Multiple payment methods give your shoppers more ways to complete their purchases. For instance, besides cash, your retail store can offer other payment options such as credit and debit cards, bank transfers, and digital wallets.

Studies show that retailers providing top three methods rather than just one option can increase conversion rate by up to 30%. Or you might lose about 13% of your sales if you do not provide enough payment methods for your customers.

As today’s customers demand more payment options, retailers should adapt to meet their expectations. In this discussion, we’ll explore how to implement different payment methods, key factors to select suitable options, and challenges of multiple payment options and solutions. Let’s dive in.

- Why you should accept more payment options in your store

- 14 types of payment methods and how to accept them

- 6 factors to decide which payment methods to offer

- How to set up a payment system for multiple payment options?

- 4 challenges of multiple payment options and how to overcome them

- 4 main payment trends in 2024

Why should you accept more payment options in your store?

If omnichannel retail means buying and fulfilling from everywhere, should ‘pay in any way’ be added to our definition? The answer is obvious. Customers are becoming increasingly demanding. They always go for the most convenient options. By offering your customers various payment options—both traditional and those brought about by emerging technologies—you can capture more sales and stay ahead of the retail competition.

Ease and convenience for customers

Regarding payments, customers expect to use the method and channel they’re most comfortable with. For that reason, it’s important to offer seamless checkout options to increase customer experience. When you limit the payment methods, customers might feel frustrated or cornered.

At the end of the day, everybody wants to have options. Cash, credit cards, e-wallets, and other alternative payment methods will allow customers to shop easily, no matter where they are.

Higher conversion rates at checkout

More choices mean a higher rate of completed payments, which translates into higher revenues for your retail store. On the other hand, customers who can complete their purchases on the spot without waiting for additionally verified transactions or bank approvals would be more likely to become loyal and recommend your business to others.

Competitive advantage for businesses

With the rapid rise in payment technology and ever-increasing competitiveness, many online-offline stores are competing on prices and exclusive deals. Payment options are a key competitive factor, as you can acquire more users by offering popular payment methods.

More payment offers to attract customers

Many payment gateways advertise their merchants or offer special discounts (funded by them) for customers using their payment method on the designated website or offline stores.

The collaboration between Careem and Mastercard is an example of how these two businesses promote each other. Customers get a 20% discount on 3 rides per month when they use Mastercard to pay for a ride. PayPal often does the same promotion as well, bringing direct benefit to the merchants.

14 types of payment methods and how to accept them

Forget one-size-fits-all payments! Modern customers expect multiple payment methods to pay for their purchases. Below is a list of the 14 most common options, along with an overview and quick guide on how sellers can accept them. We’ve grouped them into three main categories for your easy reference:

- Traditional payment methods

- Digital payment methods

- Other payment methods

1. Traditional payment methods

Traditional payment methods | Overview | How to accept |

Cash | This old payment method is still in usage, but declined in popularity by 25% due to the risk of theft or loss. | Cashiers accept cash from customers and update the balance in the register or POS system. |

Bank transfers |

|

|

Checks |

| For online transactions:

For offline transactions:

|

Money orders | Money orders are like prepaid checks. While declining in popularity, they're still secure payment methods used for purchases from unfamiliar vendors or sending rent payments. |

|

2. Digital payment methods

Digital payment methods | Overview | How to accept |

Credit and debit cards | Credit and debit cards are the most widely used payment methods with 41% of POS payments made with credit cards and 28% with debit cards. |

|

Digital wallets |

| Requirements:

How to accept:

|

Online payment gateways |

| Requirements:

How to accept:

|

Cryptocurrency |

| Requirements:

How to accept:

|

QR codes |

|

|

Contactless payments |

| Requirements:

How to accept:

|

3. Other payment methods

Other payment methods | Overview | How to accept |

Buy now pay later (BNPL) |

|

|

Invoice payments |

|

|

Subscriptions |

|

|

Loyalty payments |

|

|

Explore Live Payments POS for omnichannel retailers in Australia to accept multiple payment methods!

Top 6 factors to decide which payment methods to offer

When choosing the right payment methods, you need to think about what customers like or what’s safe. Here’s a simple breakdown:

Customer preferences

Find out how your typical customer likes to pay. Do they love paying with their phone, or do they stick to cash or checks?

For example, if you run an online store targeting young adults, digital wallets like Apple Pay and Google Pay are ideal for accepting online payments.

Industry payment standards

Different businesses have different ways of receiving money. For example, many restaurants let customers tap to pay, while software services often use subscription options. Research what’s common in your industry to ensure you’re not hindering customer expectations.

Related costs and fees

Look at the fees of multiple payment methods. This includes setup fees, transaction fees, and ongoing costs. Here is the breakdown:

- Setup fees: Mostly $0. It’s often free to set up any payment method.

- Transaction fees: Differ based on different factors like card types, card network, transaction volume, types of payment method, etc. Here’s an example of how transaction fees vary based on payment methods.

- Debit and credit card: 1.5% to 3.5%

- ACH payments (Bank transfers): $0.5-1

Try to find a balance between what’s affordable for you and easy for customers.

Security and fraud prevention

Working with IT and cybersecurity specialists can secure and protect your business and customers’ information. Choose payment systems that follow the Payment Card Industry Data Security Standard (PCI DSS) and offer payment fraud prevention features like risk analysis and identity verification.

Smooth integration and easy-to-use

The payment method should work well with your website or point of sale system.

You can check its compatibility by:

- Verify if your website or POS system supports the payment method you intend to use. Check the documentation or contact the provider for support.

- Confirm that the payment method complies with security standards (like PCI DSS)

- Conduct thorough testing in a sandbox or test environment before going live.

Also, make sure it’s easy for customers to use, or they might give up on buying.

Also read:

- 7 WorldPay ePOS systems to speed up checkout and sync real-time data

- 7 Adyen point of sale to complement Adyen terminals

- Buckaroo POS for medium-sized Magento retailers in the Netherlands and Belgium

How to set up a payment system for multiple payment options?

After shortlisting your customers’ favorable payment options, it’s time for payment integration. Instead of using different systems for each payment type, it’s much better to use one system to handle all of them and simplify management.

Here’s how to do it.

Step 1: Select a payment system

A comprehensive payment system often includes software components (e.g., payment gateway, payment processor, merchant bank, customer bank, and card network) and hardware (e.g., POS terminals and card readers) for in-store transactions. Hence, if you’re looking for a payment system, make sure:

- Its components are compatible with your POS system.

- The payment system can support multiple payment options your target customers use. For example:

- Online customers prefer debit and credit cards, digital wallets, and BNPL.

- In-store customers prefer cash, debit and credit cards, digital wallets, and QR codes.

- Fees (e.g., setup fees, transaction fees, ongoing fees) fit your budget

- The system can handle multi-currency payments and comply with international payment rules if you sell globally.

Step 2: Integrate the payment system

To integrate a payment system, follow the steps below:

- Create a merchant account with the chosen payment processor and complete necessary verification processes

- Integrate the payment gateway using API credentials and documentation from the provider

- Enable and configure all the desired payment methods (credit/debit cards, digital wallets, BNPL, etc.) in your payment gateway setting

Payment integration might require some technical knowledge. Hence, if you’re not sure how to do it, you could get a developer to help set everything up for you.

A highly-compatible POS solution can help streamline the process. For omnichannel sales, POS for Magento and POS that integrates with Shopify from Magestore are your go-to options since they work well with various payment providers such as PayPal, Stripe, Tyro, Square, Global Payments, and Adyen.

Step 3: Configure payment options

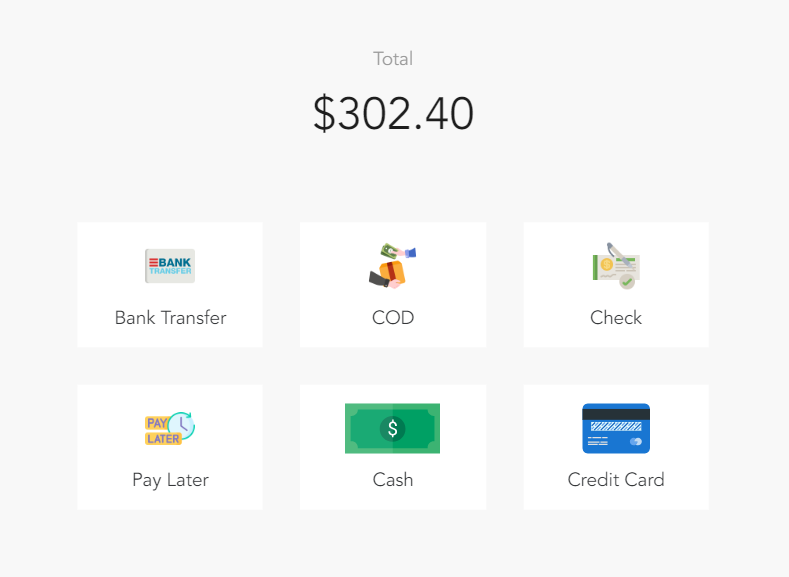

At this step, activate different payment methods in your account settings. Make sure your checkout page displays all payment options clearly, helping customers easily choose their preferred method.

Tips: Look at your sales reports to see how your customers like to pay to decide which payment methods to offer. For example, most online transactions require mobile payments, while cash is commonly used at physical stores.

Multiple payment methods on Magestore POS

Step 4: Test transactions

After you’ve set everything up, it’s important to check if all payment methods work accurately and smoothly. How to do so?

- Performance tests

- Option 1: Manual testing by walking through the entire checkout process for each payment method (credit card, debit card, digital wallet, etc.)

- Option 2. Automated testing by selecting a testing tool (e.g., Selenium, Cypress) and integrating it with your payment gateway for seamless testing

- Analyze test results to identify any bugs, security risks, or performance issues. Customers will consider whether the system accurately captures their information, securely transmits payment data, and provides appropriate authorization or error messages.

- Address any issues found during testing and re-run tests to ensure functionality and stability

Notes: Remember to back up your data before testing to prevent data loss if your system crashes.

4 challenges of multiple payment options and how to overcome them

While offering various payment methods can be great for customer convenience and increasing sales, it also comes with a set of hurdles for businesses.

1. Integration complexity

Adding different payment methods to your business can be tricky. Each method, such as credit cards and digital wallets, has its own API to communicate with your website or system. This requires some coding to ensure everything works together smoothly.

Solutions:

- Choose one with user-friendly APIs and clear documentation

- Consider platforms offering pre-built integrations for easier setup

- Hire an IT specialist to help

2. Security concerns

Using multiple payment solutions increases the potential risk of fraud. You need to ensure each option adheres to industry standards, such as PCI compliance.

Solutions:

- Select reputable gateways with strong security track records

- Implement robust fraud detection and prevention measures across all gateways

- Stay updated on the latest security protocols and guarantee regular security audits

3. Operational challenges

Reconciling transactions from various platforms can be time-consuming and complex. Additionally, managing customer inquiries related to different payment methods can add to the operational workload.

Solution:

- Invest in tools, a payment processor, or gateway that consolidates transaction data from different payment methods into a single platform for central management

4. Keeping up with regulations

The world of payments is constantly evolving with new regulations and compliance requirements. So are you.

Solutions:

- Partner with gateways that stay updated on regulations and ensure their systems meet the latest standards

- Consider subscribing to industry newsletters to stay informed yourself

4 main payment trends in 2024

The payment landscape continues to change, with new trends focusing on online payment options. Here’s a look at the 4 key trends in 2024 based on Statista’s report.

Market share of cash, credit cards, and other payment methods at point of sale (POS) in the U.S. from 2017 to 2023, with a forecast for 2027. Source: Statista

Also read: Mobile mobile trends to find more popular payment methods used recently

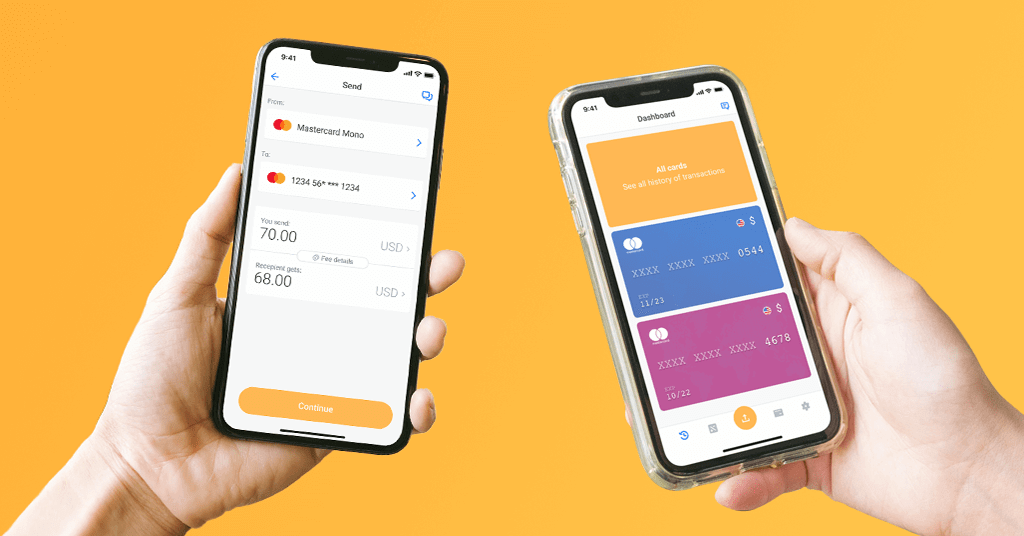

Digital wallets

As peer-to-peer payments gain popularity, many people are opting for digital wallets, which have become the most popular payment method due to their ease and secure transaction processing. According to a report, the global mobile wallet market was valued at $9.55 billion and is projected to grow at a CAGR of 28.0% over the forecast period.

Credit and debit cards

Debit and credit card processing are the second most popular payment methods. However, in eCommerce, credit and debit card payment transactions are expected to decrease slightly by 2027. This “decline” is mostly due to a switch from card payments to digital wallets.

A2A

More people are using account-to-account (A2A) payments because they’re quick and easy. With A2A, you can move money between accounts right away, making it a popular choice over older payment methods. The amount of money sent using A2A is expected to grow by 14% annually until 2027. By then, A2A will account for an extra 1% of all global money transfers.

Buy now, pay later (BNPL)

More and more young people are using BNPL to shop online, even though it’s not as common as wallets or credit cards. A survey found that BNPL is used in over 40 eCommerce markets worldwide, with a projected 900 million users by 2027. As more and more customers prefer flexibility, BNPL will soon become a dominant eCommerce payment method.

BNPL with down payment on Magestore POS

Final thoughts

We hope that you’ve found helpful insights on various payment methods and their implementation in this article. Offering customers with multiple payment options provides significant competitive advantages. This can broaden your market reach and increase conversion rates. Therefore, carefully select payment solutions that align with customer preferences while maintaining security.

FAQs

1. Is it possible to have several payment methods for a customer?

Yes! You can definitely offer multiple payment methods, like credit cards, debit cards, or digital wallets, to your stores or websites. This allows customers to choose the most convenient option for their purchase.

2. What is the most common payment method?

It’s no surprise that credit and debit cards remain the most frequent payment methods. However, digital wallets are quickly catching up, with a projected 16% increase in usage by 2027.

3. What are split payment methods?

Split payments or split tenders allow you to settle a single transaction using multiple payment methods.

For example, regular customers come to your store and run out of cash to pay for their orders. They want to pay by credit card plus the remaining points in the customer loyalty account balance. If your store accepts both credit cards and loyalty points separately, it’d be easier for the customers to check out by both payment methods in one order.

4. How to split payments in retail stores?

If you use a POS system that allow split payments, here’s the main flow:

- Staff check out orders as usual

- Enter the exact amount for each payment method and process it

- Finalize and complete the transaction.

If you need more details about how to process a split, check our guide on split payments, where you can find easy step-by-step instructions and the best system to do so.