and do not use coupon codes.

- Cart Price Rules: The concept of cart/shopping cart rules, while not explicitly detailed by name in the available snippets, is inferred by the mention of Catalog Price Rules, which deal with merchandising and promotions. Catalog rules and their focus on pre-cart application contrast with the expectation of a cart-level or transaction-level processing system.

Differing models require explicit mappings, leading to potential issues:

- Mapping necessity: Integration between QBPOS and QuickBooks Financial Software already requires complex Account Mappings (“linking”) to direct data correctly. Customizing the flow of data is a core part of the system. For items, sales are posted to specific income, Cost of Goods Sold (COGS), and asset accounts, which can be defined by item type or individually.

- Discount translation complexity: QBPOS transactions must be translated accurately for financial records. When discounts are sent to QuickBooks, they are either incorporated into the net price of the items or sent as separate original and discounted values, based on user preference.

- Priority and conflicts (QBPOS Internal Mapping): Even within QBPOS, managing multiple discounts is complex. The system uses specific discount priority rules to determine which discount applies (e.g., giving the customer the better price, or prioritizing the scheduled discount with the latest start date). This complexity suggests that translating an external, rule-based system like Adobe Commerce’s Catalog/Cart rules into the QBPOS transactional structure (which primarily records item price, quantity, and a single discount field per item) would require explicit mappings to ensure the intent and value of the complex Commerce rule are preserved and correctly categorized.

- Risk of misapplication/Missing discounts: The sources warn that integration errors caused by incorrect mapping or missing configuration fields can cause data exchanges to fail or lead to inaccurate data. If complex promotional rules from Commerce cannot map exactly to QBPOS’s line-item or global discount fields, the resulting financial document could be miscalculated or lack the necessary discount detail for reporting.

- For example, if an exchange sends only the “net value” of discounted items, the original and discounted prices are not separately accounted for in QuickBooks (if preferred).

- If a $$$-off Customer Reward is applied, QBPOS treats it as a separate line item functioning like a global discount, illustrating a mechanism needed to handle discounts that don’t fit the standard item discount percentage field. Complex Commerce promotions would likely require similar specialized handling to prevent them from being “misapplied or missing.”

5. Payment handling conflicts: QuickBooks records payment types; Magento links payments to gateways. Unsupported or unmapped methods stall the sync. (Sources: Using “Account” payment method in Intuit POS, Commerce payment provider gateway)

See more

QuickBooks records payment types:

QuickBooks Point of Sale (QBPOS) operates by tracking payments based on distinct, integrated transaction types or non-integrated media types, and subsequently maps these types to financial accounts.

- Standard payment types recorded: QBPOS accepts and records standard payment methods such as cash, credit card, debit card, check, gift card, gift certificate, and charge to customer account.

- Integrated processing: QBPOS supports integrated processing for credit, debit, and gift card transactions using the QuickBooks POS Merchant Service and Gift Card Service. When using these integrated services, authorization and settlement occur within the POS software.

- Manual mapping/accounting focus: The transfer of sales data (receipts) to QuickBooks Financial Software relies entirely on Account Mappings, which link the various Point of Sale fields and payment types to the appropriate accounts (e.g., Cash goes to “Cash in Drawer,” while Credit Card/Debit Card go to “Undeposited Funds”). This mechanism focuses on classifying the type of payment media received for financial reporting.

Adobe Commerce links payments to gateways:

Adobe Commerce (Magento) is explicitly structured to connect to external services via a Payment Provider Gateway, emphasizing the relationship between the store and the transaction service:

- Gateway mechanism: The Adobe Commerce payment provider gateway is the mechanism used to integrate stores with payment service providers.

- External service interaction: The gateway creates and handles transactions based on order details by interacting with an external Payment service provider (e.g., PayPal, Authorize.Net).

- Transaction commands: The Commerce payment provider supports operations like authorize, sale, capture, refund, and void. This focus is on interacting with the external payment processor to manage the lifecycle of funds.

Unsupported or unmapped methods stall the sync (Break mapping/cause errors):

The necessary integration between a Commerce system and QuickBooks/QBPOS requires mapping the gateway-level transaction data into QBPOS’s payment types. If this mapping fails or a method is unsupported, it causes synchronization to stall or break.

- Unsupported/Unmapped Payments in QBPOS: If QBPOS users utilize a payment card service other than the specialized QuickBooks POS Merchant or Gift Card Services, they cannot:

- Authorize and settle transactions directly within QBPOS.

- Authorize or track gift card balances

- They must follow the third-party service’s instructions for authorizing/settling and manually enter payment amounts. If these external/manual payments are not correctly mapped or accounted for, they represent unsupported transaction details that conflict with the automatic Financial Exchange procedures.

- Synchronization stall due to errors: The Financial Exchange process is designed to handle errors and requires troubleshooting to complete synchronization successfully. If an error occurs during the exchange (which could be caused by bad data or an unsupported payment record), the exchange process displays an error status (ERROR or Problems Found). The failure to correctly resolve an exchange error related to a specific record or document means that record is stalled and must be corrected before the data exchange can successfully proceed.

6. Staff impact: Queued or stalled jobs require manual re-entry of orders to maintain accurate stock and accounting, resulting in increased costs and slower fulfillment.

Refund and return model mismatches result in redo work

Magento processes refunds using credit memos (including partial refunds and adjustments), while QuickBooks POS records returns and exchanges at the register.

Because the two systems represent refunds, discounts, and tax adjustments differently, some transactions may not map one-to-one through a connector, and staff may need to redo the refund to keep inventory and accounting aligned.

Under the hood: Why refunds are redone with QuickBooks Web Connector (QBWC)

1. Partial refunds mismatch: Magento issues credit memos for single items or partial amounts; QuickBooks POS processes item-level returns/exchanges, and QuickBooks Payments supports partial amount refunds at the transaction level. Because these models differ, the connector must map refund lines and amounts explicitly, or the refund may not sync one-to-one. (Sources: How can you issue a partial refund to someone who paid through Quickbooks with a credit card?, Credit memos)

See more

Adobe Commerce (Magento) issues credit memos for single items or partial amounts:

- A credit memo is a document showing the amount due the customer for a full or partial refund.

- With credit memos, you can refund a partial amount of an invoice or refund multiple partial amounts of an invoice.

- You can refund a portion of the quantity for one line item, such as three of the five shirts in an order.

- The credit memo process allows for managing the exact quantity of items to refund (Qty to Refund), and includes fields for Adjustment Refund (an extra refund amount not applied to a specific part of the order) and Adjustment Fee (an amount subtracted from the total refund, like a restocking fee).

- When a credit memo is issued, it triggers a compensation reservation to clear inventory holds (if items are returned to stock).

QuickBooks POS processes item-level returns/exchanges:

QBPOS focuses on transactional documents where returns are handled directly against specific item quantities, either as a Return Receipt or within a Sales Receipt (item-level return/exchange):

- Returns via sales receipt (Item-level): Merchandise returns are typically recorded on regular sales receipts as negative quantities. This is particularly useful for an exchange, as you can list the item being returned (negative quantity) and the new item (positive quantity) on a single receipt. Using this method, the return is processed at the original sale price.

- Returns via return receipt (Item-level): QBPOS also uses dedicated Return Receipts which add returned items back to inventory. When using a return receipt, the returned quantities are positive numbers.

- Inventory impact: A return adds the returned item quantities back to inventory.

QuickBooks Payments supports partial amount refunds at the transaction level

QuickBooks supports processing partial refunds via the QuickBooks Payments portal (Merchant Service Center), which operates independently of specific item lines in QBPOS:

- To process a partial refund in QuickBooks, one option is to log in to the QuickBooks Payments account, select the transaction, and enter the amount that needs to be refunded, then click Submit

- When dealing with integrated credit card payments, it is possible to edit the refund amount or items if a partial refund is needed.

- The partial refund capability allows an amount (like a security deposit) to be refunded to the original payment source without re-entering credit card details.

- If a credit card transaction has already been settled in QBPOS, reversing the original receipt automatically credits the cardholder’s account, and the reversal receipt is sent to the card processor as part of the next settlement batch.

Models differ and require explicit mappings (Stall/mismatch risk)

The structural differences between Commerce’s itemized credit memo and the QuickBooks documentation flow confirm that explicit mapping is necessary to prevent synchronization problems:

- QBPOS data flow: In QBPOS, returns (return receipts) are ultimately sent to QuickBooks Financial Software as credit memos. If a single QBPOS receipt contains both returned items and sold items, only one document is created in the financial software, based on the net amount.

- If the net amount is negative (a refund), a customer payment or credit memo is created.

- If the net amount is positive (a balance due), a customer invoice is created.

- This netting approach fundamentally conflicts with Commerce’s highly granular credit memo structure (which itemizes refunds, shipping refunds, adjustment refunds, and fees) unless explicit item-level and amount-level mapping occurs.

- Synchronization stall/break risk: The sources indicate that synchronization relies on detailed Account Mappings. If data exchange fails due to missing information, it results in an ERROR status. The failure of complex refund logic to map cleanly could lead to errors, requiring the user to manually resolve the problematic document before the Financial Exchange can proceed.

Explicit mapping needed: Customizing the financial exchange flow requires defining how discounted items are sent (either net value or separate original and discounted values). Because Commerce handles item price, shipping, fees, and separate “Adjustment Refunds,” the connector must perform explicit mapping of all these distinct amounts into the specific document fields required by QuickBooks to ensure the refund is captured accurately and avoids transaction errors.

2. Tax adjustments differ: Magento configures tax via Tax Zones and Rates and Tax Rules; QuickBooks manages sales tax using Desktop Sales Tax Items/Groups (with POS creating corresponding items during Financial Exchange). Because these models differ, tax amounts may not align unless mappings and configurations are kept consistent. (Sources: Set up sales tax in QuickBooks Desktop, Tax zones and rates)

See more

Magento configures tax via tax zones and rates and tax rules

Adobe Commerce relies on a geographical and rule-based system for tax calculations:

- Tax Zones and Rates: Adobe Commerce uses the Tax Zones and Rates tool to specify the tax rate for each geographical area from which taxes are collected and remitted. Since each tax zone and rate has a unique identifier, multiple tax rates can exist for a given geographic area (e.g., specific taxes on food vs. other items). Tax rates are defined based on geography (e.g., ZIP or postal code).

- Tax Rules: The Commerce configuration allows setting up tax classes for products and customer groups, and creating tax rules that combine these classes with tax zones and rates.

- Calculation Methods: Commerce has specific tax calculation methods (Unit Price, Row Total, and Total) that determine how rounding is handled and how prices are displayed (including or excluding tax). The actual customer tax for an order is calculated after the customer completes the order information, according to the store’s tax configuration.

QuickBooks manages sales tax using desktop sales tax items/groups

QuickBooks Desktop (via QBPOS integration) uses a structured item/group system for managing tax collection and financial reporting:

- QBPOS sales tax structure: QBPOS utilizes sales tax codes (based on the type of merchandise sold) and tax locations (based on where the sale takes place). Tax codes can contain a single tax rate or multiple tax rates (for multiple agencies), and can include price-dependent tax based on item price thresholds.

- QuickBooks Desktop items/groups: QuickBooks Desktop requires corresponding tax items and codes to exist for proper tax posting. Users can set up individual tax rates as Sales Tax Items and then combine them using a Sales Tax Group if they need to pay taxes to more than one agency. The Sales Tax Group allows tax reports to correctly break out payments to multiple agencies.

- POS creating corresponding items during financial exchange: This part of the claim is Factually Supported. If the necessary QuickBooks tax items and codes do not already exist, Point of Sale will automatically create these items in QuickBooks during the Financial Exchange (based on tax rate and tax agency). However, QBPOS cannot automatically create Sales Tax Groups in QuickBooks; these must be manually set up in QuickBooks first

Models differ, requiring explicit mappings to prevent misalignment

The differing approaches to tax calculation and reporting necessitate explicit mapping to ensure consistency, and failure to map correctly leads to discrepancies or synchronization issues.

- Necessity of mapping: QBPOS provides options to map collected sales tax to QuickBooks sales tax items or groups. Users can customize this process to link Point of Sale tax data to their preferred QuickBooks tax items. If these linking fields are left blank, QBPOS auto-fills them, creating corresponding items in the financial software if necessary.

- Tax calculation discrepancies (Rounding): Adobe Commerce itself explicitly notes that certain combinations of tax calculation settings (like setting methods to Row or Total) combined with prices that both exclude and include tax can lead to rounding errors where the amount displayed in the cart might differ from the amount that a customer expects to pay. These inherent calculation differences make one-to-one reconciliation challenging unless calculations (and rounding rules) are fully aligned.

Integration risk/inconsistency: The overall principle of integration requires careful configuration because entering incorrect information during setup (e.g., typos in item, customer, or tax configurations) “can cause their subsequent data exchanges to fail or, worse, to create duplicate accounts, items, etc. that can be difficult or impossible to reverse”. If the tax rules established in Commerce (based on zones and complex item/customer classes) are not precisely mapped to the necessary QBPOS tax codes and corresponding QuickBooks Items/Groups, tax amounts sent for financial posting may not align.

3. Discounted items conflict: Magento uses rule-based promotions, while QuickBooks/QuickBooks POS applies line-item or subtotal/transaction discounts. Because these models differ, refunds for discounted orders may not map one-to-one through a connector unless the discount mapping is configured correctly, raising the risk of reconciliation work during returns. (Sources: Use discount and subtotal items on an Invoice, Cart price rules)

See more

Magento uses rule-based promotions

Adobe Commerce (Magento) utilizes a sophisticated, rule-based promotion system centered on pre-defined criteria, which supports various complex discount applications:

- Cart price rules: Discounts are defined using shopping cart price rule actions that determine how prices are updated when specific conditions are met.

- Rule types: These rules allow for discounts applied as a Percent of product price discount, a Fixed amount discount (per item), a Fixed amount discount for whole cart, or Buy X get Y free.

- Discount scope: Discounts can apply only to the cart subtotal, or separately to the subtotal and shipping amounts.

- Priority and stacking: Commerce allows defining the Priority of price rules. Rules can be configured to Discard Subsequent Rules to prevent unintended stacking of multiple discounts on the same product.

QuickBooks/QuickBooks POS applies line-item or subtotal/transaction discounts

QuickBooks Point of Sale (QBPOS) primarily uses simpler, manual, or predefined discounts applied at the item level or across the entire transaction subtotal:

- Item-Level Discounts (Line-Item): These deduct a specific amount or percentage per item. QBPOS Pro versions can predefine discounts (like “Buy X quantity for $Y price”) using Price Manager, but these are always given as line item discounts on the receipt.

- Subtotal/Global Discounts (Transaction-Level): These affect the total amount of all items before additional charges. In QBPOS, a global discount is taken from the receipt subtotal and is not spread across the listed items. Dollar-off customer rewards function like a separate line item acting as a global discount.

- Discount Calculation: In QBPOS, if a manual discount is entered, the system calculates the discount based on whether it is an item-level discount (applied per unit) or a subtotal discount (applied once to the total)

Models differ, leading to reconciliation risk during refunds

The fundamental difference between Commerce’s complex, rule-based pricing (which determines the original sale price) and QBPOS’s simpler, transactional accounting method creates challenges for reversing those sales accurately during a refund/return:

- Magento refund granularity (Credit memos): Commerce handles refunds using a credit memo, which is a detailed document that supports partial refunds, line-item quantity control, and specific adjustments for elements like Refund Shipping, Adjustment Refund (extra refund amount), and Adjustment Fee (subtracted from refund, e.g., restocking fee).

- QBPOS return limitations (Netting): QBPOS handles returns typically as negative quantities on a sales receipt or via a Return Receipt. If a receipt contains both returned items (negative) and sold items (positive), only one document is created in the financial software, based on the net amount. This means the granular detail of a complex Commerce discount (e.g., a “Buy X Get Y Free” or stacking rule) applied to the original sale must be carefully translated into QBPOS’s item price structure upon sale and then accurately reversed during the refund transaction.

- The need for explicit mapping: For financial posting, QBPOS lets users choose whether discounts are incorporated into the net price of the items or whether separate original and discounted values are sent to QuickBooks Financial Software. If this mapping is incorrect or inconsistent:

- It can cause subsequent data exchanges to fail.

- It introduces the risk of reconciliation work, as discrepancies arising from complex discount rules that are not correctly reflected in the reverse transaction can result in incorrect account adjustments. For example, when returning a voucher (the purchasing equivalent of a sale reversal), the Vendor Credit created in QuickBooks is not automatically applied to the Vendor Bill; this must be done manually in the financial software. Similarly, complex refund scenarios often require manual intervention in QBO, such as ensuring that amounts or items are correctly edited for a partial refund.

4. Operational impact: Staff must redo refunds in one or both systems, increasing workload and risking accounting mismatches, such as QuickBooks showing a completed refund while Magento still lists store credit.

A sync stock–reservation conflicts force manual adjustments

Magento uses reservations to immediately reduce salable quantity when an order is submitted, and updates on-hand per source as the order is shipped, canceled, or refunded.

QuickBooks POS typically updates through scheduled Web Connector polls or end-of-day exchanges, rather than in real time.

In multi-location environments, these timing differences can create short-term discrepancies between salable and on-hand figures and increase the risk of overselling or post-order corrections, sometimes requiring manual adjustments.

Under the hood: Why inventory gets adjusted manually with QuickBooks Web Connector (QBWC)

1. In-store sales lag online: QuickBooks POS updates on-hand inventory at the register, but Magento won’t reflect that change until the next scheduled connector run (e.g., QuickBooks Web Connector). Magento updates immediately only for orders placed in Magento itself, so website availability can lag between syncs. (Sources: Source algorithms and reservations, QuickBooks Point of Sale: User’s guide)

See more

QuickBooks POS updates on-hand inventory immediately at the register.

QBPOS uses a perpetual inventory system that updates quantities instantly upon completing a transaction:

- Instant update: As items are ordered, received, and sold, QBPOS inventory quantities and costs are instantly updated.

- Receipt effects: Saving a Sales Receipt is a permanent transactional document that deducts quantities from inventory immediately.

- Item level tracking: QBPOS tracks the items on-hand quantity for that specific store.

Magento won’t reflect the change until the next scheduled connector run

- QBWC is scheduled: The QuickBooks Web Connector (QBWC) operates on a scheduler feature where the user determines how often QBWC “polls” the web service (Magento/Adobe Commerce). Updates only post after the next scheduled poll (previous fact-check).

- Deferred data exchange (QBPOS): Information exchanged between QBPOS and external applications occurs during a Financial Exchange. This exchange is typically run as part of the End of Day procedure, but can be initiated manually at any time. Only data added since the last exchange is transferred.

- The lag: Because the QBPOS inventory deduction is immediate, but this change is only sent out to the external world (where Magento would consume it) during the next scheduled Financial Exchange or manual update run, the website inventory quantity will lag behind the physical store’s actual count

Lag occurs because:

- In-store sales immediately reduce the QBPOS on-hand quantity.

- QBPOS only sends this updated transactional data (which Magento needs to reflect the reduction) out to QuickBooks Financial Software or a connecting web service during a scheduled Financial Exchange.

- Magento’s web service receives this update during its polling schedule (via QBWC), allowing it to finally update its own source quantities. Until that scheduled sync occurs, the website’s calculated salable quantity remains based on the older, higher quantity, potentially leading to overselling if multiple sales occur between syncs.

2. Online sales lag in QuickBooks: When a web order is placed, Magento immediately reduces the salable quantity using reservations. QuickBooks POS will not reflect that web sale until the next scheduled Web Connector run, so its on-hand quantity can temporarily remain unchanged. Once the sync runs (or when the POS records its own sale), QB POS updates the on-hand inventory accordingly. (Sources: QuickBooks Point of sale: Getting started guide, Source algorithms and reservations)

See more

When a web order is placed, Magento immediately reduces the salable quantity using reservations.

- The core functionality of Inventory Management tracks every available product virtually and on-hand. This system uses the Source Selection Algorithm (SSA) and Reservations systems, which run in the background to keep salable quantities updated and help prevent overselling.

- Reservations hold inventory amounts until orders ship or cancel and automatically update the salable quantity at the stock level.

- Reservations place temporary holds on inventory quantities that are deducted from the salable quantity when an order is submitted.

- When a customer submits an order, Commerce checks the current inventory’s salable quantity. If enough inventory is available, a reservation is entered, placing a temporary hold for the product SKU (assigned a negative quantity value), and the salable quantity recalculates.

- When an order is submitted for products, a reservation is entered for that amount (e.g., -5), and the salable quantity is reduced

QuickBooks POS will not reflect that web sale until the next scheduled Web Connector run:

- The connection between the QB Web Connector and the web service occurs when the merchant manually initiates it or at regular intervals scheduled by the merchant.

- The user determines how often the QBWC “polls” the web service using the scheduler feature. The scheduling options include specifying intervals in minutes or seconds (the latter sometimes displayed as “Real Time”).

- Since the communication occurs based on a scheduled interval chosen by the user, there will necessarily be a delay between a transaction occurring on the web storefront (Commerce) and that data being transferred to QB POS.

- The web-based application (which would handle the web sale data) must locally store the information that should be updated with QuickBooks upon the next connection.

- QB POS maintains an on-hand quantity for inventory items. This quantity is typically updated in QB POS by transactional documents such as sales receipts. If the web sale originates externally, the transactional data must be passed through the QBWC sync to update the local QB POS records, meaning the internal on-hand quantity remains unchanged until the sync runs.

3. Manual reconciliation: Staff manually adjust counts, often at the end of the day.

4. High sales impact: Delays accumulate during peak periods, forcing emergency stock adjustments and resulting in canceled orders.

Why switching connectors won’t stop QuickBooks–Magento data drift

Switching to a different connector won’t stop sync errors because the data drift comes from fundamental structural differences.

2 sources of truth create drift

QuickBooks POS and Adobe Commerce each maintain their own authoritative data (POS company data and Commerce’s database).

Connectors exchange updates between the two, often at scheduled intervals via tools like the QuickBooks Web Connector, but they do not merge them into a single database.

As a result, when timing and data models differ, totals can drift between systems unless one application is treated as the single system of record

Under the hood: Why 2 sources of truth create drift

Dual systems of record: QuickBooks Desktop (used by POS) and Adobe Commerce each maintain their own authoritative data stores—the QuickBooks company file and Magento’s database. Integrations exchange updates via the QuickBooks Web Connector, which polls on a schedule and posts changes with qbXML/qbposXML. There is no cross-system transaction that commits to both databases at once, so each system applies updates independently. (Source: QuickBooks Point of sale: Getting started guide)

See more

QuickBooks Desktop (used by POS) and Adobe Commerce each maintain their own authoritative data stores:

- QuickBooks/QuickBooks POS data store: QuickBooks Point of Sale (POS) refers to its local data file as company data, which stores point-of-sale information. When integrated with QuickBooks Financial Software, the financial data is stored in the QuickBooks company file, and the integration involves linking these two files for data sharing. QuickBooks POS tracks retail activities like purchasing, receiving, inventory, and sales, while QuickBooks Financial Software tracks financial data.

- Adobe Commerce/Magento data store: Adobe Commerce uses an underlying database system to manage core information. The information needed to calculate sales tax, for example, can be captured directly from the data store in the Commerce database tables. Furthermore, within the Inventory Management features of Commerce, data is tracked virtually and on-hand in warehouses and stores, suggesting an internal mechanism for data storage. This data is specifically managed via entities like SourceItem, which represents the amount of a specific product at a physical source.

Integrations exchange updates via the QuickBooks Web Connector, which polls on a schedule and posts changes with qbXML/qbposXML:

- The go-between application: The QuickBooks Web Connector (QBWC) is explicitly defined as a Microsoft Windows application that enables web services (web-based applications, such as an Adobe Commerce integration) to exchange data with QuickBooks Desktop products, including QuickBooks Point of Sale (QBPOS). The QBWC acts as the standard go-between application.

- Communication protocol: The QBWC acts as a conduit supporting the passing of qbXML and qbposXML requests and responses between a web-based application and QuickBooks or QuickBooks Point of Sale.

- Scheduled polling: The connection between the QBWC and the web service occurs when the customer initiates it or at regular intervals scheduled by your customer. The user determines how often the QBWC “polls” the web service using the scheduler feature. A web service provider can optionally supply a default update interval in minutes (<RunEveryNMinutes>) or seconds (<RunEveryNSeconds>) within the QWC file, but the user can override these settings in the QBWC interface.

There is no cross-system transaction that commits to both databases at once, so each system applies updates independently:

- Asynchronous nature of QBWC: The QBWC model requires that communication be initiated by the QBWC running on the local system. Because the connection happens based on the user’s choices on the desktop (either manually initiated or on a schedule), the web-based application must locally store the information that should be updated with QuickBooks upon the next connection. This means the web application records a transaction first, queues the data, and then transmits it later when the QBWC polls.

- Independent application of updates: Once data (like sales receipts or inventory adjustments) is sent from Point of Sale to QuickBooks during a Financial Exchange (which is a core part of the synchronization process), QuickBooks applies this data as corresponding documents (e.g., invoices, sales receipts, or general journal entries). Similarly, QuickBooks applies updates independently, such as when customer account balances are updated in QuickBooks and subsequently overwrite Point of Sale’s values during the next exchange.

- Adobe Commerce inventory mechanism: Adobe Commerce’s internal inventory updates are also independently applied using a system of Reservations, which hold inventory amounts until orders ship or cancel and automatically update the salable quantity at the stock level when an order is submitted. These reservations operate in the background.

- Lack of real-time, cross-system commitment: Since the entire communication process is initiated by the local QBWC contacting the remote web service on a schedule, it requires that the web application queues data for later exchange. This scheduled, file-based mechanism clearly contradicts the nature of a single, real-time, cross-system transaction committing simultaneously to both the remote web store database and the local QuickBooks company file.

QBWC as the default sync layer: Many QuickBooks Desktop/Point of Sale integrations use the QuickBooks Web Connector (QBWC), which polls on a schedule and exchanges qbXML/qbposXML with QuickBooks/POS. Even when a vendor uses a different connector, it still acts as middleware—an external translation layer between the systems—rather than a shared database or transaction.

See more

Alternative connectors are still middleware: a translation layer, not a shared data store or joint transaction:

- Middleware/go-between necessity: Due to the technical requirements of accessing QuickBooks (the COM issue, requiring the application to be resident on the same machine/LAN as the QuickBooks SDK request processor), web-based applications cannot access QuickBooks directly. Historically, developers created their own go-between application to perform the interaction.

- QBWC as standard middleware: QBWC was developed as a free and standard go-between application that performs this mediation role.

- Alternatives function as middleware: The only recommended alternative to QBWC is for a developer to write their own go-between application, effectively replacing QBWC with their own implementation. This proprietary application would still serve as the necessary intermediary layer.

- Rejection of shared database/transaction model: Here is why a direct, real-time connection or shared database model is fundamentally excluded:

- No firewall port opening: QBWC uses an “upside-down” communication model where QBWC initiates the session over HTTPS, eliminating the need for the server to open firewall ports to external services (a critical security measure).

- Data queuing/independence: Because the connection happens based on the merchant’s choices on the desktop (scheduled polling), the web-based application must locally store the information that should be updated with QuickBooks upon the next connection. This asynchronous, request/response cycle confirms that data changes are recorded locally (in the web service’s queue) before being transmitted and applied independently in QuickBooks.

RDS risk: While Remote Data Sharing (RDS) is an alternative way to exchange data across a network, it is not recommended due to substantial security risk and the requirement of opening a firewall port (as RDS is intended as a LAN solution, not an internet solution). This reinforces that the preferred method (QBWC or proprietary middleware) relies on a buffered exchange, not a shared or simultaneous transactional database connection.

Why drift persists: Because each system insists on being the system of record for orders, refunds, and inventory, connectors can only pass updates back and forth. That architecture guarantees timing gaps and mismatched states, regardless of which connector you use.

Batch windows create lag; drift grows between runs

Magento lowers the available stock as soon as an order is placed, and it updates the actual shelf counts later when the order is shipped or canceled. QuickBooks POS usually sends updates on a schedule—every so often or at the end of the day.

Because of this timing gap, one system can show changes later than the other, so reports and stock numbers may not match in real time.

Under the hood: Why batch vs. event-based sync creates sync issues

- QBWC cadence: QuickBooks Web Connector runs on a user-defined schedule and exchanges qbXML via the sendRequestXML / receiveResponseXML cycle.

- Magento side: MSI immediately adjusts salable quantity via reservations at order time and updates on-hand at shipment/cancel/refund; external systems write via REST/SOAP or imports.

- Event hooks: Connectors may publish from Magento events (e.g., order placed, invoice, credit memo), but QuickBooks Desktop/POS applies changes on the next QBWC poll (or via a local POS SDK/qbPOSXML exchange).

- Structural latency: Because the systems commit independently and communicate over the network, event-based sync reduces but doesn’t remove timing gaps; temporary mismatches can appear between syncs.

Entities don’t match: credit memos vs. returns, MSI vs. on-hand

Magento and QuickBooks POS label things differently. Magento uses a unique product code (SKU) and records refunds as a “credit memo.” QuickBooks POS uses Item Number/UPC/ALU and records returns or exchanges at the register.

Discounts and payment types also don’t line up one-for-one. So the connector has to match these fields. If any match is missing or inconsistent, an order or refund can fail, and someone must fix it.

Under the hood: Why different data models create sync issues

Products and SKUs: Magento uses parent–child SKUs for configurable products; QuickBooks POS represents variants via style/matrix items. The models differ, so variant mapping requires care. (Sources: Cart price rules, QuickBooks POS user’s guide)

See more

Magento (Adobe Commerce) utilizes parent and child SKUs for managing configurable products:

- When setting up certain cart price rule conditions using a SKU product attribute for a configurable product, both the parent and child product SKUs must be selected.

- Alternatively, to avoid listing all child SKUs in a rule, the does not contain condition can be used with common SKU parts of a configurable product and its child products.

- When calculating discounts, variations of a configurable product are counted separately.

- SKUs are defined as identifiers generated by the seller, often based on characteristics like size, color, price, and material, and are critical for tracking and managing inventory.

QuickBooks POS represents variants via style/matrix items:

QuickBooks Point of Sale (POS) uses an organizational structure known as “styles” (managed via a style grid) to handle product variants.

- The QuickBooks Point of Sale Pro level includes features for tracking style items.

- An item style is defined as a method of grouping inventory items that share basic information but differ in one or two traits, such as size, color, or pattern.

- The different combinations of size and color constitute an item style.

- QuickBooks POS provides a style grid window to view and work with all items within a style, allowing users to see on-hand quantities for each size and color.

The models differ, requiring care in variant mapping:

The underlying structures used by the two systems for handling item variations—parent/child SKUs (Magento) versus the style/attribute/size grid (QuickBooks POS)—are fundamentally different. This supports the notion that mapping between them requires caution:

- QuickBooks item structure: A style is defined by items sharing the same Department and Item Name but differing in Attribute and Size entries. Each unique combination of Department, Item Name, Attribute, and Size must be unique in inventory.

- Integration caution: When integrating systems, such as a storefront application with QuickBooks (or POS), developers must configure whether items in the online store should be mapped 1:1 to QuickBooks items or mapped to a single item.

- The general complexity of data exchange (Financial Exchange) between POS and financial software (QuickBooks) highlights the care needed, as errors like incorrect initial setup or manual entry can create duplicates, incorrect data, or problems that are “difficult or impossible to reverse.”

- Specific cautions exist regarding linking systems, such as the need for an initial session to draw information directly from the company file to prevent errors like typos or duplicate accounts. If accounts are manually edited in POS, adjustment memos are automatically created and sent to QuickBooks Financial Software, illustrating how changes in one system impact the other.

Inventory: Magento immediately lowers salable quantity via reservations; QuickBooks POS maintains on-hand. Between scheduled syncs, temporary differences can occur, which may increase oversell risk if site availability isn’t constrained.

Discounts and Taxes: Magento applies flexible cart price rules; QuickBooks POS uses fixed discounts and tax codes. Result: order totals don’t match. (Sources: Manual Discount QuickBooks POS, Cart price rules)

See more

Magento applies flexible cart price rules:

- Rule-based discounting: Cart price rules apply discounts based on a set of conditions that, when met, apply the discount automatically or via a coupon code.

- Flexible conditions: Conditions can be based on sophisticated shopping cart attributes, such as Shipping Postcode, Shipping Region, Shipping State/Province, Shipping Country, Subtotal, Total Items Quantity, or Total Weight. The subtotal condition is applied to the base subtotal before any discounts.

- Diverse Discount Types: Magento supports a variety of discount calculations, including:

- Percent of product price discount (subtracting a percentage from the original price).

- Fixed amount discount (subtracting a fixed amount from the original price of each qualifying item).

- Fixed amount discount for whole cart (subtracting a fixed amount from the cart subtotal).

- Buy X Get Y Free (where the discount amount is Y quantity)

- Granular control & stacking: Rules can be configured to apply the discount amount separately to the subtotal and shipping amounts. Furthermore, rules can be set to “Discard Subsequent Rules” to prevent multiple discounts from stacking, or they can be configured to allow multiple rules to apply to the same product, potentially resulting in multiple discounts.

QuickBooks POS uses defined discount methods and tax codes:

- QuickBooks POS discounts (defined methods):

- Item-level vs subtotal: Discounts apply to a single line item or to the receipt subtotal before shipping/tax.

- Price levels/markdowns: Up to five prices per item; predefined discount rules (e.g., % off, bundle/quantity deals) managed in Price Manager.

- Priority rules: When multiple discounts apply, POS follows built-in precedence and generally gives the best price.

- Manual discounts: Cashiers can discount an item or the whole receipt; editing an item price is recorded as a discount.

- QuickBooks POS taxes (codes & locations):

- Tax codes & locations: Codes set taxable/non-taxable status and rules by item type; locations apply geographic or customer-specific tax.

- Multiple rates per code: Supports combined rates (e.g., state + local) and price-dependent tax thresholds.

- At sale time: Tax is calculated automatically from the item’s code; users can override an item’s code or the sale’s tax location.

- Shipping: Tax on shipping is supported with the proper item/location setup.

Why totals can mismatch between Magento and QuickBooks POS:

- Discount logic differs. Magento layers/excludes discounts via site rules, while QuickBooks POS applies item vs. subtotal discounts with its own priority order. Example: a shipping % discount in Magento may need a mapped shipping item in POS to match.

- Tax math and rounding vary. Magento can calculate tax by unit, row, or total, which changes rounding. QuickBooks POS supports multiple rates and thresholds. When discounts, tax, and shipping combine, small method/rounding differences produce different totals.

- Integration behavior isn’t uniform. Financial Exchange/connector setups often require custom mapping. Discounted lines can be sent as net values or as original + discount, meaning totals depend on how the integration is configured.

Refunds: Magento issues credit memos linked to invoices; QuickBooks POS creates return transactions. Result: no clean 1:1 mapping, staff often rekey. Even with event-based sync, these mismatches remain because the models themselves don’t align.

See more

Magento: Credit memos linked to invoices

- Refund object: Refunds are processed as credit memos tied to the order/invoice; full or partial.

- Workflow: If payment was Authorize, invoice first, then create credit memo. If Authorize & Capture, invoice already exists.

- Granularity: Refund a single item, quantities, shipping, and add adjustments (refund/fee).

- Inventory effect: Issuing a credit memo clears MSI reservations via compensations.

- Settlement: Supports online refunds (via gateway) and offline refunds (COD, check).

- API: Partial refunds can be created via API using order or invoice references.

QuickBooks POS: Return transactions:

- Refund object: Customer returns recorded as return receipts (or negative lines on a sales receipt); vendor returns as return vouchers.

- Workflow: A return receipt reverses a prior sale; exchanges list the returned item (–qty) and new item (+qty) on one receipt.

- A/R behavior: If the original sale used Invoice/A/R, QuickBooks Financials uses a credit memo; if paid upfront, a refund receipt adjusts revenue/inventory.

- Payments: QuickBooks Payments can issue card reversals (void/credit) by finding the original transaction.

- Inventory effect: Return receipts add items back to on-hand.

Result: Not a clean 1:1 map → manual steps remain:

- Model gap: Magento’s invoice-linked credit memo vs. POS transaction reversals/return documents means fields and flows don’t always align.

- Accounting alignment: Whether QuickBooks posts a credit memo (A/R) or a refund receipt (cash sale) changes the accounting path; Magento always uses the credit memo object for the refund calculation.

- Inventory timing: Magento clears reservations on refund; POS increments on-hand on return—different triggers, same intent.

- Corrections: POS history documents are generally not edited; operators use Reverse → Copy → Correct when fixing errors—i.e., practical rekeying.

- Multi-store constraints: Receipts must typically be reversed at the origin store before Store Exchange; late discoveries require manual return documents or HQ intervention.

- Credit limits: In multi-store charge-account scenarios, limits can be exceeded between exchanges, creating errors that require manual resolution.

Peak traffic overwhelms queues and leaves partial syncs

As order volume rises, scheduled integrations can fall behind if the Web Connector isn’t running frequently enough or if errors halt a run.

Because QBWC exchanges data at scheduled intervals—not in real time—updates may be deferred to the next run, creating a temporary backlog.

When mapping or validation errors occur, an order may error out and require staff intervention before it can sync successfully.

Under the hood: Why order volume creates queues

Sequential design: Sequential design: QBWC polls on a schedule and exchanges qbXML/qbposXML in a request/response sequence. (Source: QuickBooks Web Connector: Programmer’s Guide)

See more

- Polling and scheduling: The QBWC architecture is based on the web connector initiating contact with the web service (the “upside-down” communication model). The QuickBooks/QuickBooks POS user decides how often QBWC “polls” your web service by using the scheduler feature inside QBWC. This polling can be automatically scheduled at regular intervals or initiated manually by the user.

- Request/response sequence (exchange format): The QBWC acts as the conduit through which all qbXML/qbposXML requests and responses pass between web-based applications and QuickBooks or QBPOS. The communication flow involves a sequential pattern: the web service is called via sendRequestXML to deliver a request string (qbXML/qbposXML), and QBWC subsequently calls receiveResponseXML to deliver the response. This sequence repeats until the web service indicates 100% completion.

Queue blocking: If a request errors, the current batch/run can stop until corrected, so later items wait.

See more

This is caused by the error handling mechanisms inherent in the QBWC communication model and within QuickBooks POS Financial Exchange:

- QBWC session termination on error: If an error condition occurs, such as a negative return value from receiveResponseXML, the QBWC will call getLastError and then terminate the current session (closeConnection). Furthermore, if QuickBooks XML Request Processor fails to start a session (OpenConnection or BeginSession), QBWC notifies the user and calls connectionError.

- During Financial Exchange, an error prompts an alert and points you to the Activity Log to identify the offending record (customer, vendor, receipt, voucher, etc.). Example: a sale exceeding a customer’s credit limit errors out; staff must raise the limit or reverse the receipt. The document’s status shows ERROR in POS, and that transaction will not transfer until it’s corrected—holding up that item on subsequent attempts.

Throughput limits:

- Backlogs between polls: In a scheduled model, work can pile up if the Auto-Run interval is too infrequent.

- Scheduler basics: QBWC connects at user-set intervals (e.g., RunEveryNMinutes/Seconds in the QWC file); the UI won’t allow < 1 minute.

- Peak-time lag: The scheduler enforces a minimum time between runs—it doesn’t guarantee delivery at an exact time. Data created between polls waits until the next run (or a manual trigger).

Latency risk:

- Errors extend delay: On failures, QBWC triggers connectionError; the service may retry a limited number of times, otherwise surface getLastError to the user—both add delay.

- Manual fixes required: Out-of-sequence or validation errors often need user correction (e.g., fix the source document) before the next successful run.

Operational risk:

- Inside Magento: MSI reservations update salable quantity immediately on order/cancel/refund events. (Source: Reservations)

- Outside Magento: QuickBooks POS and HQ update external systems only on Financial/Store Exchange cycles, so data is stale between runs.

- In multi-store, HQ reflects activity after mailbags/processes complete.

- Charge sales or inventory moves at a remote store aren’t visible at HQ—or online—until the full Store/Financial Exchange completes.

- During these gaps, teams can act on outdated stock/credit views, increasing oversell or limit-exceed risks.

Magento-native POS benefit: A native POS writes into Magento via native APIs (no external middleware), reducing cross-system queues and keeping Magento as the system of record.

Refunds don’t map cleanly

Magento processes refunds using credit memos, while QuickBooks POS records returns/exchanges at the register.

Because these models differ, a connector must map fields between them. When a mapping is missing or inconsistent – especially with partials, discounts, or tax adjustments – a refund may not sync one-to-one, and staff may need to correct it to keep accounting and inventory aligned.

Under the hood: Why refunds might not map cleanly

- Magento (refunds): Refunds are credit memos linked to the order/invoice; support full/partial amounts, Return to Stock, and Adjustment Refund/Fee fields; online/offline and API flows are available. (Source: Issue a credit memo)

- QuickBooks POS (returns): Customer returns are recorded as return receipts/exchanges (item-level, negative qty), and vendor returns as return vouchers. Financially, QuickBooks Desktop uses a credit memo for A/R sales or a refund receipt for cash sales. Direct 1:1 fields for Magento’s Adjustment Refund/Fee are not documented; similar amounts are handled as items/fees/discounts. (Source: QuickBooks POS user’s guide)

- Translation gap: Because the refund objects differ (credit memo vs return receipt/exchange), connectors must map lines, quantities, and fees; partials, restocking, and surcharges may not map one-to-one without custom rules. (Source: Credit memos)

- Failure modes: When a post fails validation or a run errors, the item is deferred until corrected (per QBWC error-handling), so staff may need to fix and re-submit to keep accounting and inventory aligned. (Source: QuickBooks Web Connector | Programmer’s Guide)

- Native POS path: Using a Magento-native POS that writes refunds as Magento credit memos avoids cross-model translation and keeps sales, stock, and accounting consistent in one system of record.

Thresholds: Where connectors break down

At low volume, teams can manually correct occasional sync errors. As operations expand, these risks grow and manual patches become less sustainable.

- Multi-store complexity. Store Exchange timing and return constraints introduce location-to-HQ delays and edge cases that increase mismatch risk across stores.

- Scheduled (batch) sync. Web Connector or similar scheduled integrations can fall behind at peak volume if frequency, payload size, or error handling aren’t tuned, creating temporary backlogs..

- ERP program requirements. ERP rollouts typically require a single source of truth; keeping Magento and QuickBooks POS as co-masters increases reconciliation risk.

- Taxes and reporting models. Differences in how each system configures taxes, discounts, and reports raise the likelihood of configuration mismatches—especially in regulated environments.

1. Multi-store complexity

- Signal: Fixes in one store break in others—promos, loyalty, stock.

- Risk: Split customer history, inconsistent pricing, and stock drift.

- Action: Use a Magento-native POS that records sales, refunds, and stock directly in Magento.

2. High order volume

- Signal: Queues build during busy hours, and staff re-enter data.

- Risk: Overselling, refund delays, and dissatisfied customers.

- Action: Process sales instantly with a Magento-native POS that updates Magento in real time.

3. ERP in the mix

QuickBooks POS was built to work with QuickBooks Desktop (Financial Exchange); native QuickBooks Online integration is not supported.

When a retailer adds an ERP but keeps QuickBooks POS in-store and Magento for e-commerce, they end up with 3 separate systems.

Without a single source of truth, each system maintains its own records and timing, increasing reconciliation work.

- Signal: ERP and Magento expect consistent, system-wide data, while QuickBooks POS continues to create its own sales, returns, and stock updates through store workflows.

- Risk: Three authoritative records (POS, ERP, Magento) create mapping and timing discrepancies, so orders, refunds, and inventory may not reconcile without manual intervention.

- Action: Reduce sync paths by making Magento the system of record for commerce and integrating ERP to that single feed—using a Magento-native POS to avoid POS-to-ERP-to-Magento triangles.

ERP + QuickBooks POS + Magento: Mechanics of Conflict

- SAP: SAP follows an order-to-cash flow (sales order → delivery/post-goods-issue → billing → A/R posting). SAP Finance uses open-item management and open-item reconciliation to match debits/credits. If outside systems (e.g., a POS) post transactions outside that standard flow, you can see mismatches that must be reconciled in SAP. (Sources: Running the Sales Process in SAP Business One, Sales order to cash, Defining “Open Item Management”)

- Odoo: Odoo apps run on a single PostgreSQL database per Odoo database, and modules are loaded into (and write to) that same DB, so Sales, Inventory, and Accounting stay synchronized by design. If a connector fails to sync and users post changes outside Odoo, teams often have to reconcile the impacted records across apps inside that same database (inference based on Odoo’s single-DB architecture). (Sources: Chapter 1: Architecture Overview, System configuration)

- Microsoft Dynamics 365: Dynamics 365 master planning uses current demand (including sales orders) to generate planned purchase/transfer/production orders. If POS data arrives late (batch delay) or with SKU mismatches, the plan can produce late or inaccurate POs. (Sources: Master planning with demand forecasts, Master plans overview, Firm planned orders)

4. Compliance-heavy niches

- Signal: Retailers in regulated sectors – vape, liquor, smoke – face stricter tax and reporting rules.

- Risk: QuickBooks POS lacks built-in compliance features like age checks or excise tax tracking. Add-ons such as Webgility Desktop add cost and increase sync errors. Once compliance thresholds are crossed, manual entry can no longer prevent violations.

- Action: Move to systems with native compliance controls and audit-ready reporting instead of relying on patched connectors.

- Excise tax tracking: Many regulated goods carry special taxes beyond standard sales tax. These require item-level mapping and reporting, which QuickBooks POS doesn’t natively support.

- Age verification: Compliance requires integration with ID scanners or software validation. QuickBooks POS doesn’t provide built-in hooks for these checks.

- Webgility Desktop: A connector often used to sync QuickBooks POS with QuickBooks Financials. While it adds compliance-related mapping features, it increases sync points, raising the risk of errors or delays.

- Audit-ready reporting: Compliance systems must produce reconciled reports that regulators can review directly. Workarounds with connectors or manual entry often fail to meet this standard.

These thresholds mark the breaking points. Beyond them, businesses aren’t just fighting inefficiency; they are fighting for operational survival. Manual entry, batch connectors, or even ERP stopgaps can’t hold up once compliance, volume, or multi-store complexity crosses the line.

The native alternative: Magento as the single system of record

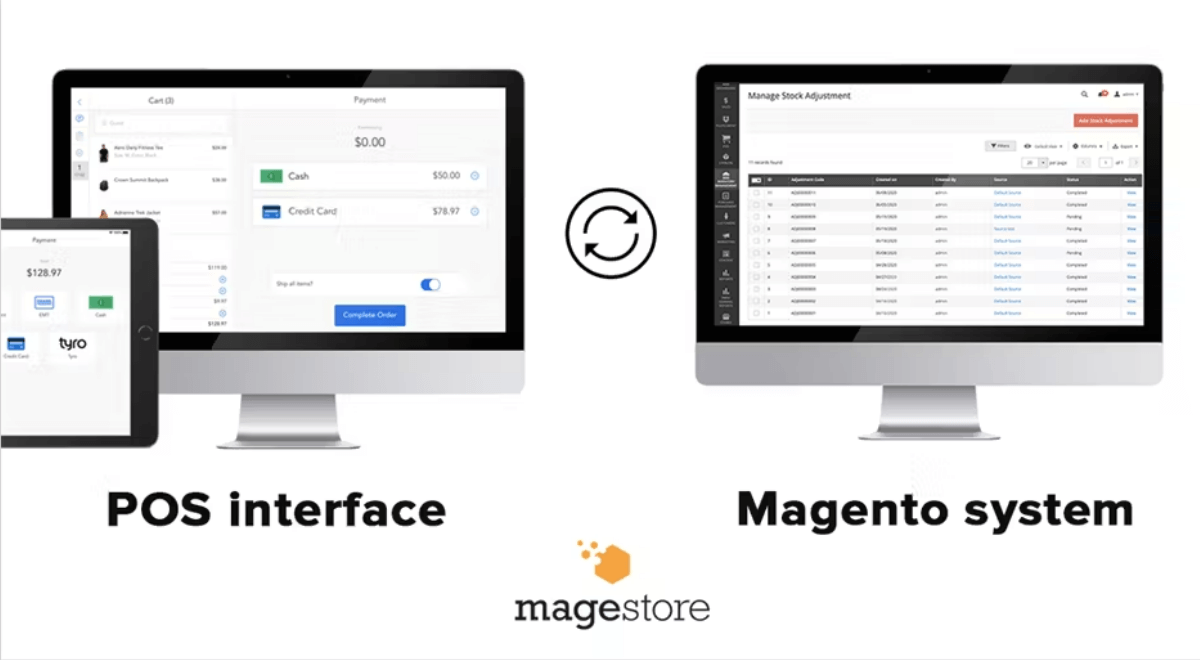

A Magento-native POS system writes directly in Magento, so every sale, refund, and stock change stays in one source of truth. Magestore POS is a Magento-native POS solution that unifies all retail operations – online and offline – inside Magento, eliminating the connector layer.

Why Magestore POS is different

- One record everyone sees: POS writes into Magento, so online and in-store share the same order/refund/stock record – no rekeying.

- Fewer exceptions: No queue/translation layer to stall or duplicate entries.

- Cleaner reporting: Finance, inventory, and customer history align across all locations in real time.

- Dual-master removed: Magento becomes the system of record; the POS uses Magento services/events to create native entities.

- No out-of-process translation: Eliminates QBWC-style polling/queues; reduces latency and mapping error surfaces.

- Atomicity/ordering restored: Order → invoice → refund → stock updates commit within one system; fewer partials/race conditions.

- Observability: Failures and exceptions surface in Magento logs/alerts; replay/recovery is centralized.

- Downstream simplicity: ERP, loyalty, and analytics subscribe to one authoritative dataset (Magento), not competing feeds.

How Magestore POS eliminates double entry

With QuickBooks POS, staff often had to key transactions twice: once at the register and once in the ecommerce system, or spend hours reconciling mismatched connector data. Magestore POS removes that problem entirely by writing directly into Magento entities:

- Orders: When a cashier completes checkout, Magestore POS creates the same sales order entity that Magento generates for online purchases. Customer information, product SKUs, applied discounts, tax, and payment details are stored natively, so finance, fulfillment, and customer service all see the same record instantly.

- Refunds: A return at the POS triggers Magento’s native credit memo. Because it uses Magento’s refund flow, the transaction automatically updates stock, accounting entries, and customer history without rekeying.

- Inventory: Stock decrements occur at the SKU level in Magento’s inventory module, immediately upon completion of the sale. Transfers, returns, and audits also write directly into Magento’s Multi-Source Inventory (MSI), ensuring accurate counts across warehouses and stores.

Magestore POS uses Magento’s service contracts and APIs to create standard Magento objects, instead of creating “shadow records” that later need reconciliation.

Why Magestore POS grows with you

- Multi-store ready: Magestore POS centralizes data so loyalty programs and promotions follow customers across all stores. Staff no longer manage separate systems for each location.

- Large catalog support: In benchmark tests, Magestore POS sustained 320,000+ SKUs, 320,000+ orders, 200+ stores, and 400+ staff with 99% uptime. This was achieved on a 64-bit CPU, 128GB RAM, and 60GB storage test environment, showing enterprise-level catalogs and transactions remain fast and reliable.

- Omnichannel fulfillment: Magestore POS supports buy online, pick up in store (BOPIS), ship-from-store, and dropship in one workflow, keeping all fulfillment options inside Magento.

- ERP integration: Magestore POS consolidates POS and online data directly in Magento, then feeds ERP systems with a single clean dataset.

- SAP: aligned sales orders, stock moves, and financial postings.

- Odoo: unified sales, refunds, and stock adjustments.

- Dynamics 365: live sales and stock updates for demand planning.

- Sage: consistent tax and accounting data for compliance.